Third Party Property Damage Liability

What is Third Party Property Damage Liability?

Third Party Property Damage Liability, often abbreviated to TPPD, is a type of insurance coverage that is designed to protect individuals and businesses from damage they cause to other people’s property. For example, if you were to accidentally damage a car while driving, your TPPD policy would cover the costs of repairing the vehicle. It is important to understand that TPPD does not cover damage to your own property, only the property of other people.

TPPD coverage is typically included with most auto insurance policies. In fact, many states require drivers to carry TPPD coverage in order to legally drive a vehicle. This coverage is also available as an add-on to other types of insurance, such as home insurance and renters insurance. It is important to read your insurance policy carefully to make sure you know what is and isn’t covered.

What Does TPPD Cover?

TPPD coverage is designed to cover the cost of repairing or replacing other people’s property that has been damaged due to your negligence. This includes things like: damaged vehicles, buildings, fences, and other property. This coverage does not typically cover any medical costs associated with the damage, only the cost of repairing or replacing the property.

What Doesn’t TPPD Cover?

It is important to understand that TPPD does not cover any damage caused intentionally or due to gross negligence. Additionally, it does not typically cover any damage to your own property, only the property of other people. It is also important to note that TPPD does not cover any medical costs associated with the damage.

Do I Need TPPD Coverage?

Whether or not you need TPPD coverage depends on your individual situation. If you are a business owner, it is important to have TPPD coverage in order to protect yourself from any potential damages that may be caused to other people’s property. Additionally, if you are a driver, it is important to understand that many states require drivers to carry TPPD coverage in order to legally drive a vehicle.

Overall, Third Party Property Damage Liability is an important type of insurance coverage that can help protect individuals and businesses from the costs associated with damages they cause to other people’s property. It is important to read your insurance policy carefully to make sure you know what is and isn’t covered. Additionally, it is important to understand that many states require drivers to carry TPPD coverage in order to legally drive a vehicle.

Third Party Property Damage Liability (TPPD Insurance) Explained

What Does Third Party Property Damage Cover - PRFRTY

☑ Letter Denying Claim For Damages

🤔 Do You Need A Property Damage Lawyer Or Personal Injury Attorney?

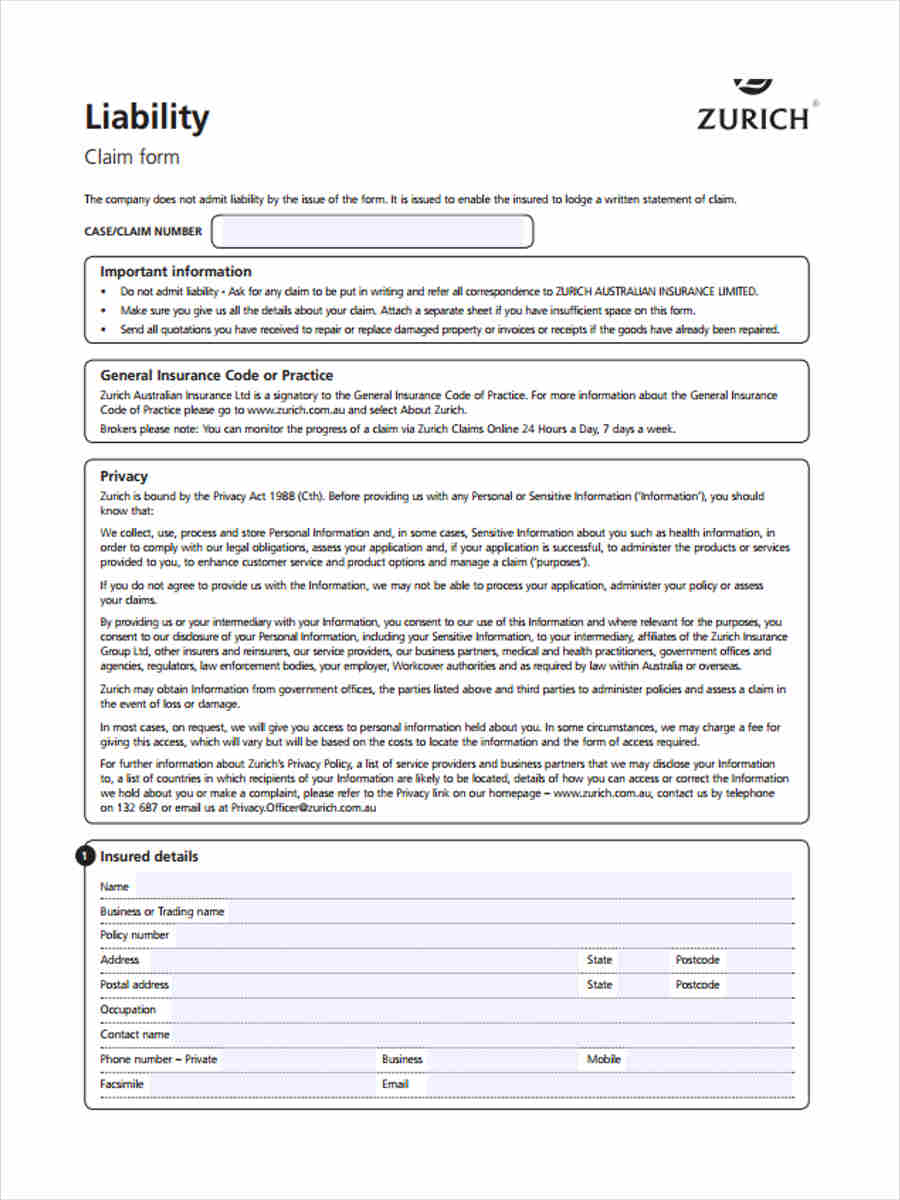

FREE 5+ Third Party Liability Forms in PDF