What Does Gap Insurance Cost

Tuesday, June 11, 2024

Edit

What Does Gap Insurance Cost?

What Is Gap Insurance?

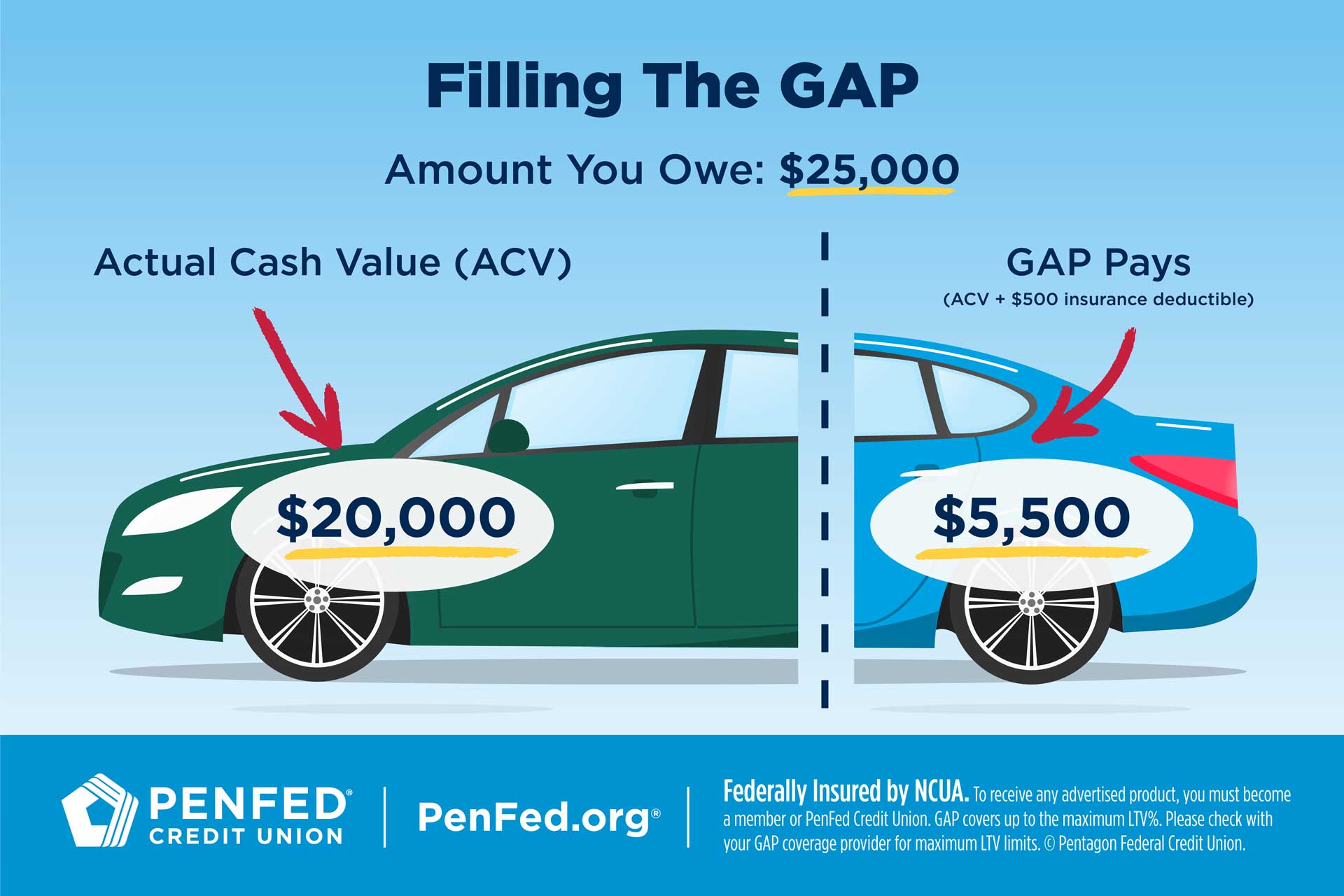

Gap insurance is an additional type of auto insurance coverage that helps pay off a car loan if the car is totaled or stolen. Gap insurance covers the difference between the amount owed on a vehicle loan and the actual cash value of the vehicle at the time of the incident. Gap insurance is most commonly used on new cars or vehicles purchased with a loan.

