Johnson Auto Insurance Cancellation Policy

Understanding Johnson Auto Insurance Cancellation Policy

Johnson Auto Insurance is well-known for providing reliable coverage for drivers and passengers alike. When it comes to canceling a policy, however, the process can be confusing. That’s why Johnson Auto Insurance has provided a comprehensive guide to its cancellation policy so that customers can understand their rights and responsibilities.

Reasons to Cancel a Johnson Auto Insurance Policy

There are several reasons why a policyholder might need to cancel their Johnson Auto Insurance policy. Some of the most common reasons include:

- Moving to a new home

- Buying a new vehicle

- No longer needing coverage

- Excessive premium costs

- Dissatisfaction with service

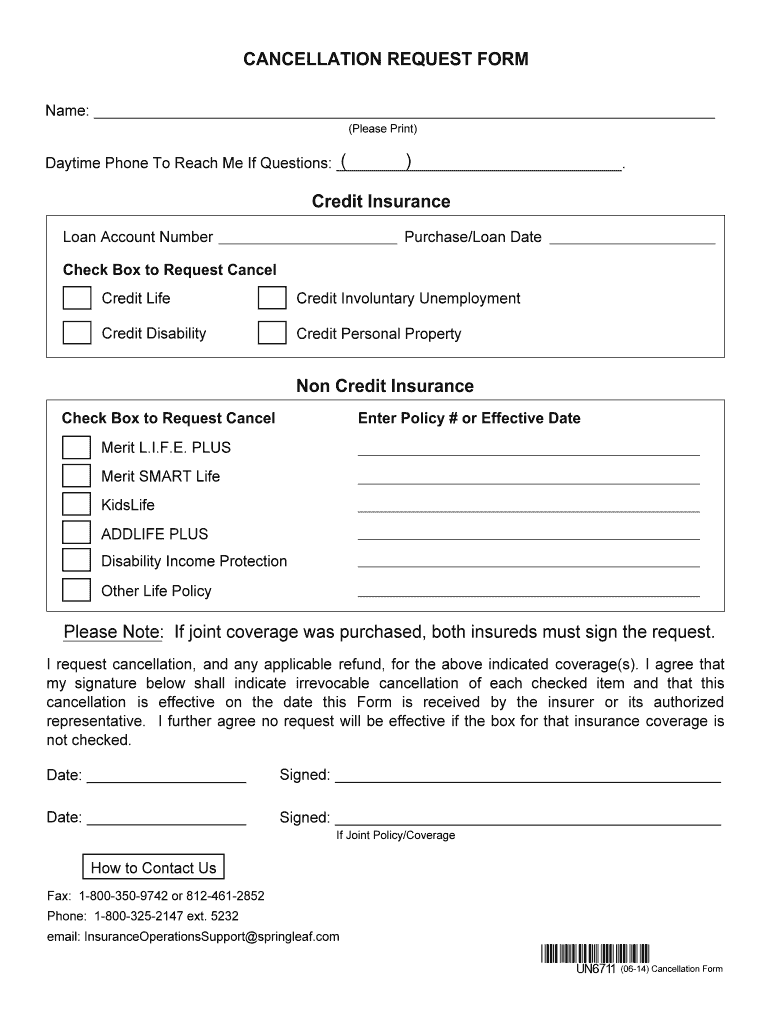

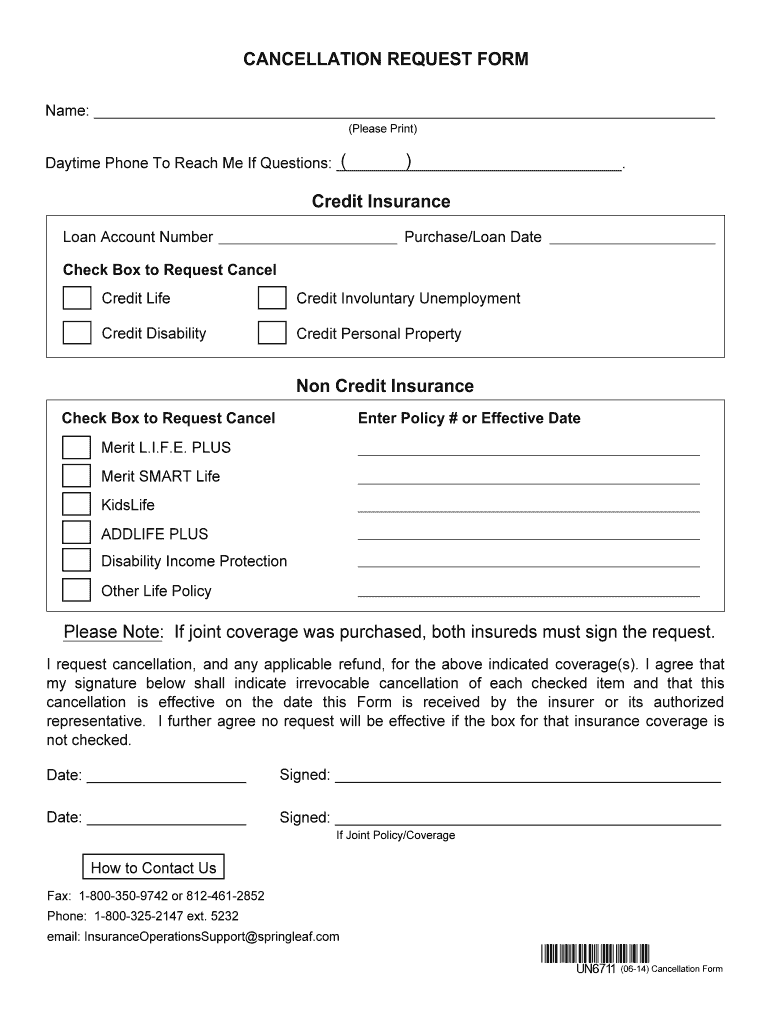

Cancellation Notice Requirements

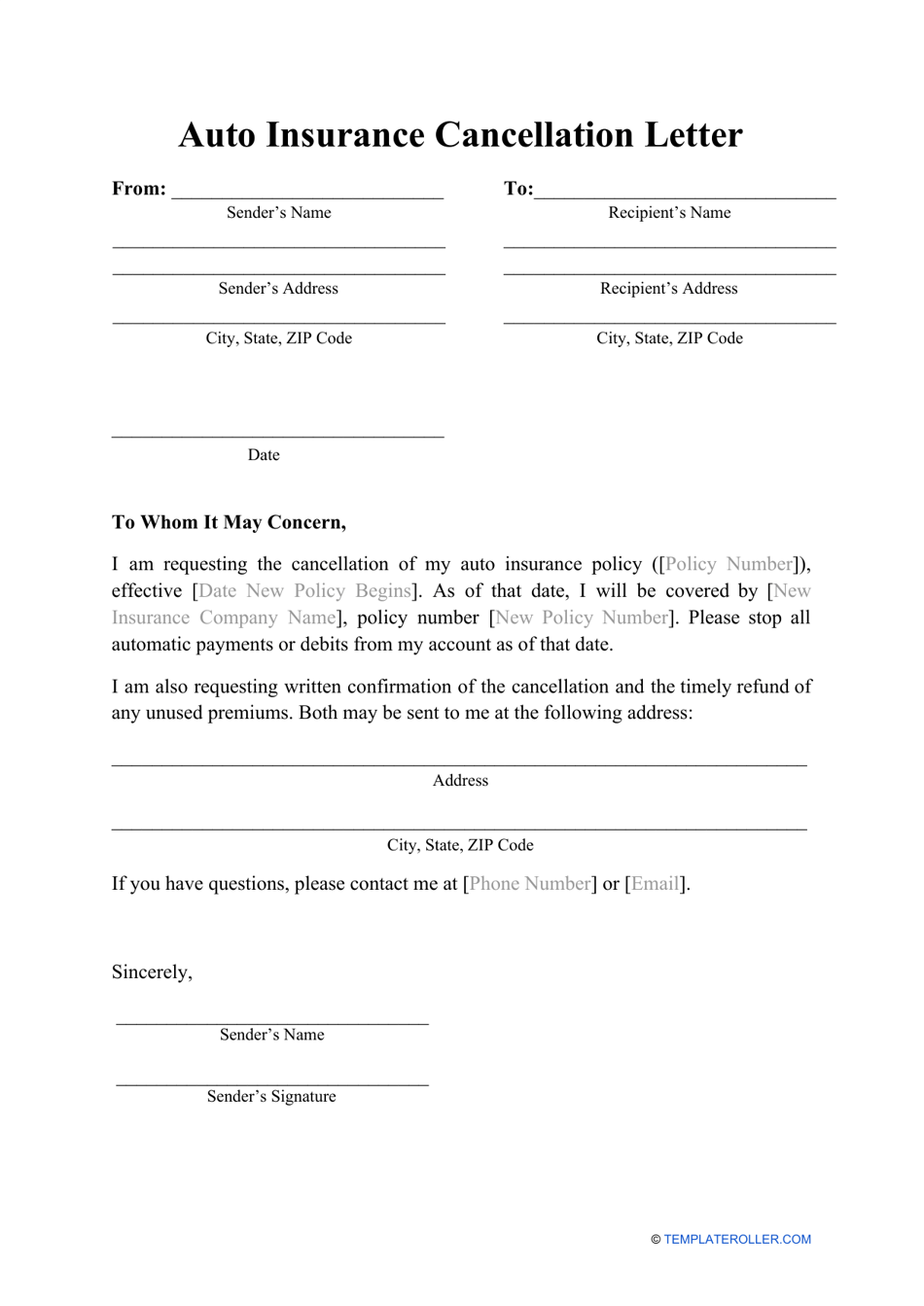

To cancel a policy, customers must provide written notice via mail, email, or fax. Customers must include the following information in their cancellation notice:

- Name

- Policy number

- Reason for cancellation

- Date of cancellation

- Signature of policyholder

Once Johnson Auto Insurance receives the cancellation notice, the customer will be notified of their cancellation date. The cancellation date is the date on which the customer’s coverage will end. It is important to note that any premiums paid prior to the cancellation date will not be refunded.

Refunds and Cancellation Fees

In some cases, customers may be eligible for a partial refund of their premium. This refund is based on the amount of coverage that was used before the cancellation date. Customers will receive a full refund if they cancel their policy within the first 14 days of purchase. Customers may also be charged a cancellation fee, depending on their policy.

Transferring Coverage to Another Provider

If a customer is transferring their coverage to another provider, Johnson Auto Insurance will provide the necessary information to the new insurer. If a customer has a loan on their vehicle, the lienholder may require proof that the vehicle is insured by another provider before releasing the lien.

Conclusion

Johnson Auto Insurance provides a comprehensive guide to its cancellation policy. Customers should always provide written notice of their cancellation request, and should expect to pay any applicable cancellation fees or refunds. Being familiar with the policy and understanding the requirements can help make the cancellation process easy and hassle-free.

Life cancellation form: Fill out & sign online | DocHub

Auto Insurance Cancellation Letter Template Download Printable PDF

Johnson Insurance Pdf

Farmers insurance cancellation form: Fill out & sign online | DocHub

ScotiaLife Financial Chooses Johnson as Home and Auto Insurance Partner