What Is Gap Car Insurance

What Is Gap Car Insurance?

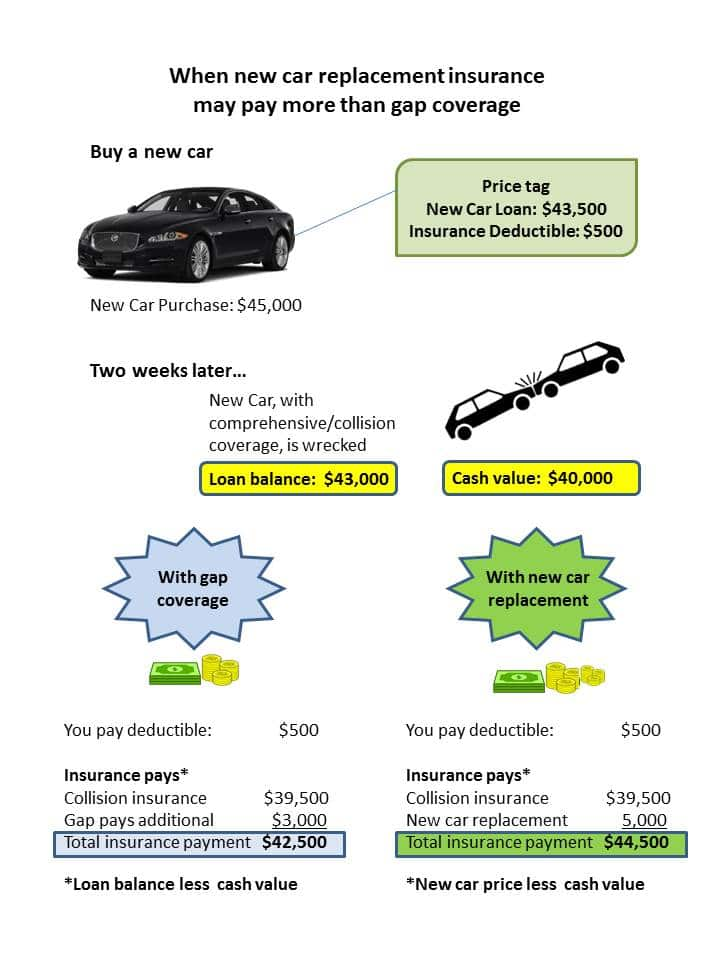

Gap car insurance, or Guaranteed Auto Protection, is a type of insurance coverage that helps to provide financial protection when a vehicle is totaled or stolen. This type of coverage is often referred to as “gap insurance” because it helps to bridge the gap between the actual cash value of a vehicle and what the vehicle's owner owes on the loan or lease. Gap car insurance can be purchased from a variety of sources, including banks, credit unions, and insurance companies.

Gap car insurance is designed to cover the difference between the actual cash value of a vehicle and the balance of the loan or lease. This coverage can be especially beneficial for those who have recently purchased a new car with a loan or lease, as it can help to protect them from taking a financial loss if the vehicle is totaled or stolen before the loan or lease is paid off.

Gap car insurance is usually required by lenders when financing a vehicle purchase. Many lenders require that a borrower pay for gap insurance in order to get approved for a loan or lease. This type of coverage can also be beneficial for those who have a loan or lease on a vehicle that has depreciated in value significantly since it was purchased.

Gap car insurance can also be beneficial for those who are leasing a vehicle, as it can help to protect them from taking a financial loss if the vehicle is totaled or stolen before the lease is paid off. In addition to helping to protect the borrower from taking a financial loss, gap car insurance can also help to protect the lender from taking a loss if the vehicle is totaled or stolen before the loan or lease is paid off.

Gap car insurance can be purchased in a variety of different ways. Many lenders offer gap insurance as part of the loan or lease package, while others may require that the borrower purchase it separately. The cost of gap insurance can vary from lender to lender, so it is important to shop around and compare rates before making a decision.

Gap car insurance is a type of insurance coverage that can be beneficial for those who have a loan or lease on a vehicle. It is designed to help protect the borrower from taking a financial loss if the vehicle is totaled or stolen before the loan or lease is paid off. Gap insurance can also help to protect the lender from taking a loss if the vehicle is totaled or stolen before the loan or lease is paid off. Gap insurance is usually required by lenders when financing a vehicle purchase, and the cost of gap insurance can vary from lender to lender.

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Page for individual images • Quoteinspector.com

How Does Gap Insurance Work? | RamseySolutions.com

Gap Insurance for your New or Leased Cars

What Is Gap Insurance? - Lexington Law