How Much Does The Average Person Spend On Car Insurance

How Much Does The Average Person Spend On Car Insurance?

What is Car Insurance?

Car insurance is an agreement between an insurance company and a driver. The insurance company agrees to pay for certain losses and damages that occur due to the driver's negligence or other events that are covered by the policy. The driver agrees to pay a certain amount of money to the insurance company in exchange for the insurance coverage. The amount that the driver pays is called a premium, and this is usually based on the driver's age, driving record, type of car, and other factors.

How Much Does The Average Person Spend On Car Insurance?

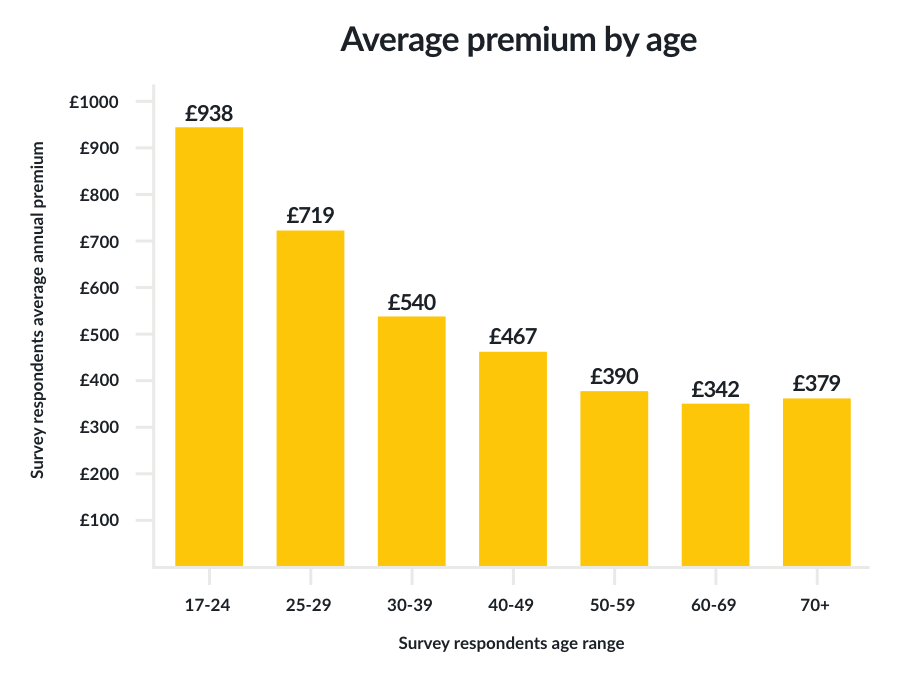

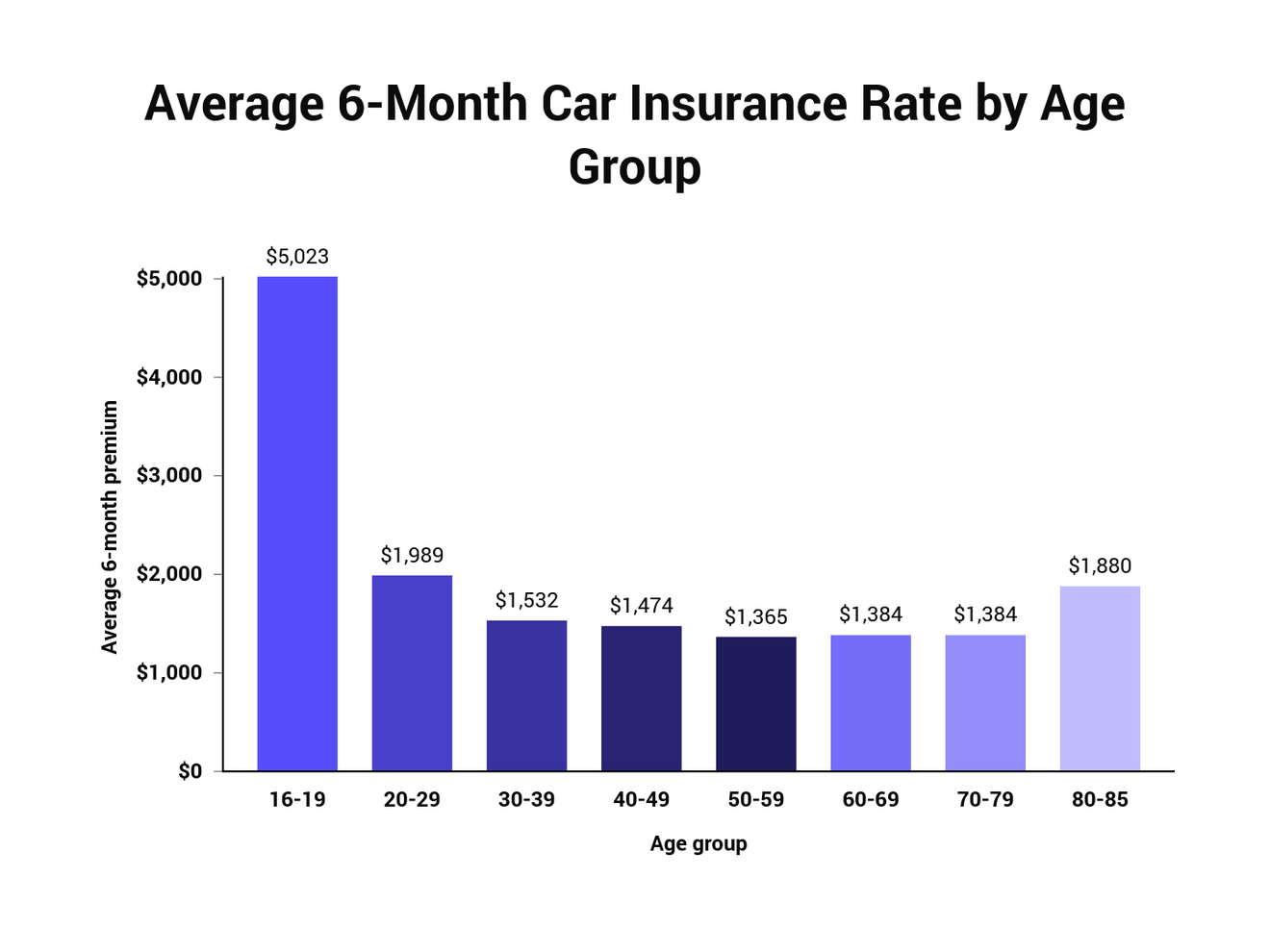

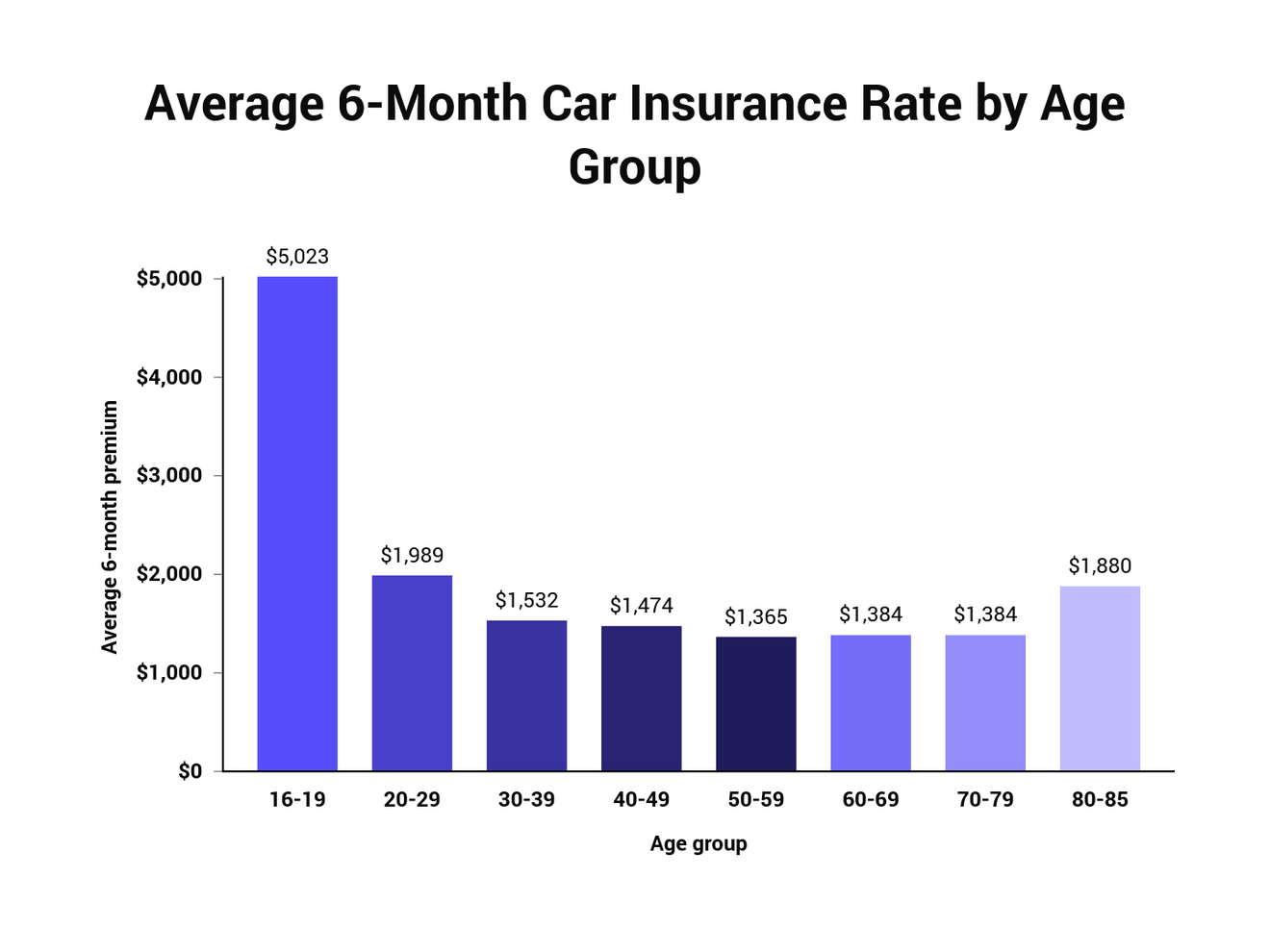

