Average Auto Insurance Cost Per Month Florida

Saturday, August 26, 2023

Edit

Average Auto Insurance Cost Per Month in Florida

What is the Average Auto Insurance Cost in Florida?

The average auto insurance cost per month in Florida is around $139 for minimum coverage and $211 for full coverage. This is based on a study conducted by the Insurance Information Institute (III). It also found that the annual cost of minimum coverage in the state is $1,673, and the annual cost of full coverage is $2,532. In comparison, the national average cost of minimum coverage is $1,474 and the national average cost of full coverage is $2,305.

Factors that Impact Auto Insurance Costs in Florida

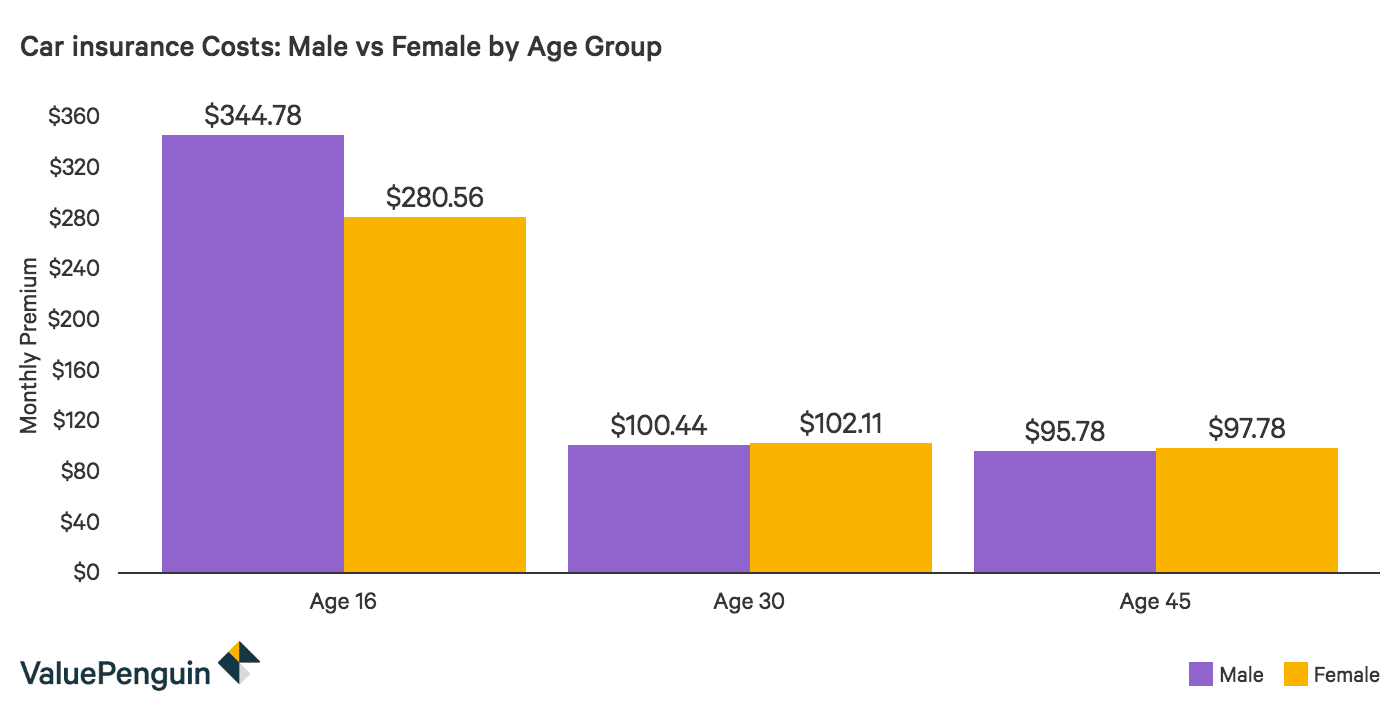

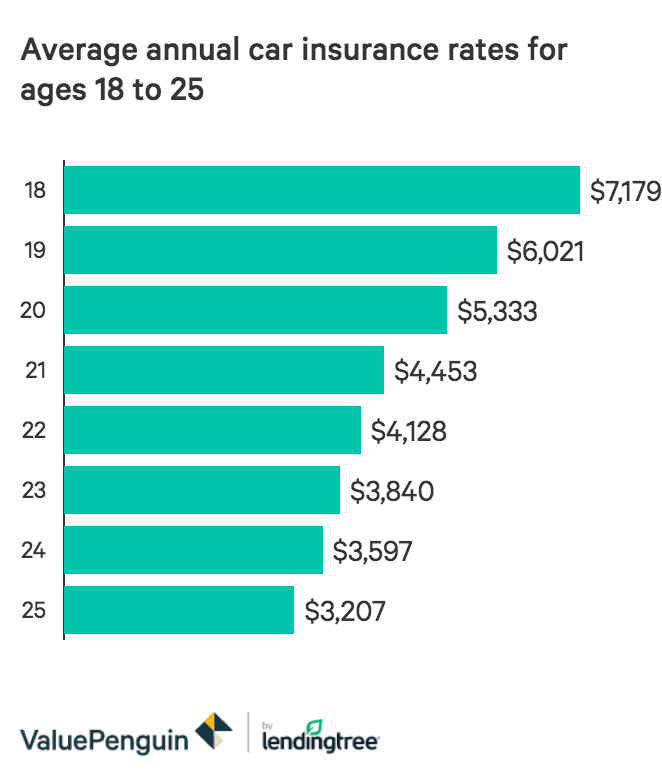

The cost of auto insurance in Florida is determined based on a variety of factors. These include age, gender, zip code, credit score, driving record, type of vehicle, and coverage level. Other factors that can affect auto insurance costs include the age of the vehicle, marital status, and the type of coverage that is purchased.

Age and gender play a significant role in determining auto insurance costs. For example, drivers under the age of 25 are typically considered riskier and are charged higher rates. Likewise, male drivers are typically charged higher rates than female drivers.

Location is another important factor that affects auto insurance costs. Drivers living in cities with higher population densities, such as Miami and Tampa, tend to pay higher auto insurance premiums than drivers living in rural areas. This is because there is greater potential for traffic accidents, theft, and other losses in densely populated areas.

Credit score and driving record also play a role in determining auto insurance costs. Drivers with poor credit scores are considered riskier and are charged higher rates. Similarly, drivers with a history of traffic violations or accidents are also considered riskier and are charged higher premiums.

Types of Auto Insurance Coverage in Florida

In Florida, there are two types of auto insurance coverage: liability and comprehensive coverage. Liability coverage covers the costs of property damage and bodily injuries that result from an accident. Comprehensive coverage covers the costs of damage to a vehicle resulting from events such as theft, vandalism, or fire.

The minimum required coverage in Florida is $10,000 for property damage and $10,000 for bodily injury. This is referred to as the 10/20/10 coverage. Drivers can purchase additional coverage if they wish, such as collision coverage and uninsured/underinsured motorist coverage.

