Average Auto Insurance Cost Per Month Nyc

Tuesday, November 14, 2023

Edit

Average Auto Insurance Cost Per Month in New York City

The Auto Insurance Market in New York City

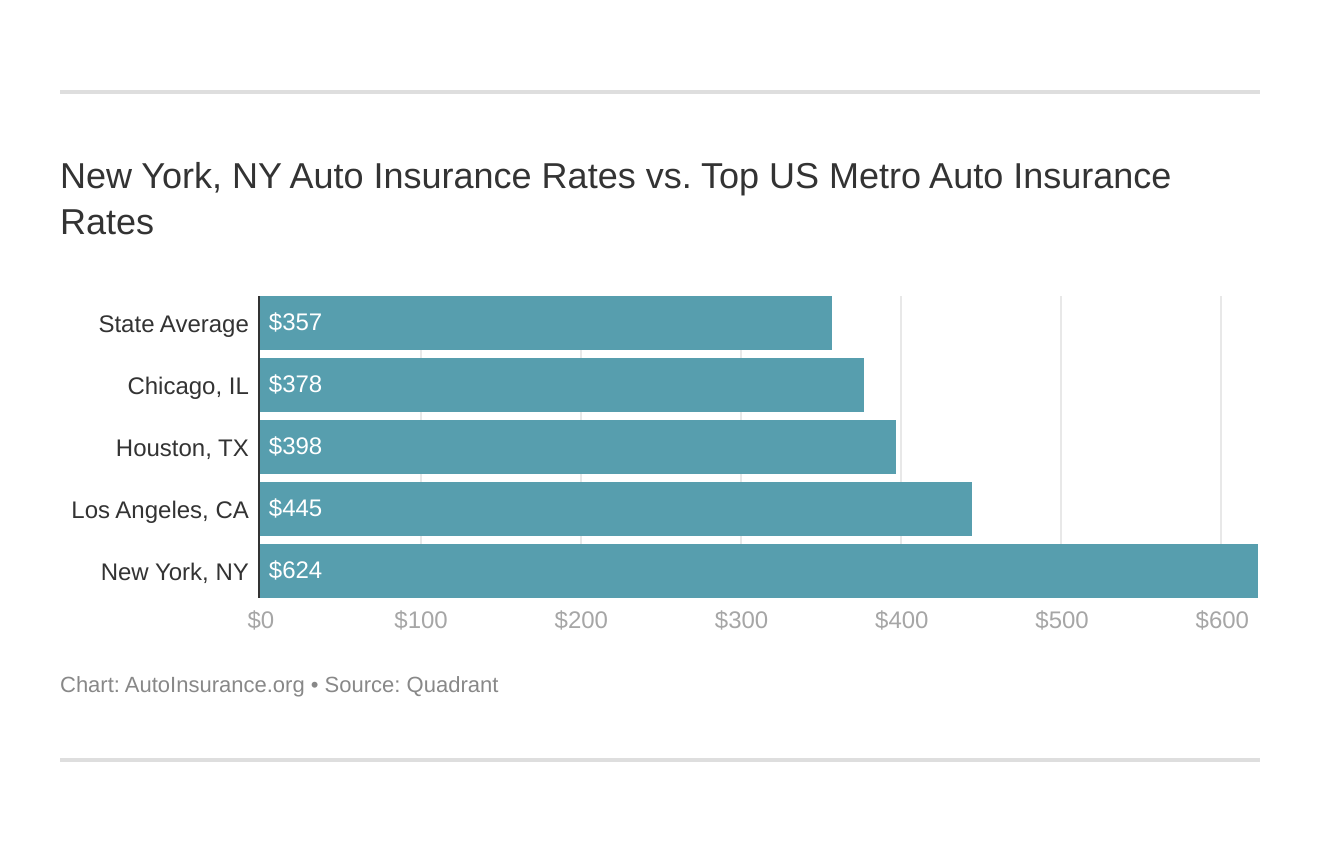

New York City is a major metropolitan area with a unique auto insurance market. With a population of over 8.6 million people, the city is one of the most populous in the United States. The vast majority of New Yorkers use their cars to get around, making auto insurance a necessity for most. Unfortunately, auto insurance in the city is notoriously expensive. According to recent estimates, the average cost of auto insurance per month in New York City is $170. Of course, this cost can vary significantly depending on factors such as the driver's age, driving record, and the type of vehicle driven.

Understanding Auto Insurance in New York City

Before signing up for auto insurance in New York City, it's important to understand the market. In the city, auto insurance regulations are determined by the New York State Department of Financial Services. This agency sets the minimum coverage requirements for drivers in the state. In general, New York drivers are required to carry liability coverage, uninsured/underinsured motorist coverage, and personal injury protection.

