What Is Gap Insurance For A Car

What Is Gap Insurance For A Car?

What Is Gap Insurance?

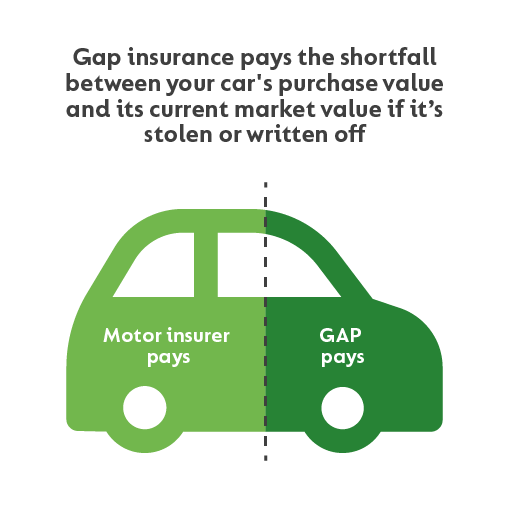

Gap insurance (also known as Guaranteed Auto Protection) is a type of auto insurance that covers the difference between what you owe on a vehicle and what the insurance company will pay out on that vehicle if it is totaled in an accident or stolen. Gap insurance is important to have if you have a loan on a vehicle, since the amount you owe on the loan may be more than the current market value of the vehicle. Without gap insurance, you may be responsible for the difference between what you owe and what your insurance company will pay out.

Why Do I Need Gap Insurance?

If you have a loan on your car, you may be required to purchase gap insurance. This is because the amount you owe on the loan may be more than what the car is worth. If your car is totaled in an accident or stolen and your insurance company pays out the current market value of the car, you may still owe money on the loan. Gap insurance covers the difference between the amount you owe and what the insurance company will pay out.

How Much Does Gap Insurance Cost?

The cost of gap insurance depends on several factors, including the type of vehicle you have, the amount of coverage you want, and your driving record. Generally, gap insurance costs between $20 and $30 per year, but it can be much more expensive if you have a high-end vehicle or if you have a poor driving record. You can also purchase gap insurance from an independent insurance provider, which can be more affordable than purchasing it through your auto insurance provider.

How Do I Get Gap Insurance?

Most auto insurance providers offer gap insurance as an optional coverage. You can add gap insurance to your existing auto insurance policy, or you can purchase it through an independent insurance provider. If you have a loan on your vehicle, check with your lender to see if they require that you have gap insurance. If you are financing a new car, you may be able to purchase gap insurance from the dealership.

What Happens If I Don't Have Gap Insurance?

If you don't have gap insurance and your car is totaled in an accident or stolen, you may be responsible for the difference between what you owe on the loan and what the insurance company will pay out. This can be a significant amount of money, so it is important to make sure you have adequate coverage. If you don't have gap insurance and you want to purchase it, make sure you do so before an accident or theft occurs.

Conclusion

Gap insurance is an important type of coverage to have if you have a loan on a vehicle. It can cover the difference between what you owe on the loan and what the insurance company will pay out if your car is totaled or stolen. Gap insurance can be expensive, but it can help protect you from a major financial loss. Make sure you check with your lender and auto insurance provider to see if gap insurance is an option for you.

Gap Insurance For Cars Is It Worth It - Is Car GAP Insurance Worth It

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Buying A Car Gap Insurance ~ designologer

Gap Insurance at GoCompare | What is Gap Insurance and How Does it Work?

How Does Gap Insurance Work? | RamseySolutions.com