Excess Third Party Liability Insurance

What Is Excess Third Party Liability Insurance?

Excess third party liability insurance is a type of policy that provides additional coverage to an individual or business that is at risk of being sued. It offers protection against claims of negligence or other forms of liability that can be brought against you or your business. This type of coverage is usually more expensive than regular liability insurance, but it can provide additional peace of mind in the event that you are sued or held liable for something. It is important to note that this type of insurance does not cover the cost of defending you in court, but it can help to cover the costs of any damages or settlements that may arise from a lawsuit.

What Does Excess Third Party Liability Insurance Cover?

Excess third party liability insurance covers a variety of different things, depending on the policy and the insurer. Generally, it will provide coverage for claims of property damage, bodily injury, or personal injury that are caused by you or your business. It can also provide coverage for medical expenses, legal costs, and other financial losses that may arise from a lawsuit. It is important to note that this type of coverage is usually limited to a certain amount, so it is important to read the terms of your policy carefully to make sure that you are properly covered.

Who Needs Excess Third Party Liability Insurance?

Excess third party liability insurance is an important type of coverage for anyone who may be at risk of being sued. This includes individuals and businesses who work in fields where they could be held liable for something, such as medical professionals, lawyers, and other professionals. Additionally, individuals who own property or have a lot of assets may also want to consider this type of coverage. It is important to remember that it is not required by law, but it is a good idea to have it in place if you think that you may be at risk of being sued.

What Are the Benefits of Excess Third Party Liability Insurance?

The main benefit of excess third party liability insurance is that it can provide additional protection in the event that you are sued or held liable for something. It can help to cover the costs of any damages or settlements that may arise from a lawsuit, as well as medical expenses and legal costs. Additionally, this type of coverage can give you peace of mind knowing that you are protected in the event of a lawsuit.

How Much Does Excess Third Party Liability Insurance Cost?

The cost of excess third party liability insurance will vary depending on the type of policy that you choose, the type of coverage that you need, and the insurer. Generally, this type of coverage is more expensive than regular liability insurance, but it can be a worthwhile investment if you are at risk of being sued or held liable for something. It is important to compare different policies and insurers in order to get the best deal.

Conclusion

Excess third party liability insurance is an important type of coverage for anyone who may be at risk of being sued. It can provide additional protection and peace of mind knowing that you are covered in the event of a lawsuit. The cost of this type of coverage can vary depending on the type of policy and the insurer, but it can be a worthwhile investment if you are at risk of being sued or held liable for something.