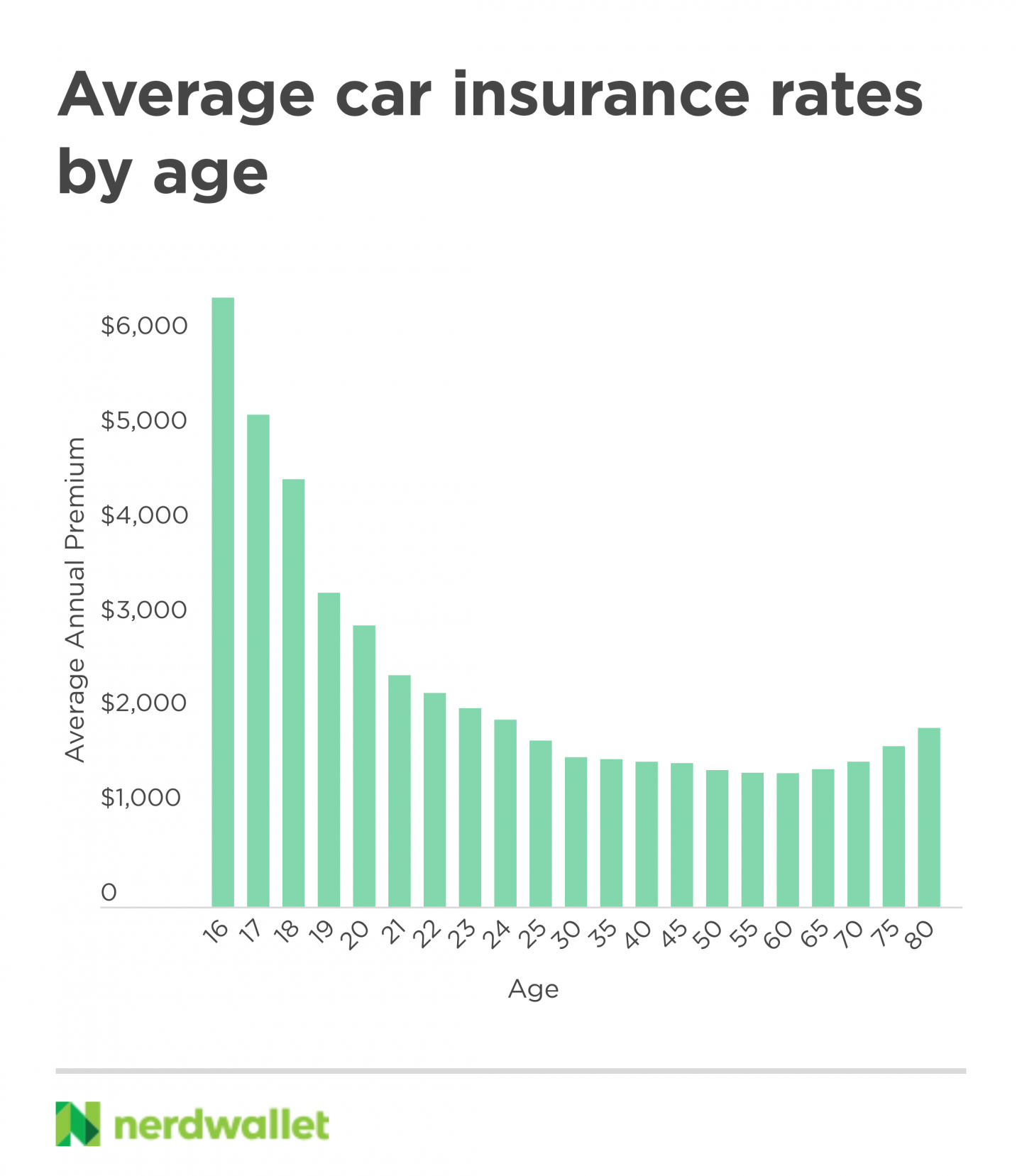

The amount that the average person spends on car insurance depends on a variety of factors. Generally, the younger the driver, the higher the premium will be. This is because younger drivers are more likely to get into accidents. Drivers with an excellent driving record will usually pay less than those with a history of moving violations or accidents. The type of car that a person drives can also affect the premium. Sports cars and luxury vehicles are typically more expensive to insure than sedans and SUVs. The location of the car can also affect the cost of insurance. Generally, insurance rates are higher in urban areas than in rural areas.

How Much Is The Average Premium?

