Property Damage Liability How Much

Understanding Property Damage Liability and How Much Coverage You Need

Property damage liability is an important component of auto insurance. It’s a coverage that provides financial protection for car owners who are found to be legally liable for damage caused to another person’s property. Property damage liability covers costs associated with repair or replacement of the other person’s property, such as a vehicle or a building. It does not cover the cost of repairing or replacing the policyholder’s own property.

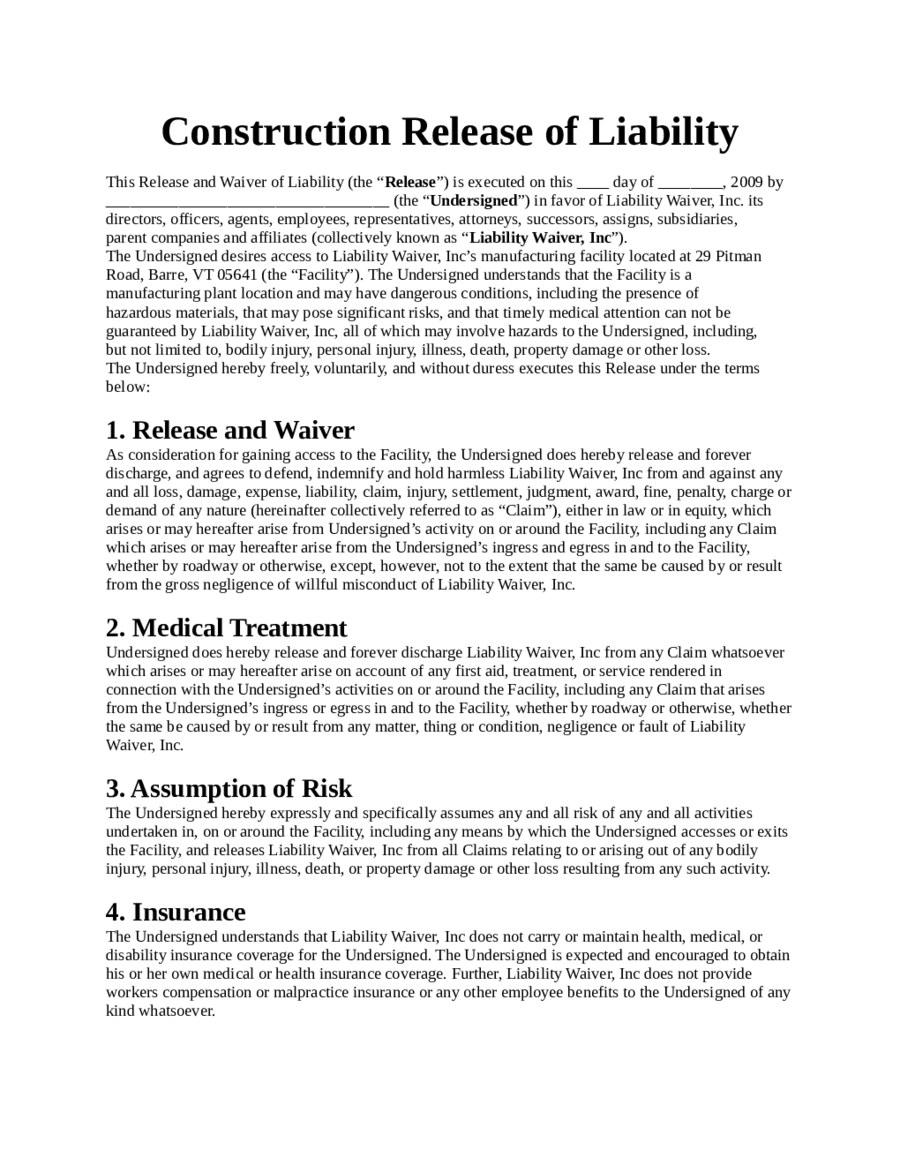

When it comes to auto insurance, property damage liability coverage is typically required in most states. However, the minimum amount of coverage you are required to carry varies by state. It’s important to familiarize yourself with the laws in your state to ensure you are compliant with the law. In some cases, you may be able to carry lower limits of coverage if you are willing to sign a waiver.