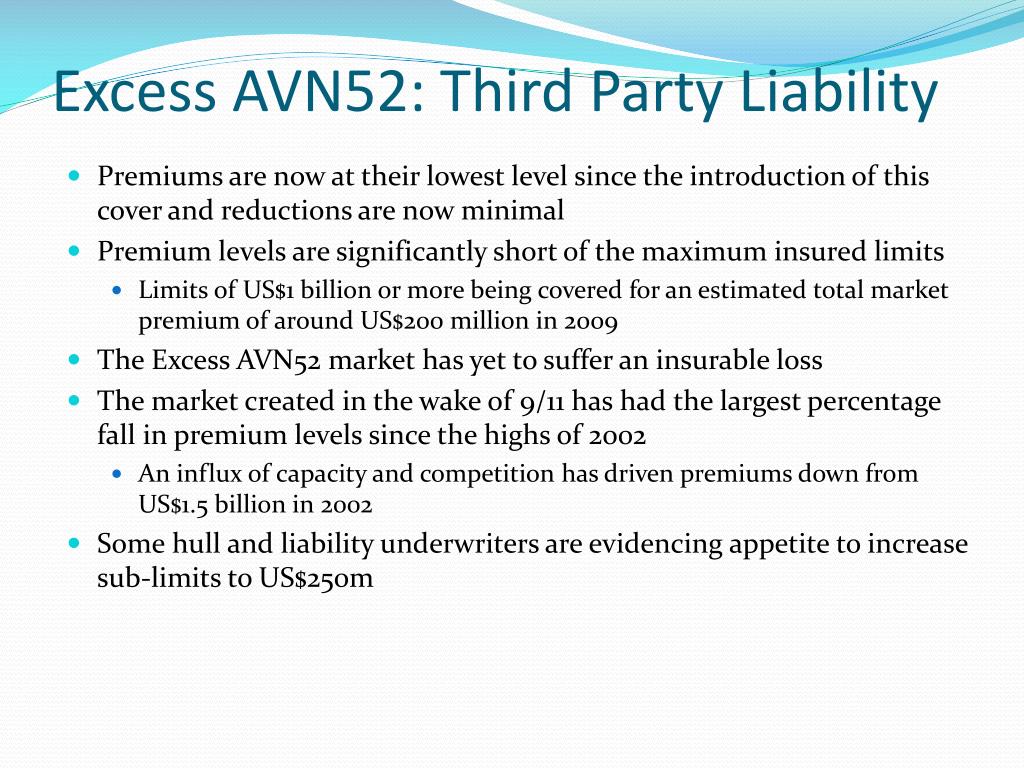

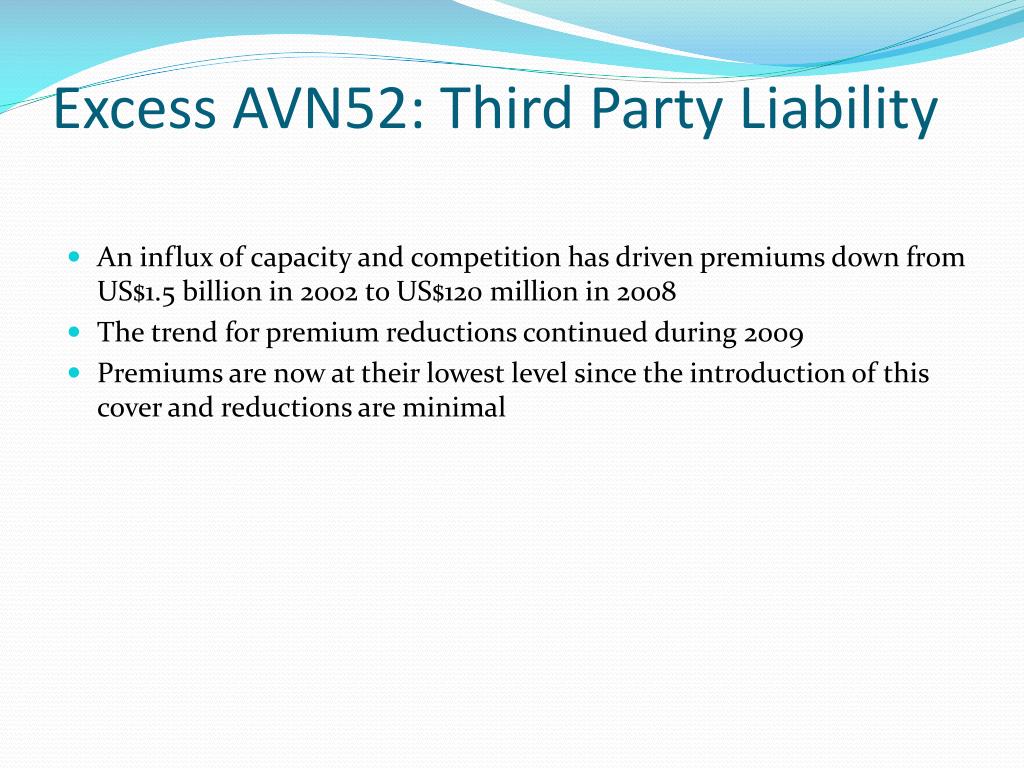

PPT - The Aviation Insurance Market PowerPoint Presentation, free

PPT - The Aviation Insurance Market PowerPoint Presentation, free

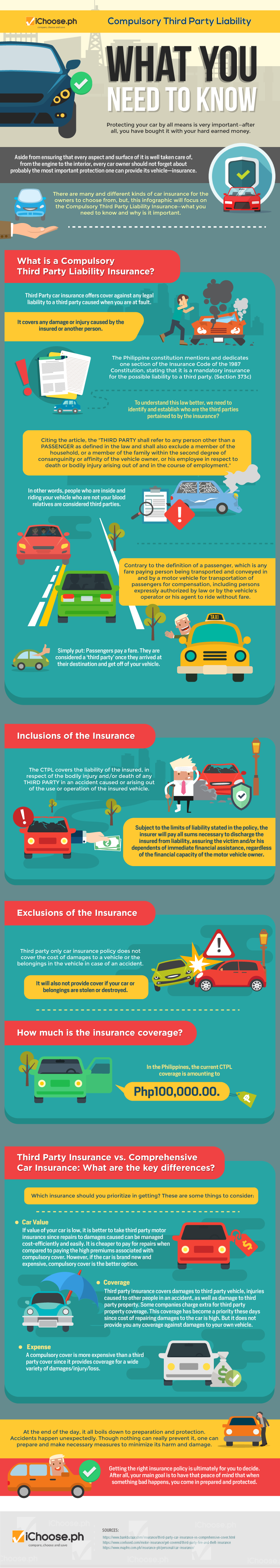

What is Compulsory Third Party Liability Insurance? | iChoose.ph

Compulsory Third Party Liability What You Need to Know | iChoose

What is Third Party Insurance Policy and its Protection