According to the Insurance Information Institute, the average cost of car insurance in the United States in 2020 was $1,470 per year. This amount varies greatly depending on the factors mentioned above. Drivers in Alaska had the highest average premium at $2,154, while drivers in Maine had the lowest at $878. It's important to note that these averages are based on the rates for full coverage, which includes liability, collision, and comprehensive coverage.

How Can I Save Money On Car Insurance?

There are several ways to save money on car insurance. First, shop around and compare rates from multiple insurance companies. You may be able to find a better deal with a different company. It's also important to maintain a good driving record. Moving violations and accidents can cause your rates to increase significantly. Additionally, consider increasing your deductible. A higher deductible means that you will have to pay more out of pocket for repairs, but it can result in lower premiums.

Conclusion

The average person spends around $1,470 per year on car insurance. The amount can vary greatly based on a variety of factors, including age, driving record, type of car, and location. To save money on car insurance, it's important to shop around and compare rates from multiple companies, maintain a good driving record, and consider increasing your deductible. With a little research and effort, you may be able to find a better deal on car insurance.

ALL You Need to Know About the Average Car Insurance Cost

Average Cost of Car Insurance (2019) | Car insurance, Best car

2021 Car Insurance Rates by Age and Gender - NerdWallet

What do Americans Pay for Car Insurance in 2019?

UK's Best Car Insurance Providers | mustard.co.uk