Cheap And Best Car Insurance Policy In India

Cheap And Best Car Insurance Policy In India

What Is Car Insurance?

Car insurance is a type of insurance policy which provides financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could be incurred in an accident. It is basically a contract between a car owner and the insurance company, in which the insurer agrees to provide economic protection against losses incurred due to traffic collisions or other events.

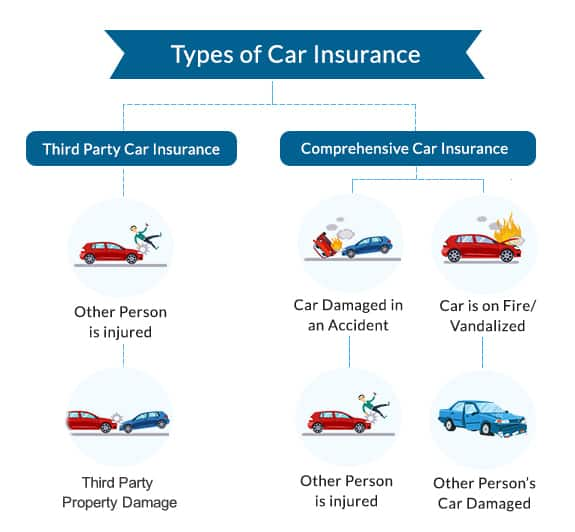

Types of Car Insurance Policies

There are two types of car insurance policies available in India - Third-Party Liability and Comprehensive Car Insurance. Third-Party Liability car insurance provides coverage against any legal liability that may arise due to injury, death, or damage caused to a third-party in a road accident. On the other hand, Comprehensive car insurance provides coverage against damage caused due to natural calamities, theft, fire, and other such events. It also provides coverage against third-party liability.

Benefits of Car Insurance

Car insurance is beneficial in a number of ways. It provides financial protection against any losses incurred due to an accident. It also protects the car owner from any legal liabilities that may arise in the event of a road accident. Moreover, it helps in saving money as the insurer will bear the expenses of repairing or replacing the car in the event of an accident.

How to Find Cheap and Best Car Insurance Policy?

There are many factors that can help you in finding a cheap and best car insurance policy. The first factor is the type of car you own. It is important to compare the different policies from different insurers to find the one that offers the best coverage at the lowest premium. It is also important to check the deductibles and other features of the policy to ensure that it provides the right coverage. Additionally, it is important to check the company’s reputation, customer service, and claim settlement process before buying a policy.

Conclusion

Car insurance is essential for every car owner. It provides financial protection against any losses incurred due to an accident. It is important to compare different policies from different insurers to find the one that offers the best coverage at the lowest premium. Additionally, it is important to check the company’s reputation, customer service, and claim settlement process before buying a policy.

best car insurance policy in india 2020 in hindi - YouTube

How to Choose the Best Car Insurance Policy? A Complete Guide

Which is the Best Car Insurance Policy in India | Car Insurance Plans

Cheapest Vehicle Insurance In India : Get India's cheapest car

Car Insurance Online: Compare, Buy/Renew Car Insurance Policy