What Is Gap Insurance When Buying A Car

What Is Gap Insurance When Buying A Car?

When you purchase a new car, there are a lot of things to consider. One of the things you should take into account is gap insurance. This type of insurance protects you in the event that your car is totaled in an accident or is stolen. Here’s what you need to know about gap insurance when buying a car.

What Is Gap Insurance?

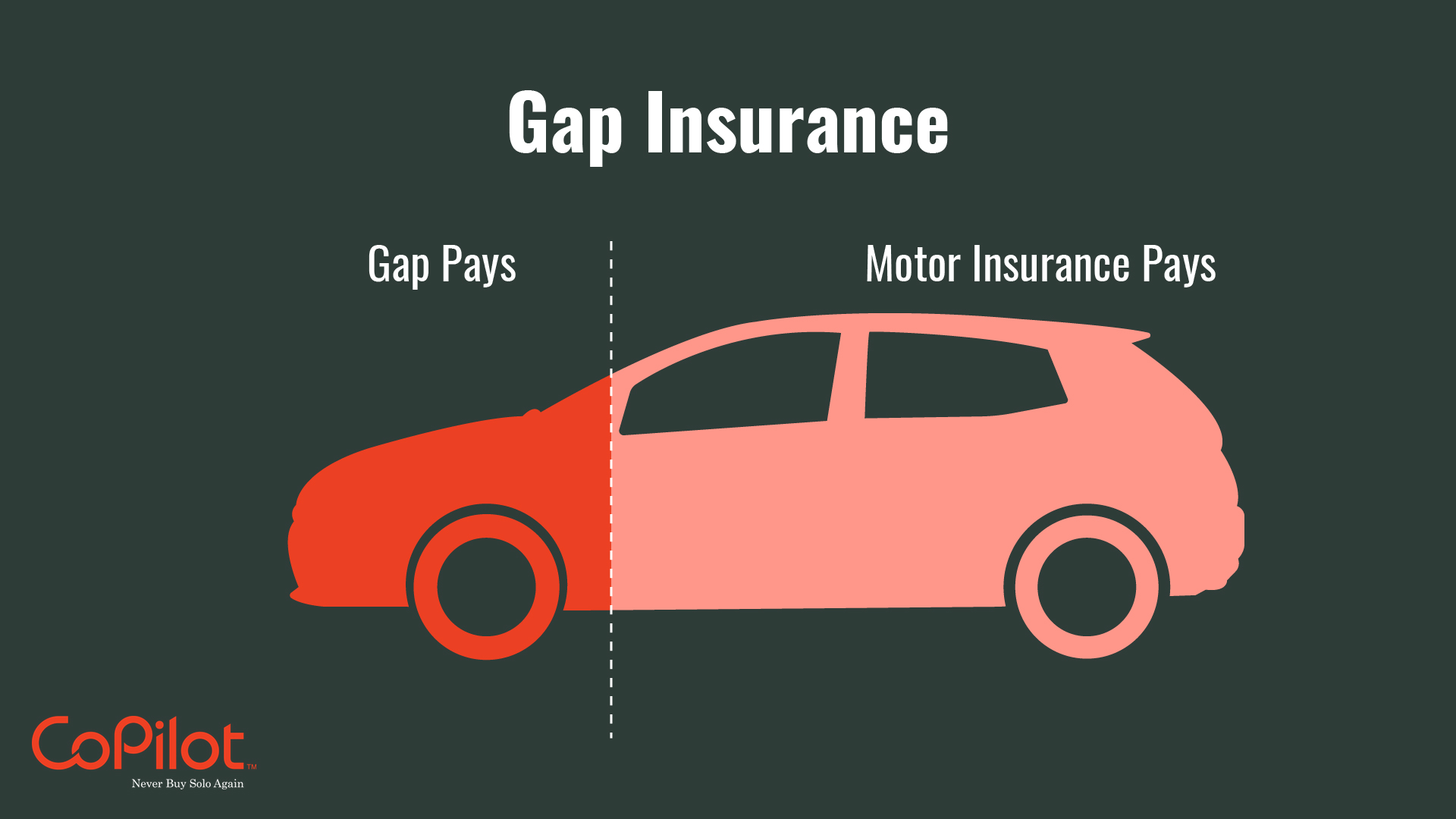

Gap insurance is an additional form of insurance that pays the difference between the amount you owe on your car loan and the actual cash value of your car. This type of insurance is designed to protect you if your car is damaged beyond repair or stolen. Gap insurance kicks in after your normal auto insurance has paid out its claim.

Who Needs Gap Insurance?

Gap insurance can be beneficial for anyone who finances their car. When you finance a car, you are usually required to put down a large down payment. This down payment covers the cost of the car and any additional fees associated with the loan. However, if your car is totaled in an accident or stolen, the insurance company will only pay out the actual cash value of your car, which is typically lower than the amount you still owe on your loan. This is where gap insurance comes in. It pays the difference between the actual cash value of the car and the amount you still owe on the loan.

How Much Does Gap Insurance Cost?

The cost of gap insurance varies depending on the type of car you have and the coverage you want. Generally, gap insurance costs between 5% and 7% of the total loan amount. For example, if you take out a loan for $10,000, your gap insurance could cost between $500 and $700. The best way to find out how much gap insurance will cost for your particular car is to contact your insurance provider.

Is Gap Insurance Worth It?

Gap insurance can be beneficial for anyone who is financing their car. If your car is totaled in an accident or stolen, gap insurance can ensure that you don’t have to pay more than the actual cash value of the car. It can also protect you from having to pay out-of-pocket for the difference between the actual cash value and the amount you still owe on the loan. For this reason, gap insurance can be a worthwhile investment.

Where Can You Get Gap Insurance?

Gap insurance is offered by most major auto insurance companies. You can contact your insurance provider to inquire about gap insurance and get a quote. You can also shop around to compare quotes and find the best deal. Regardless of where you get your gap insurance, make sure that you read the policy carefully and understand what you are covered for.

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Buying A Car Gap Insurance ~ designologer

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

30 Car Buying Industry Terms Every Buyer Should Know - CoPilot

Quick Guide to GAP Insurance - CRASH Services NI