What Is Gap Insurance For Car

Friday, May 17, 2024

Edit

What Is Gap Insurance For Car

What Is Gap Insurance?

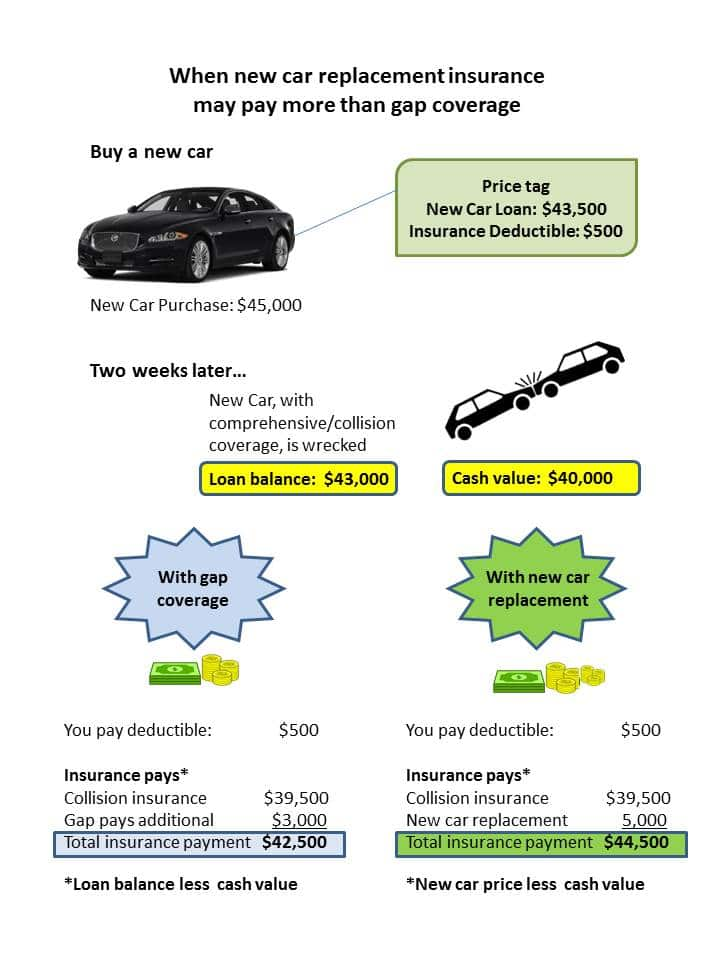

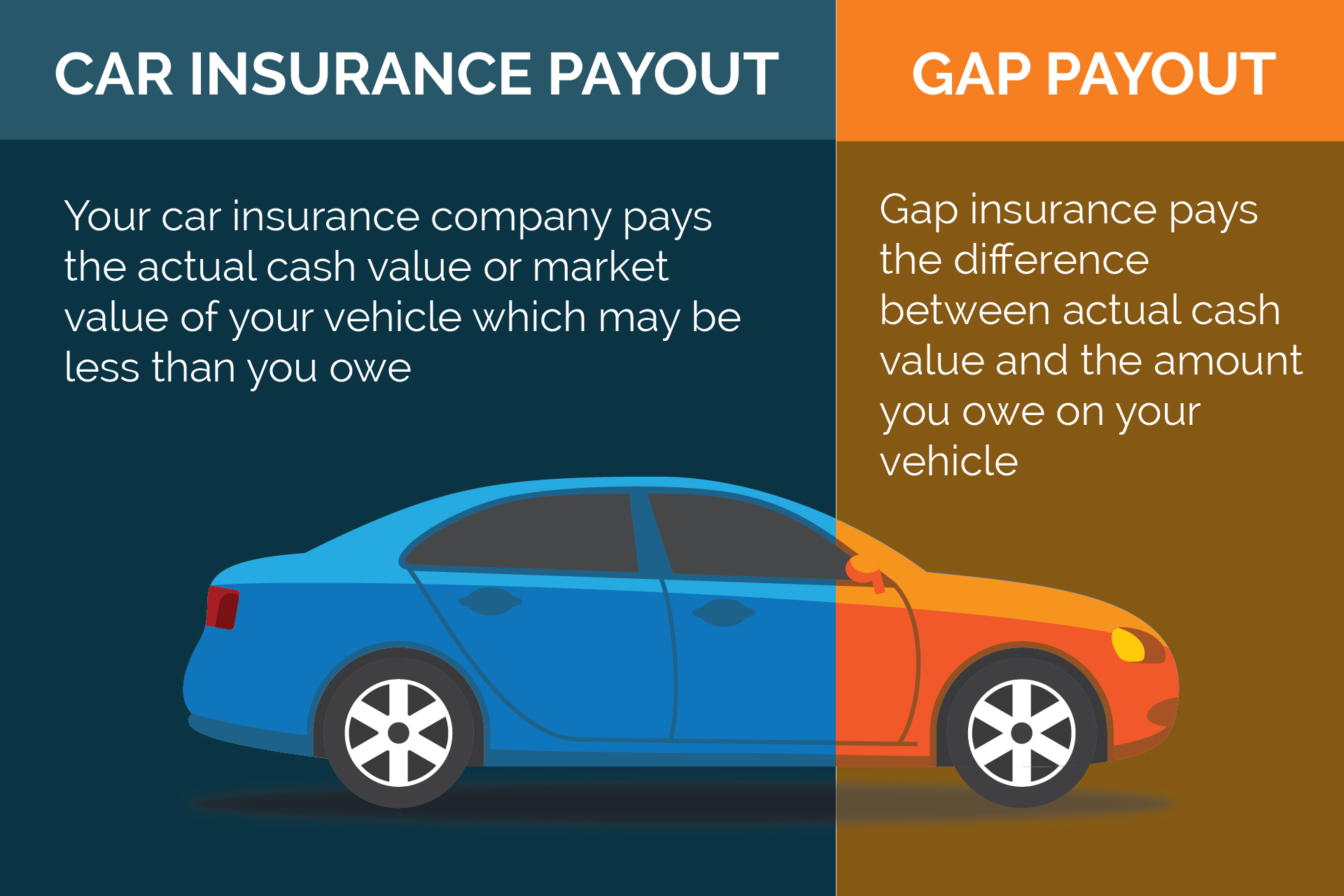

Gap insurance, also known as loan/lease gap coverage, is an optional car insurance coverage that helps pay off your car loan if your car is totaled or stolen and you owe more than the car’s actual cash value. When you purchase a new car, the vehicle’s actual cash value is typically lower than the amount you paid for the car. This difference is called the “gap” between what you owe and the car’s actual cash value. Gap insurance helps pay the difference between the amount you owe and the actual cash value of the car.

Do I Need Gap Insurance?

Gap insurance is important to consider if you have a loan or a lease on your car. When you have a loan or lease on a car, the car is typically worth less than what you owe on the loan or lease. This means, if you total your car in an accident, your insurance company would only pay the actual cash value of the car, which may be less than what you owe on the loan or lease. Without gap insurance, you may have to pay the difference out of pocket.

What Does Gap Insurance Cover?

Gap insurance covers the difference between the actual cash value of your car and the amount you still owe on your car loan or lease. This coverage can help you pay off your loan or lease balance in the event of a total loss or theft of your car. It can also help pay for your deductible if you have comprehensive or collision coverage on your car.

How Much Does Gap Insurance Cost?

Gap insurance costs vary depending on the carrier and the coverage. Generally, gap insurance costs range from $20 to $40 per year. Some insurance companies may offer gap insurance as an add-on to your existing car insurance policy. It’s important to talk to your insurance agent to find out if this coverage is available and what it would cost to add it to your policy.

What Happens If My Car Is Totaled?

If your car is totaled, your insurance company will pay the actual cash value of your car. If the amount you owe on your loan or lease is more than the actual cash value of your car, the difference is what gap insurance will cover. Gap insurance will help pay off the loan or lease balance so you don’t have to pay it out of pocket.

Conclusion

Gap insurance is an optional coverage that can help protect you if your car is totaled or stolen and you owe more than the car's actual cash value. If you have a loan or lease on your car, gap insurance is important to consider. It can help cover the difference between the actual cash value of your car and the amount you owe on the loan or lease. Gap insurance typically costs between $20 and $40 per year, depending on the carrier and the coverage.

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

Buying A Car Gap Insurance ~ designologer

Quick Guide to GAP Insurance - CRASH Services NI

Gap Insurance for your New or Leased Cars