First Alternative Car Insurance Cancellation Policy

Tuesday, April 9, 2024

Edit

First Alternative Car Insurance Cancellation Policy

What is First Alternative Car Insurance Cancellation Policy?

First Alternative Car Insurance is an innovative, disruptive type of car insurance policy that allows customers to choose their own level of coverage and protection. The policy is designed to provide customers with the flexibility to choose the coverage they need and make changes to it as their needs evolve. The policy also allows customers to cancel their coverage at any time without incurring any penalties or fees. This makes it an attractive option for those who are looking for more control over their car insurance coverage.

What are the Benefits of First Alternative Car Insurance Cancellation Policy?

The primary benefit of the First Alternative Car Insurance Cancellation Policy is that it gives customers the freedom to choose their own level of coverage and protection. Customers can select the coverage that best suits their needs and make changes to it as their needs evolve. The policy also allows customers to cancel their coverage at any time without incurring any penalties or fees. This makes it an attractive option for those who want more control over their car insurance coverage.

Another benefit of the First Alternative Car Insurance Cancellation Policy is that it provides customers with a more affordable option than traditional car insurance policies. Because customers can choose their own level of coverage, they can tailor their policy to fit their budget. This makes the policy more cost-effective than traditional policies, which often require customers to pay for more coverage than they need.

What are the Disadvantages of First Alternative Car Insurance Cancellation Policy?

One of the primary disadvantages of the First Alternative Car Insurance Cancellation Policy is that it requires customers to be more active in managing their coverage. Customers must be vigilant in keeping track of their coverage and making changes to it as necessary. Customers must also be aware of the potential risks associated with cancelling their coverage before their policy expires. This can be a challenge for those who are not familiar with the process.

Another disadvantage of the First Alternative Car Insurance Cancellation Policy is that it may not provide customers with the same level of protection as traditional policies. Customers who choose this policy may be more exposed to potential risks, such as uninsured drivers or damages caused by an uninsured driver. Customers should be aware of this potential risk before they select this policy.

How to Choose the Right First Alternative Car Insurance Cancellation Policy?

Choosing the right First Alternative Car Insurance Cancellation Policy is essential for customers who want to get the most out of their coverage. Customers should take the time to review the policy and make sure it meets their needs. They should also consider the potential risks associated with the policy before making their decision.

When reviewing a First Alternative Car Insurance Cancellation Policy, customers should consider the coverage options available, the cost of the policy, and any restrictions or limitations associated with the policy. Customers should also take into consideration the potential risks associated with cancelling their coverage before their policy expires. This can help them make an informed decision that meets their needs.

Conclusion

The First Alternative Car Insurance Cancellation Policy is an innovative, disruptive type of car insurance policy that allows customers to choose their own level of coverage and protection. This policy gives customers the freedom to choose the coverage they need and make changes to it as their needs evolve. The policy also allows customers to cancel their coverage at any time without incurring any penalties or fees. Although there are some potential risks associated with this policy, it can be an attractive option for those who are looking for more control over their car insurance coverage. Customers should take the time to review the policy and make sure it meets their needs before selecting this policy.

