How Much Does Business Use Add To Car Insurance

Does Business Use Add To Car Insurance?

What is Business Use?

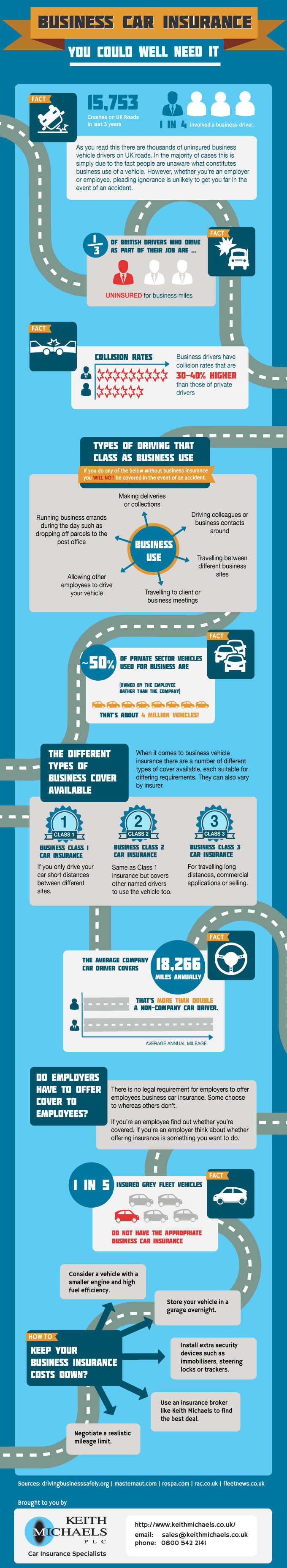

Business use is a type of car insurance coverage that allows you to use your car for business-related activities. It includes driving to meetings, driving to business-related events, and even delivering goods or services. Business use is usually an optional coverage you can add to your personal car insurance policy. It typically provides liability coverage for damage or injuries caused by the business use of your car.

How Much Does Business Use Add to Car Insurance?

The cost of adding business use to your car insurance policy varies depending on your insurer and the coverage you choose. Generally, adding business use will increase your premium by 10 to 15 percent. However, it can be as much as 30 percent, depending on the insurer. Additionally, the more business use you expect to do, the more expensive the coverage will be.

How Do I Add Business Use To My Car Insurance?

The process for adding business use to your car insurance policy varies by insurer. Generally, you will need to contact your insurance company to add the coverage. You will need to provide information about the type of business you are doing, the amount of business use you expect to do, and the type of vehicle you will be using for business activities. Your insurance company will then provide you with a quote for the coverage.

What Are the Benefits of Adding Business Use to My Car Insurance?

Adding business use to your car insurance policy can provide you with peace of mind knowing that you are covered for any damages or injuries that occur as a result of your business use of your car. Additionally, it can provide you with additional liability coverage, which can help protect you if you are sued. Lastly, it can be a cost-effective way to cover yourself for any business-related activities that you may need to do.

What Should I Consider Before Adding Business Use to My Car Insurance?

Before adding business use to your car insurance policy, it is important to consider the type of business you are doing, the amount of business use you expect to do, and the type of vehicle you will be using for business activities. Additionally, it is important to compare quotes from different insurers to make sure you are getting the best coverage for the best price. Lastly, it is important to make sure that your insurance company is aware of any changes in the type of business or amount of business use you are doing to ensure that you are always adequately covered.

Conclusion

Adding business use to your car insurance policy can be a great way to provide additional coverage for any business-related activities that you may need to do. It can provide you with additional liability coverage and peace of mind knowing that you are covered for any damages or injuries that occur as a result of your business use of your car. It is important to compare quotes from different insurers to make sure you are getting the best coverage for the best price and to make sure that your insurance company is aware of any changes in the type of business or amount of business use you are doing.

Car insurance infographic | 20 Miles North Web Design

What's the average cost of car insurance in the US? - Business Insider

Be Covered Adequately with Car Insurance Add on Covers - InstaBima

What is Business Car Insurance? | Business Insurance | Keith Michaels

7 Things You Need to Know About Car Insurance | The Summit Express