Average Car Insurance Cost Las Vegas

Sunday, January 12, 2025

Edit

Average Car Insurance Cost in Las Vegas

What Factors Determine Car Insurance Cost in Las Vegas?

There are many factors that determine the cost of car insurance in Las Vegas, Nevada. Your age, driving record, and the make and model of your car are all important considerations when it comes to calculating your premiums. Insurance companies also look at where you live and the amount of coverage you need. All of these factors can affect the amount you pay for car insurance in Las Vegas.

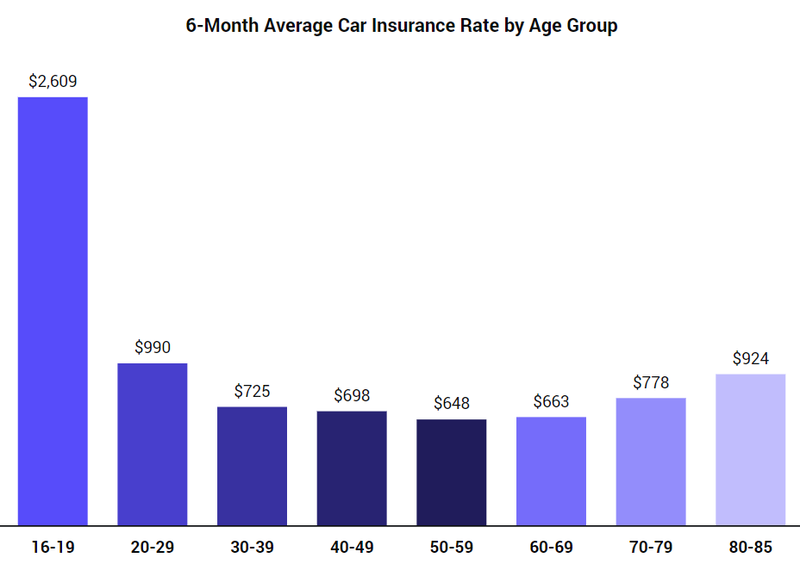

Your age is one of the most important factors in determining the cost of car insurance in Las Vegas. Generally speaking, the younger you are, the more expensive your car insurance premiums will be. This is because drivers under the age of 25 are considered more likely to be involved in an accident than drivers over the age of 25.

Your driving record is also taken into consideration when calculating your car insurance premiums. If you have a history of speeding tickets, accidents, or other moving violations, your insurance premiums are likely to be higher than if you have a clean driving record. Insurance companies also look at any claims you have made in the past, so if you have been involved in a number of accidents, your insurance premiums will be higher.

The make and model of your car also affects the cost of your car insurance in Las Vegas. Insurance companies look at the safety features and repair costs associated with each vehicle to determine the risk associated with insuring it. Generally speaking, cars with higher safety ratings and lower repair costs are cheaper to insure than cars with lower safety ratings and higher repair costs.

The area you live in also affects the cost of your car insurance in Las Vegas. Insurance companies look at the number of accidents and claims in a particular area to determine the risk associated with insuring cars in that area. If you live in an area with a high number of accidents and claims, you can expect to pay higher premiums than if you live in an area with a low number of accidents and claims.

Finally, the amount of coverage you need also affects the cost of your car insurance in Las Vegas. If you only need basic liability coverage, you can expect to pay less than if you need full coverage. The type and amount of coverage you choose will also affect the cost of your car insurance in Las Vegas.

Average Car Insurance Cost in Las Vegas

The average cost of car insurance in Las Vegas is $1,496 per year, according to the National Association of Insurance Commissioners. This figure is based on a 40-year-old male driver with a good driving record and basic liability coverage. Rates vary depending on the factors listed above, so your premiums may be higher or lower than the average.

