Most Affordable Full Coverage Car Insurance

The Most Affordable Full Coverage Car Insurance

What is Full Coverage Car Insurance?

Full coverage car insurance is a type of insurance policy that provides the policyholder with financial protection against a wide range of potential losses. It is usually more expensive than basic coverage, but it is also more comprehensive. Full coverage car insurance will typically include coverage for damage to your car from an accident, theft, fire, and other covered events, as well as liability coverage to protect you from being held financially responsible for any damage you may cause to another person or their property. It may also include additional coverage such as towing, rental car reimbursement, and coverage for uninsured/underinsured motorists.

How to Find the Most Affordable Full Coverage Car Insurance

When shopping for full coverage car insurance, it is important to shop around and compare quotes from multiple companies. Doing so will help you to find the most affordable rate that meets your needs. Factors that are taken into consideration when calculating the cost of your policy include your age, driving record, the type of vehicle you drive, and the state you live in. It is also important to look for any discounts that may be available, such as a good driver discount or a multi-policy discount for having multiple policies with the same company.

In addition to shopping around for the best rates, you should also take the time to read the policy details carefully to make sure you understand what is covered by the policy. It is also important to make sure that you are not over- or under-insured, as this can have a big impact on the cost of your policy.

What Are the Benefits of Full Coverage Car Insurance?

The biggest benefit of full coverage car insurance is that it provides comprehensive protection against financial losses due to an accident, theft, or other covered event. It also provides liability coverage to protect you from being held financially responsible for any damage you may cause to someone else’s property or person. In addition, full coverage car insurance can often include additional coverage such as towing, rental car reimbursement, and coverage for uninsured/underinsured motorists.

What Are the Drawbacks of Full Coverage Car Insurance?

The biggest downside of full coverage car insurance is that it is usually more expensive than basic coverage. It is also important to make sure that you are not over- or under-insured, as this can have a big impact on the cost of your policy. In addition, it is important to read the policy details carefully to make sure you understand what is covered by the policy.

Conclusion

Full coverage car insurance is a great option for those who want to protect themselves against potential financial losses due to an accident, theft, or other covered event. While it may be more expensive than basic coverage, it also provides more comprehensive protection and can often include additional coverage such as towing, rental car reimbursement, and coverage for uninsured/underinsured motorists. It is important to shop around and compare quotes from multiple companies to find the most affordable rate that meets your needs, and to read the policy details carefully to make sure you understand what is covered.