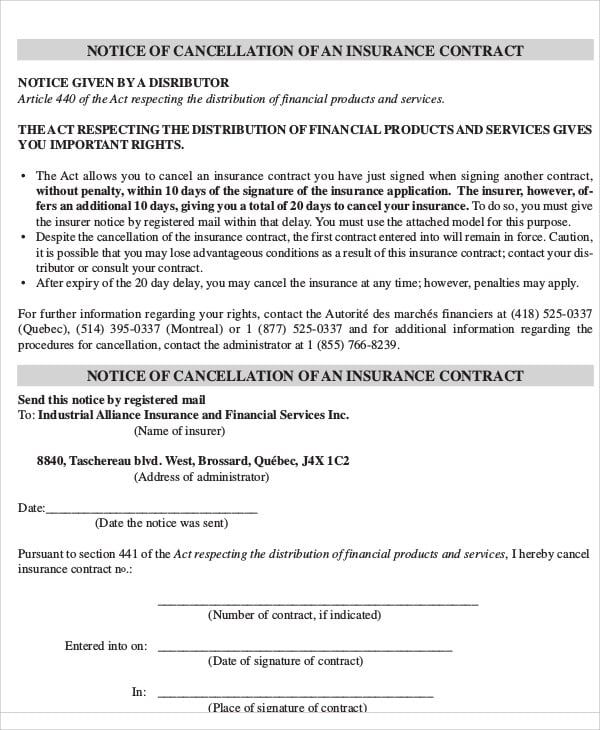

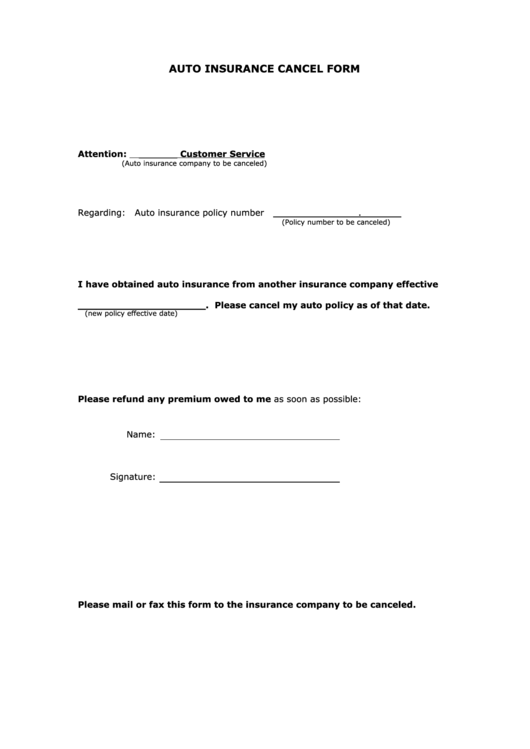

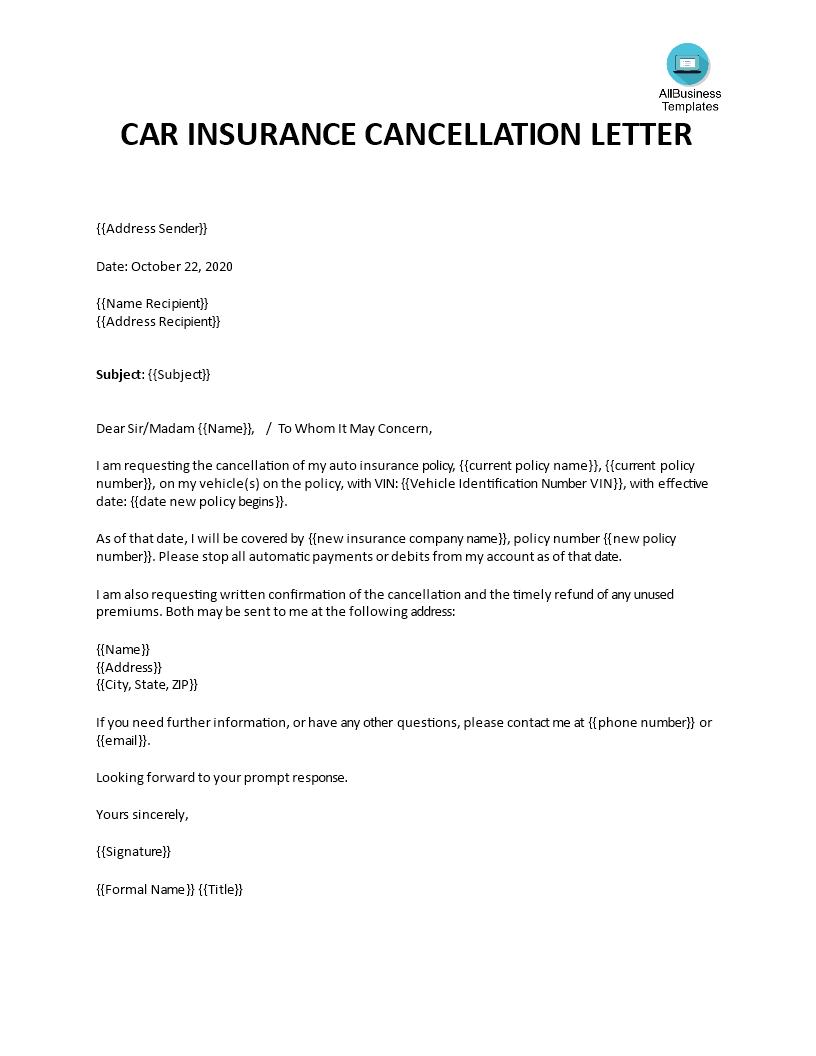

Top 5 Insurance Cancellation Form Templates free to download in PDF format

Car Insurance Cancellation Letter | Templates at allbusinesstemplates.com

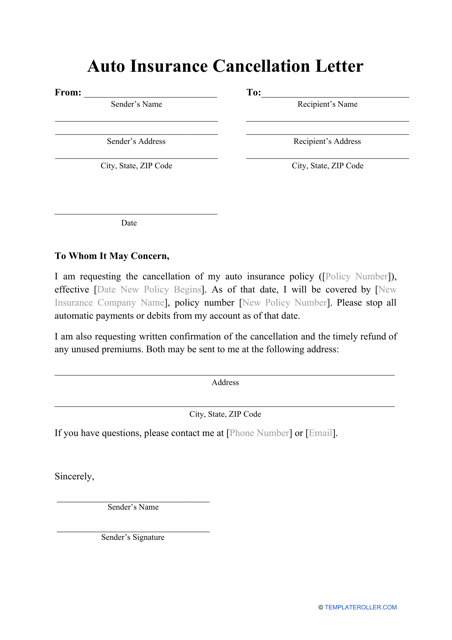

Auto Insurance Cancellation Letter Template Download Printable PDF

Cancellation Notice Templates - 10 Free Word, PDF Format Download