Discounts on Auto Insurance in Florida

There are several discounts available on auto insurance in Florida. These include safe driver discounts, multi-policy discounts, and discounts for good students. Safe driver discounts are available to drivers who have not had any traffic violations or accidents in the past three years.

Multi-policy discounts are available to drivers who purchase multiple policies from the same insurance company. For example, if a driver purchases both auto and homeowner’s insurance from the same company, they may be eligible for a discount.

Finally, good student discounts are available to students who maintain a “B” average or higher. To qualify for this discount, students must provide proof of their academic success.

How to Find the Best Auto Insurance in Florida

The best way to find the best auto insurance in Florida is to shop around. Drivers should compare rates from several different companies. It’s also important to read the fine print and make sure that the coverage is suitable for their needs.

Drivers should also consider purchasing higher coverage levels if they can afford it. Higher levels of coverage can provide more protection in the event of an accident. Finally, drivers should ask their insurance company about any discounts they may be eligible for.

In conclusion, the average auto insurance cost per month in Florida is around $139 for minimum coverage and $211 for full coverage. The cost of auto insurance in Florida is determined based on a variety of factors, including age, gender, zip code, credit score, driving record, type of vehicle, and coverage level. There are two types of auto insurance coverage in Florida – liability and comprehensive coverage – and several discounts are available, such as safe driver discounts, multi-policy discounts, and discounts for good students. The best way to find the best auto insurance in Florida is to shop around and compare rates from several different companies.

Average Car Insurance Rates By Age In Florida - Rating Walls

Average Home Insurance Cost Per Month Florida - Home Sweet Home

Average Car Insurance Rates By Age In Florida - Rating Walls

Average Car Insurance Cost 2020 [Updated] | The Zebra

![Average Auto Insurance Cost Per Month Florida Average Car Insurance Cost 2020 [Updated] | The Zebra](https://doubxab0r1mke.cloudfront.net/media/zfront/production/images/Average_6-MonthPremium_by_Credit_Score.original.png)

How Much Is Car Insurance Per Month ~ news word