How Does Gap Insurance Work?

Gap insurance coverage kicks in if the vehicle owner experiences a total loss (theft or total destruction of the vehicle). In such an event, the insurance company will pay the difference between the actual cash value of the vehicle and the balance remaining on the loan. For example, if the car is totaled and the owner owes $15,000 on it, but the insurance company only covers the actual cash value of $10,000, gap insurance will pay the remaining $5,000.

What Factors Impact the Cost of Gap Insurance?

The cost of gap insurance will vary depending on the value of the car, the term of the loan and the deductible amount. Generally, gap insurance is more expensive for luxury or high-end vehicles since they have higher loan balances. The term of the loan will also impact the cost of gap insurance since longer loan terms mean more money is owed on the car. Additionally, the deductible amount will affect the cost of gap insurance, as the lower the deductible, the higher the cost.

How Much Does Gap Insurance Cost?

The cost of gap insurance can range anywhere from $500 to $1,000 annually. This is typically a small percentage of the total cost of the car loan. Gap insurance is typically offered as an optional coverage on most auto insurance policies, but some banks or lenders may require gap insurance as part of the loan agreement. It’s important to consider the cost of gap insurance when calculating the total cost of a car loan.

When Is Gap Insurance Not Necessary?

Gap insurance is typically not necessary if the car is purchased with cash or if a buyer has a trade-in or down payment that covers the difference between the loan balance and the car’s actual cash value. Additionally, gap insurance is not necessary if the car loan is for a short-term (e.g., two years or less) or if the loan balance is less than the car’s actual cash value.

The Bottom Line

Gap insurance is an important type of auto insurance coverage that can protect drivers in the event of a total loss. While the cost of gap insurance can vary depending on the cost of the car, the term of the loan and the deductible amount, it’s generally a small percentage of the total cost of the car loan. It’s important to consider the cost of gap insurance when calculating the total cost of a car loan.

What Is Gap Insurance? - Lexington Law

How Does Gap Insurance Work? | RamseySolutions.com

Is GAP insurance worthwhile? - babybmw.net

Is GAP Insurance Necessary?

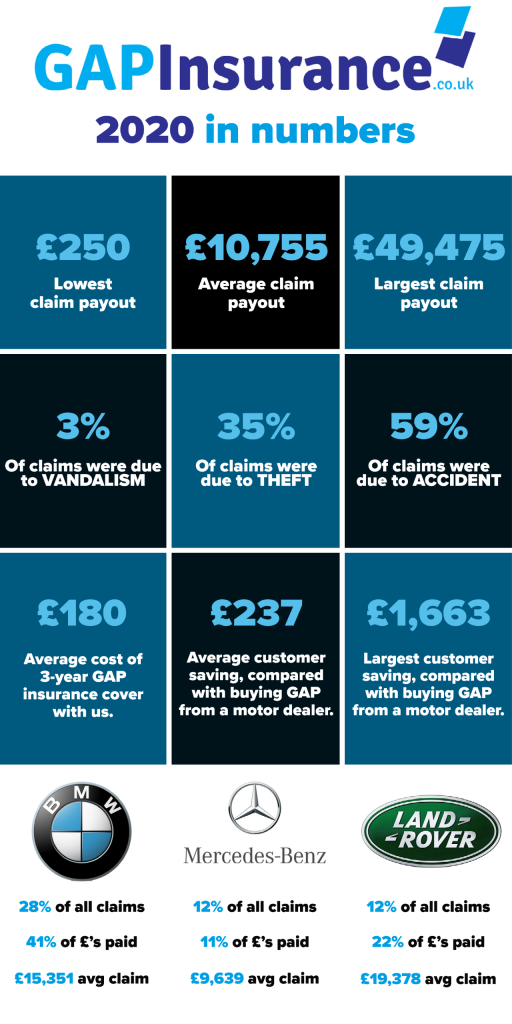

GAP Insurance Infographic: The Hidden Pitfall In Car Finance Deals