Can One Person Be On Two Car Insurance Policies

Can One Person Be On Two Car Insurance Policies?

The Basics of Car Insurance Policies

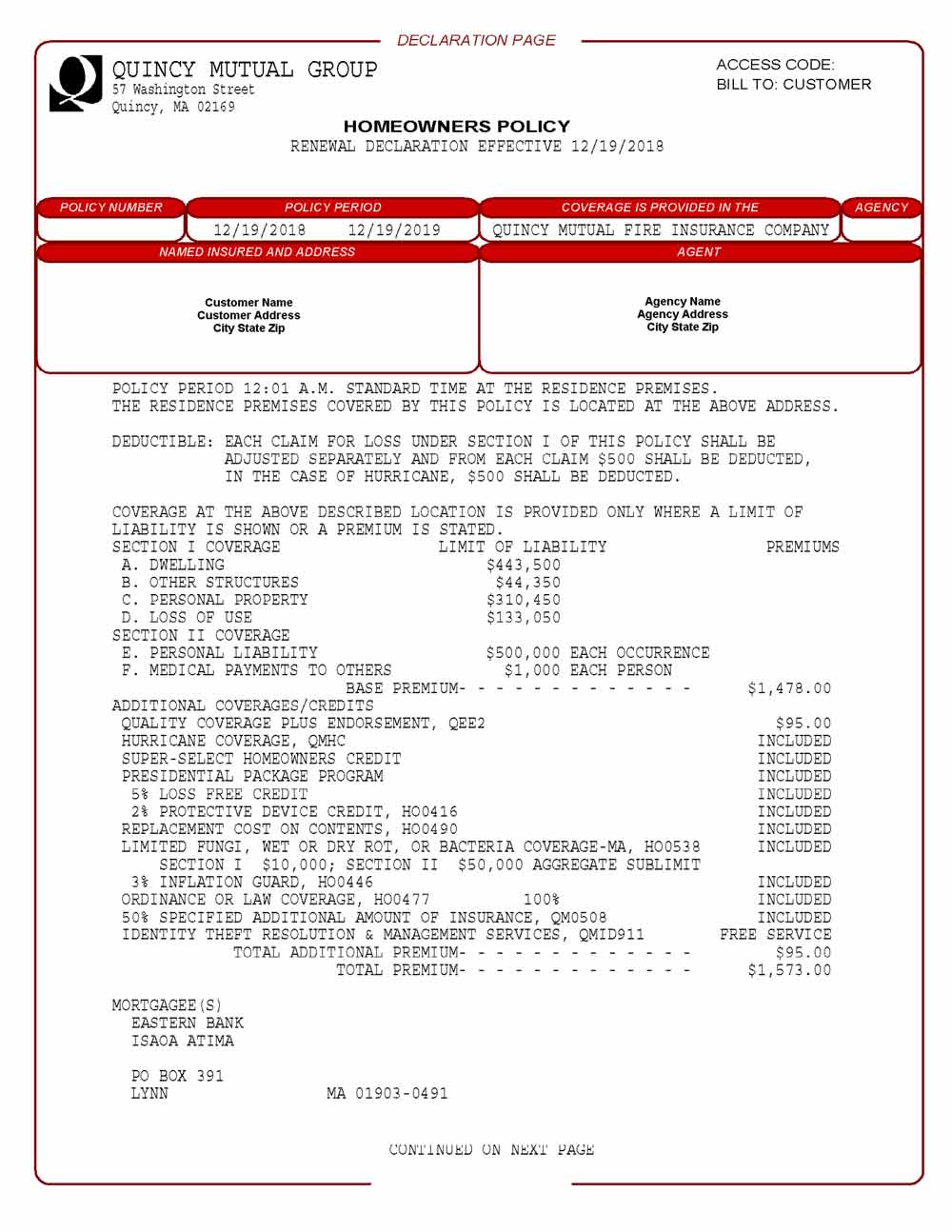

Car insurance is an important part of protecting yourself and your car from financial losses in the event of an accident or other damage to your vehicle. Insurance policies can help to cover the costs of repairs or replacement for your car and may even cover medical costs for yourself and any other passengers. Each state has its own rules and regulations regarding car insurance policies, so it is important to make sure you understand the laws in your area. In most cases, you will need to purchase a policy that meets the minimum requirements for your state.

Most car insurance policies are based on what type of coverage you need. There are three main types of coverage: liability, collision, and comprehensive. Liability coverage covers damages to another person or their property in the event of an accident. Collision coverage helps to pay for repairs to your own vehicle if it is damaged in an accident. Comprehensive coverage helps to pay for any damage to your vehicle that is caused by something other than an accident, such as theft or vandalism.

Can One Person Be On Two Car Insurance Policies?

The answer to this question is that, yes, one person can be on two car insurance policies. However, there are some important things to consider before doing so. First, it is important to understand that each car insurance policy is separate from the other. Even if you are on two policies with the same company, each policy will still have its own coverage and limits, so it is important to read through each policy before signing up.

Another thing to consider is that if you are on two policies, you will likely have to pay two separate premiums for each policy. This means that you will need to budget for two payments each month. It is important to think about whether this is something you can afford before signing up for two policies.

Finally, if you are on two policies, it is important to make sure that you are properly protected. You may need to adjust your coverage levels or limits to make sure that you are adequately covered in the event of an accident. For example, if you are in an accident with someone who has a higher coverage limit than you, your insurance may not cover all of the damages.

Conclusion

In conclusion, one person can be on two car insurance policies, but there are some important things to consider before doing so. It is important to make sure you understand the laws in your state, as well as your budget for two separate premiums. Additionally, it is important to adjust your coverage levels or limits to make sure that you are adequately protected in the event of an accident. By understanding the basics of car insurance policies and doing your research, you can make sure that you are adequately protected from financial losses.

Can You Have Two Different Insurance Policies On One Car - Car Retro

Can One Car Be Insured On Two Different Policies - Car Retro

Can You Have 2 Car Insurance Policies On One Car - goadesignstudio

5 phrases and terms to understand your auto insurance policy | Broccas

Best Free Auto Insurance Images and Photos