What Is Property Damage Liability Coverage?

Property damage liability coverage is designed to provide financial protection for car owners who are found legally liable for damage caused to another person’s property. This coverage pays for the costs associated with repair or replacement of the other person’s property, such as a vehicle or a building. It does not pay for the repair or replacement of the policyholder’s own property.

Property damage liability coverage is typically required in most states. It’s important to familiarize yourself with the laws in your state to ensure you are compliant with the law. In some cases, you may be able to carry lower limits of coverage if you are willing to sign a waiver. The minimum amount of coverage you are required to carry varies by state.

How Much Property Damage Liability Coverage Do You Need?

When it comes to property damage liability coverage, the amount of coverage you need will depend on the state you live in and what the minimum coverage requirements are. Typically, the minimum coverage required is between $10,000 and $25,000. However, this amount can vary significantly depending on the state.

In addition to the state minimum requirements, you may also want to consider purchasing additional coverage to cover the cost of any damage you may cause to another person’s property. The amount of coverage you need will depend on your individual circumstances, such as the value of your car and the amount of assets you have. Consider purchasing coverage that is equal to or greater than the value of your car, in case of a total loss.

What Does Property Damage Liability Coverage Cover?

Property damage liability coverage is designed to provide financial protection for car owners who are found legally liable for damage caused to another person’s property. This coverage pays for the costs associated with repair or replacement of the other person’s property, such as a vehicle or a building. It does not pay for the repair or replacement of the policyholder’s own property.

Property damage liability coverage typically covers the cost of repair or replacement of the other person’s property, such as a vehicle or a building. It may also cover the cost of legal fees if the policyholder is sued for damages. In addition, some policies may also provide coverage for damage caused by uninsured or underinsured motorists.

What Does Property Damage Liability Coverage Not Cover?

Property damage liability coverage does not cover the cost of repair or replacement of the policyholder’s own property. It also does not cover the cost of damage caused by the policyholder’s own negligence or intent. In addition, property damage liability coverage typically does not cover the cost of medical expenses resulting from the accident.

Finally, property damage liability coverage does not provide any coverage for the damage caused by a hit-and-run driver. If you are involved in an accident with an uninsured or underinsured driver, you may need to purchase additional coverage to cover the cost of the damage.

Conclusion

Property damage liability is an important component of auto insurance. It provides financial protection for car owners who are found to be legally liable for damage caused to another person’s property. The amount of coverage you are required to carry varies by state, so it’s important to familiarize yourself with the laws in your state. In addition, you may want to consider purchasing additional coverage to cover the cost of any damage you may cause to another person’s property.

If you are ever involved in an accident, it’s important to contact your insurance company as soon as possible. They can help you determine the amount of coverage you need and provide you with information on how to file a claim. By understanding property damage liability and how much coverage you need, you can make sure you are protected if you are ever in an accident.

