Buy Third Party Liability Insurance

Why You Need to Buy Third Party Liability Insurance?

Third party liability insurance is an important kind of coverage for a business or organization. This insurance is designed to protect a company from claims that are made against them for their negligence or wrongdoing. Without this kind of insurance, a company could find itself facing a lawsuit if someone files a claim alleging that the company was responsible for damages caused by their products or services. This type of insurance can be a great way to protect a business from potential financial losses.

Third party liability insurance is often required by law in many parts of the world. For example, some states in the U.S. require companies to have this type of insurance in order to be allowed to conduct business. It is important to check with the local government to ensure that your business is in compliance with the law. Additionally, some industries may require this type of insurance in order to do business.

Types of Third Party Liability Insurance

There are several types of third party liability insurance available. These include: public liability insurance, product liability insurance, professional liability insurance, and environmental liability insurance. Public liability insurance covers claims for damage caused by a company’s products or services, while product liability insurance covers claims for damages caused by the products themselves. Professional liability insurance covers claims for damages caused by the negligent acts of employees or contractors, while environmental liability insurance covers claims for damages caused by hazardous materials or pollution.

What Does Third Party Liability Insurance Cover?

Third party liability insurance typically covers claims for bodily injury and property damage caused by a company’s products or services. It also covers legal costs associated with defending a claim. This type of insurance may also cover claims for economic losses, such as lost wages or lost profits. Additionally, some policies may provide coverage for punitive damages, which are damages awarded in court to punish a party for their wrongdoing.

When Should You Buy Third Party Liability Insurance?

Ideally, companies should purchase third party liability insurance before they begin to conduct business. This type of insurance can help protect a company from potential claims and lawsuits, and can provide the necessary funds to cover legal costs. It is important to remember that this type of insurance is not a substitute for good business practices. Companies should still take steps to ensure that their products and services are safe and that their employees are properly trained.

Conclusion

Third party liability insurance is an important type of coverage for businesses and organizations. It is designed to protect a company from claims that are made against them for their negligence or wrongdoing. Additionally, this type of insurance may be required by law or by certain industries. When considering the purchase of third party liability insurance, it is important to consider the types of claims that could potentially be made against a company, as well as the costs associated with defending these claims. By having the necessary coverage in place, businesses can help protect themselves from potential financial losses.

CrackerCats – Edmonton CrackerCats

What is Third Party Insurance | What is Third Party Insurance for Car

What Is Third Party Insurance? | Embroker

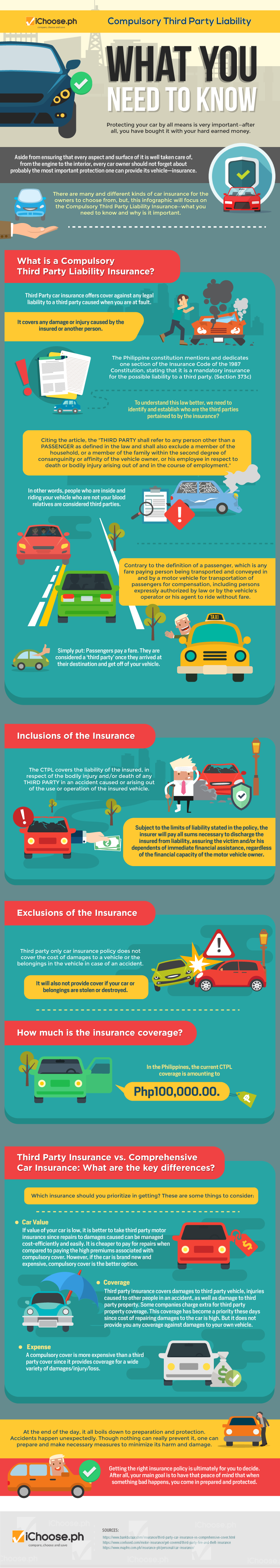

Compulsory Third Party Liability What You Need to Know | iChoose

What Is Third Party Insurance? | Embroker