In addition, drivers in the city may be required to purchase additional insurance coverage such as collision and comprehensive coverage. This coverage pays for damage to the driver's vehicle that is caused by an accident or other covered event. It is important to note that the minimum coverage requirements in New York City may be higher than in other parts of the state.

Factors That Affect Auto Insurance Rates in New York City

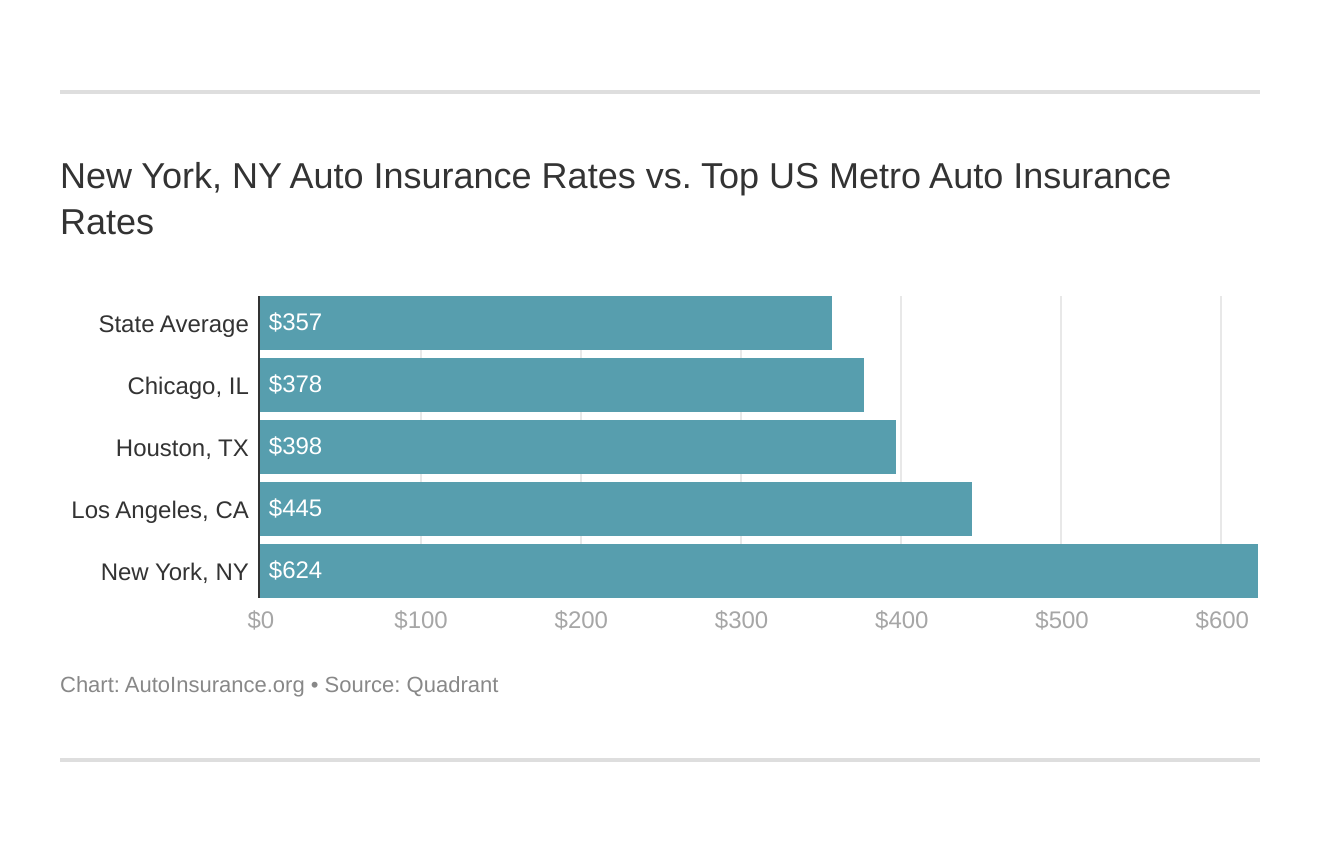

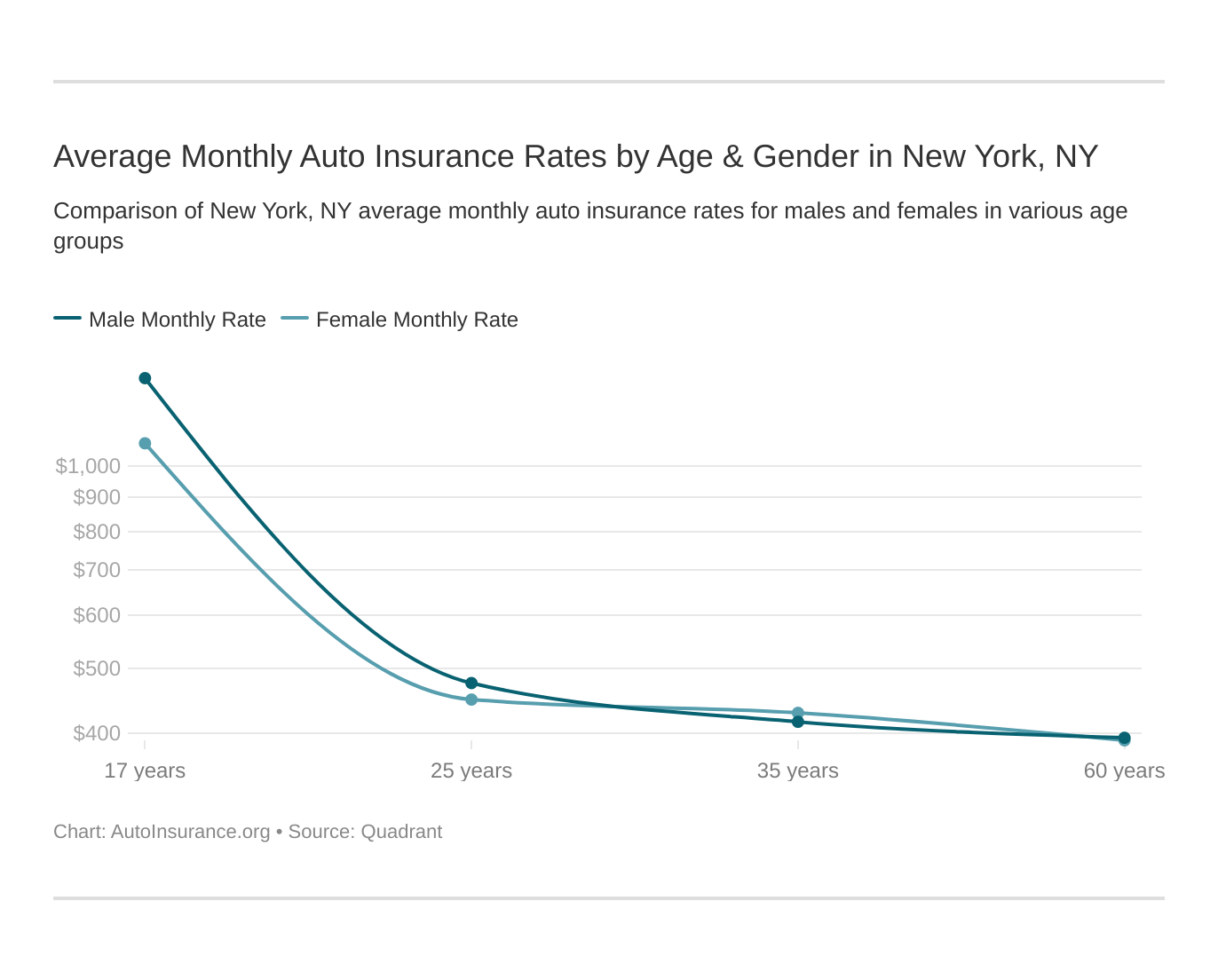

When it comes to auto insurance, the cost can vary significantly from one driver to the next. There are a number of factors that will affect the cost of auto insurance for a driver in New York City. These include the driver's age, driving record, credit score, and the type of vehicle driven.

For instance, drivers with a poor driving record or poor credit score will typically pay higher premiums than those with good records and credit scores. Furthermore, drivers of certain types of vehicles, such as sports cars or luxury vehicles, will also pay higher rates than those driving more economical options.

How to Get the Best Auto Insurance Rates in New York City

When shopping for auto insurance in New York City, it is important to compare rates from multiple insurers. This will help ensure that you get the best rate possible. Additionally, it's a good idea to take the time to understand the coverage you are purchasing and make sure it meets your needs.

Finally, consider taking advantage of discounts offered by insurers. Many insurers offer discounts to drivers who have good driving records, take defensive driving courses, or bundle their auto insurance with other types of insurance. Taking advantage of these discounts can help to lower your auto insurance rates.

Conclusion

Auto insurance in New York City is expensive, but it is an important part of owning a car in the city. To get the best rate possible, it is important to compare rates from multiple insurers and take advantage of discounts. With the right approach, it is possible to find an affordable auto insurance policy that meets your needs.

How Much Is Car Insurance In Nyc Per Month - New York City Car

How Much Is Car Insurance In Nyc Per Month - New York City Car

How Much Is Car Insurance In Nyc Per Month - New York City Car

Average Price Of Car Insurance Per Month - designby4d

Average Cost Car Insurance 18 Year Old Male - Classic Car Walls