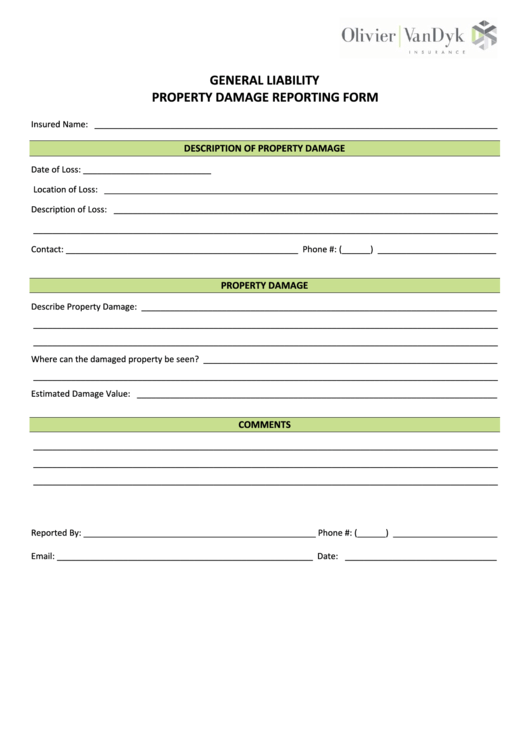

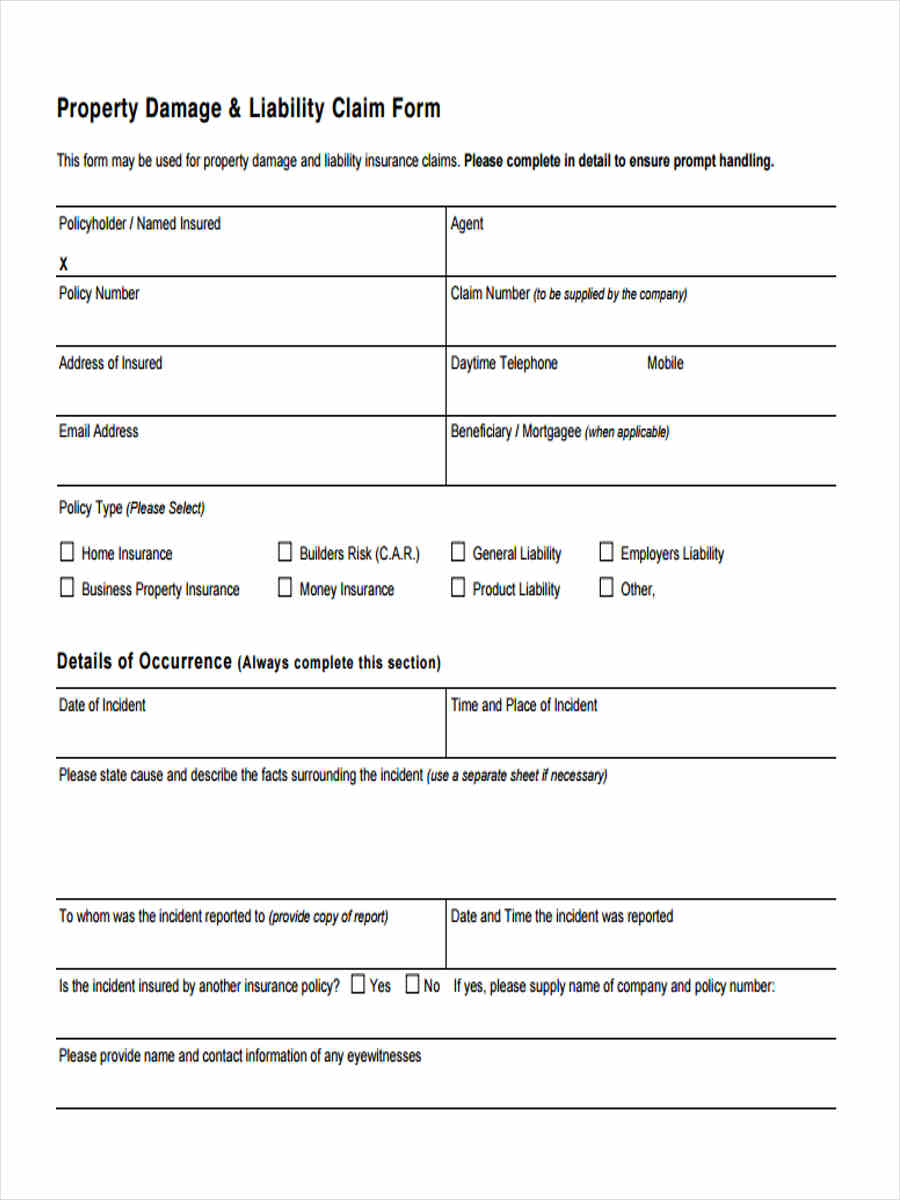

Top Property Damage Release Form Templates free to download in PDF format

Free Release of Liability Form | Sample Waiver Form | Legal Templates

FREE 26+ Liability Forms in PDF | Ms Word | Excel

PPT - Chapter 10: Risk Management and Property/Liability Insurance

Construction Release of Liability Form Download - Edit, Fill, Sign