Third Party Liability Insurance Definition

Understanding Third Party Liability Insurance

What Is Third Party Liability Insurance?

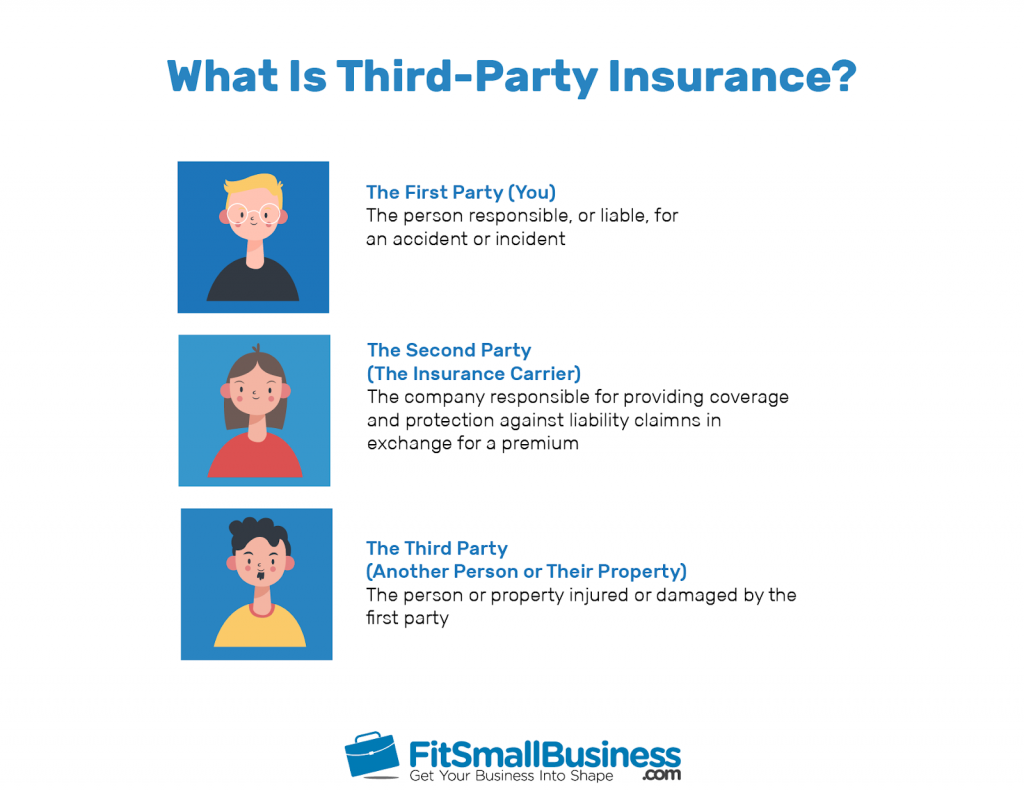

Third party liability insurance is a form of coverage that protects an individual or business from losses resulting from legal liability. It’s commonly used to protect companies and their owners from the claims of third parties, such as customers and competitors. This type of insurance helps to protect businesses and individuals from potentially expensive legal costs and damages that could arise from an incident.

In general, third party liability insurance covers the legal costs associated with defending a claim as well as any damages awarded to the other party. It can also provide coverage for court costs and any damages that may be awarded against the insured. For example, if a customer slips and falls in a business, the business owner may be liable for their medical costs, lost wages, and other damages. Third party liability insurance can help cover those costs.

What Does Third Party Liability Insurance Cover?

Third party liability insurance typically covers legal costs and damages related to claims of negligence, bodily injury, property damage, and personal injury. It does not cover intentional acts of harm. For example, if a business owner is sued for negligence for failing to maintain a safe environment for their customers, third party liability insurance would cover the costs associated with that lawsuit. It would not cover any intentional acts of harm that the business owner may have committed.

In addition to covering legal costs, third party liability insurance can also provide coverage for medical expenses, lost wages, and other damages related to the incident. This type of insurance can also provide coverage for property damage, such as damage to a vehicle or other property caused by the insured.

Who Needs Third Party Liability Insurance?

Third party liability insurance is typically required by law for businesses that operate in certain industries. These industries include construction, manufacturing, healthcare, and hospitality. In addition to being required by law, many businesses choose to purchase third party liability insurance as a way to protect their assets and financial well-being in the event of a claim.

Individuals can also purchase third party liability insurance to protect themselves from legal liability. For example, if a person is involved in a car accident, third party liability insurance can help cover their legal costs and any damages that may be awarded to the other party.

What Are the Benefits of Third Party Liability Insurance?

The primary benefit of third party liability insurance is the protection it provides against potentially expensive legal costs and damages that could arise from an incident. By having this type of coverage, businesses and individuals can rest assured that they will have the financial resources to cover any legal costs and damages that may be awarded to the other party.

In addition, third party liability insurance can help to protect a business’s reputation by reducing the risk of a lawsuit. If a business is sued and found liable, it can have a negative impact on the business’s reputation. This can lead to decreased sales, customer dissatisfaction, and decreased employee morale. Having third party liability insurance in place can help to minimize these risks.

How Do I Get Third Party Liability Insurance?

Third party liability insurance is typically purchased as part of a business’s overall insurance package. Depending on the type of business, the coverage may be included in a general liability policy or a separate policy may be required. It’s important to speak to an experienced insurance professional to determine the best coverage for your business.

Individuals can purchase third party liability insurance through an insurance carrier or through an independent agent. The cost of the coverage will depend on the type of policy, the amount of coverage, and other factors. It’s important to shop around to find the best coverage for your needs.

PPT - Third Party Liability PowerPoint Presentation, free download - ID

Pricing Equity-linked Life Insurance Contracts With Multiple Risk

PPT - Chapter 12 Commercial Insurance PowerPoint Presentation - ID:1673639

PPT - Third Party Liability Protections – The Next Wave of Brownfields

PPT - Medicaid in Schools Coverage, Reimbursement, and Time Studies