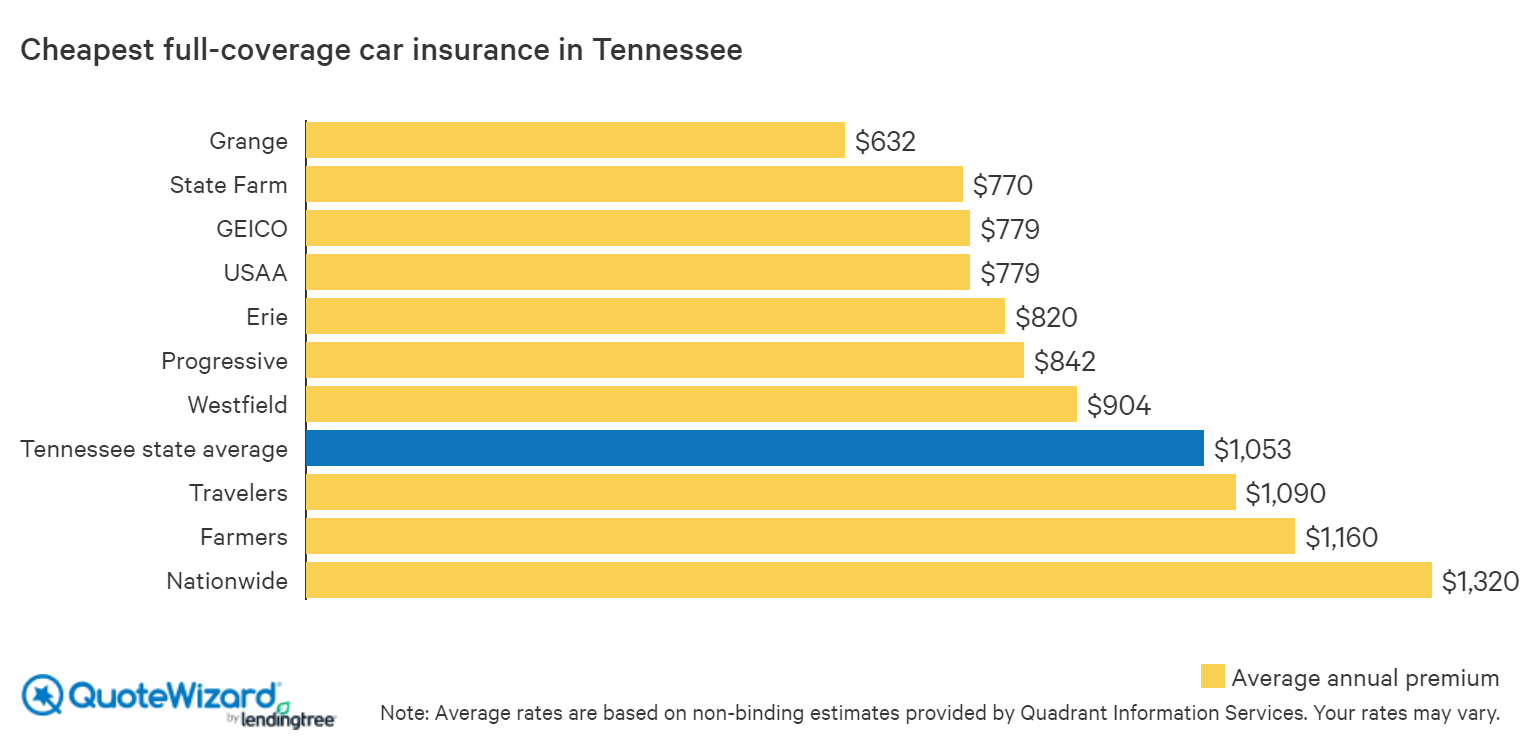

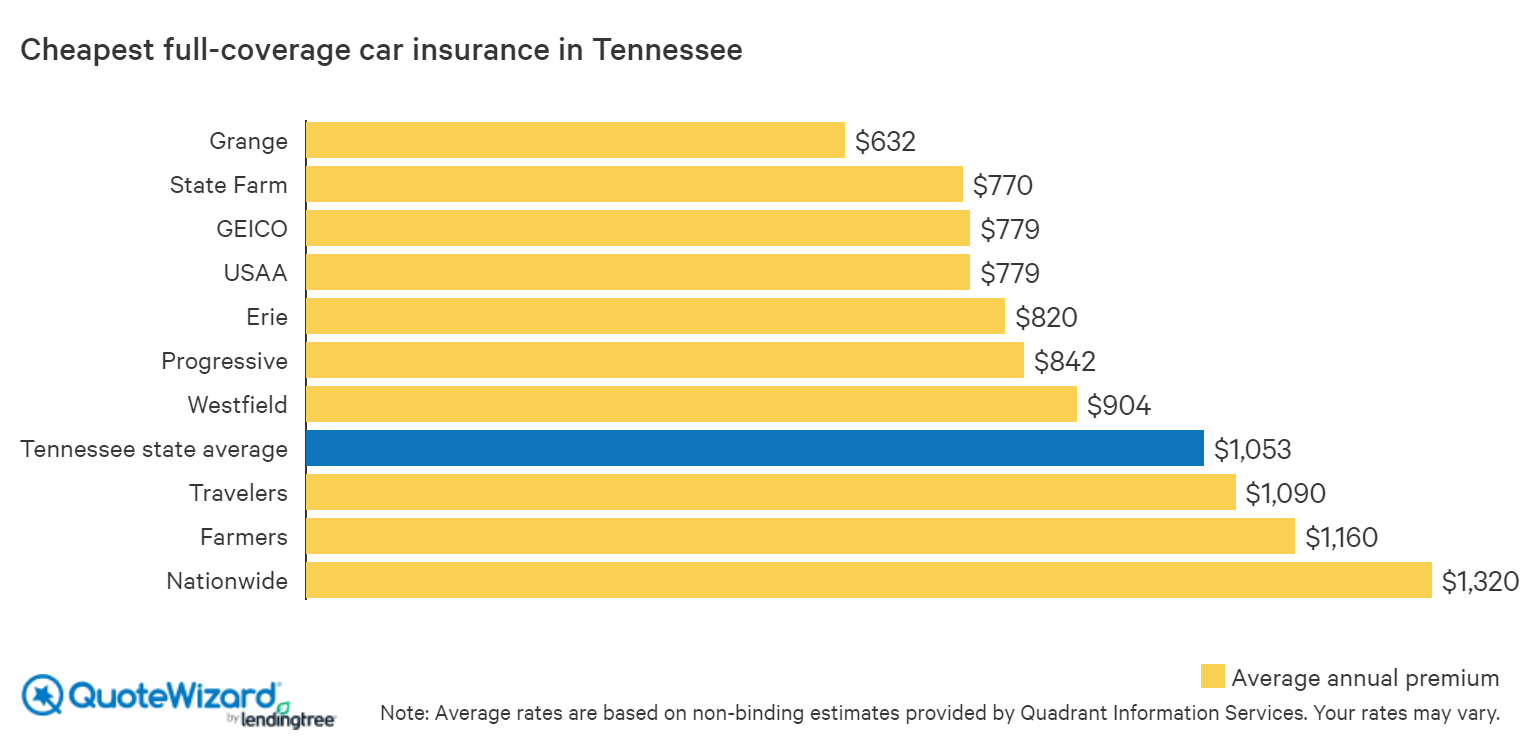

Find Cheap Car Insurance in Tennessee | QuoteWizard

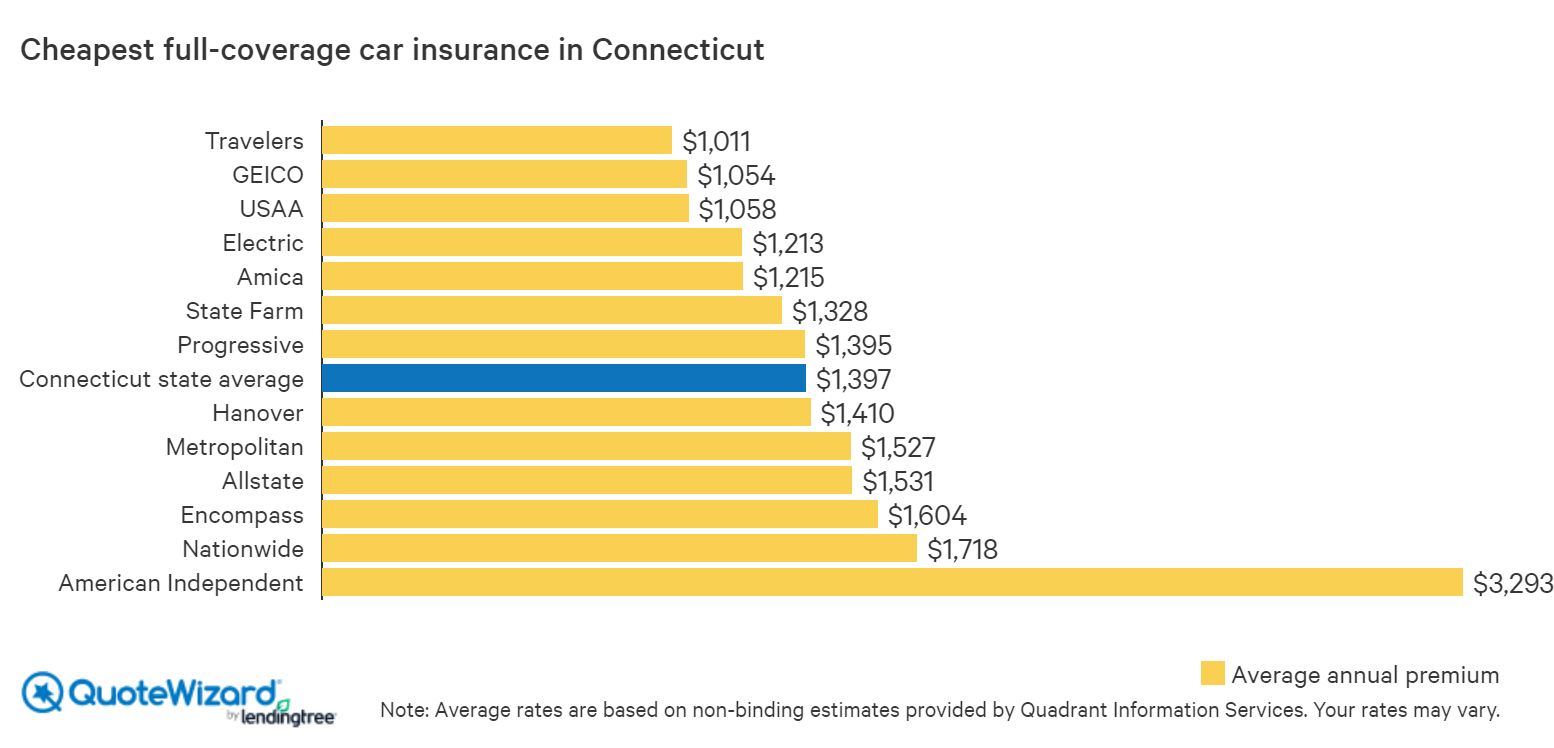

Get Cheap Car Insurance in Connecticut | QuoteWizard

18+ Full Coverage Car Insurance Quotes - Best Day Quotes

Who Has The Cheapest Full Coverage Car Insurance - Quotes quotebody.com

Details of Full Coverage Auto Insurance Quote Top Gallery Image Site Ho