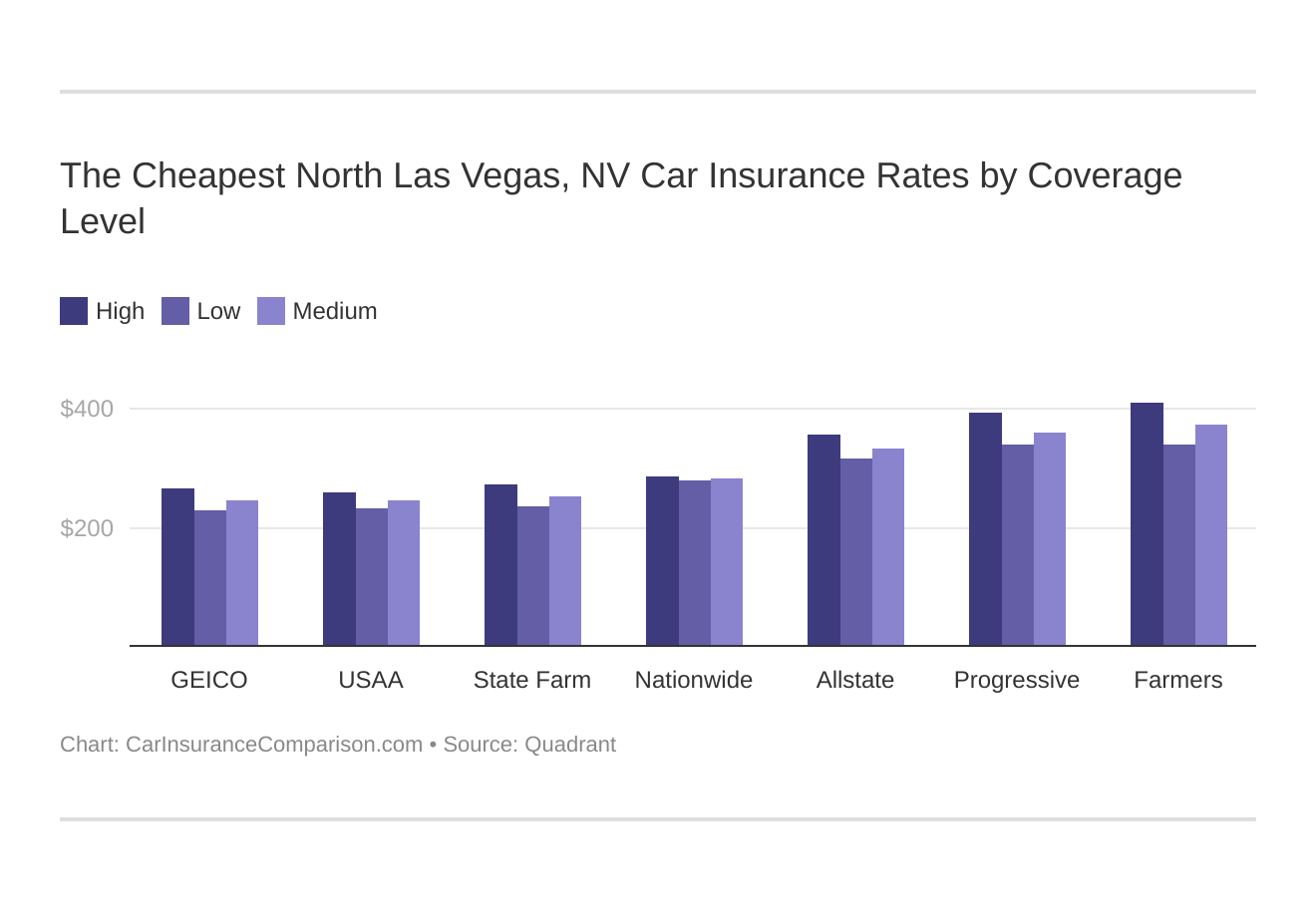

Where to Find Cheaper Car Insurance in Las Vegas

If you’re looking for cheaper car insurance in Las Vegas, there are a few things you can do to lower your premiums. First, shop around for the best rates. Insurance companies charge different rates for the same coverage, so it pays to compare prices. You can also look into discounts for drivers with a good driving record, safe drivers, and other factors.

Another way to save money on car insurance in Las Vegas is to increase your deductible. If you raise your deductible, your premiums will be lower, but you will be responsible for paying more out-of-pocket if you’re involved in an accident.

Finally, consider dropping unnecessary coverage. If you don’t need certain types of coverage, such as collision or comprehensive, you can save money by eliminating them from your policy. However, make sure you still have enough coverage to protect yourself in the event of an accident.

By taking the time to shop around and compare rates, you can find cheaper car insurance in Las Vegas. With some research and a few simple steps, you can save money on your car insurance and make sure you’re properly protected in the event of an accident.

Cheap Car Insurance in Las Vegas

Car Insurance in North Las Vegas

Common Automobile Insurance coverage Charges by Age and Gender

ALL You Need to Know About the Average Car Insurance Cost

How Much Is It For Car Insurance Per Month - Car Retro