Third Party Liability Insurance Enterprise

Third Party Liability Insurance – What is it and why you need it?

Third Party Liability Insurance is an important part of any business, as it provides protection against claims arising from injury or damage caused to third parties. It is also known as Public Liability Insurance and is commonly purchased by companies who are in contact with the public. It is important to understand the need for Third Party Liability Insurance and how it works.

What is Third Party Liability Insurance?

Third Party Liability Insurance is a type of insurance policy that covers the insured from claims arising from injury or damage to third parties caused by the actions of the insured. It is also known as Public Liability Insurance, as it is designed to protect the insured against any claims made by the public due to the insured's activities. It is important to note that this type of insurance does not cover the insured from any damage or injury caused to the insured themselves or their property, but rather from any injury or damage caused to third parties.

Who Needs Third Party Liability Insurance?

Third Party Liability Insurance is essential for businesses that come into contact with the public. This can include businesses such as retail stores, restaurants, bars, hotels, and other businesses that come into direct contact with the public. It is also important for businesses that provide professional services, such as accountants, lawyers, and other professionals. Third Party Liability Insurance is also important for large companies, as these companies may be liable for any negligent actions of their employees.

What Does Third Party Liability Insurance Cover?

Third Party Liability Insurance covers any claims arising from injury or damage caused to third parties due to the actions of the insured. This includes bodily injury, property damage, personal injury, advertising injury, and any other claims arising from the activities of the insured. It is important to note that Third Party Liability Insurance does not cover any claims arising from the insured's own negligence or wrongful conduct. It also does not cover any damage or injury caused to the insured themselves or their property.

What Are the Benefits of Third Party Liability Insurance?

Third Party Liability Insurance provides businesses with important protection from claims arising from injury or damage caused to third parties due to the actions of the insured. It also provides protection for large companies against claims arising from the negligence of their employees. Furthermore, Third Party Liability Insurance can protect businesses from the high costs of defending against any claims, as well as the costs of any settlement or award resulting from a claim.

How Much Does Third Party Liability Insurance Cost?

The cost of Third Party Liability Insurance will vary depending on the type of business, the type of coverage, the amount of coverage, and the deductible chosen. Generally, the cost of Third Party Liability Insurance is determined by the type of business and the amount of coverage. For example, a retail store may pay a lower premium than a professional service provider. It is important to shop around for the best coverage and the best price for Third Party Liability Insurance.

How is a group insurance scheme effective? - MyAnmol Insurance

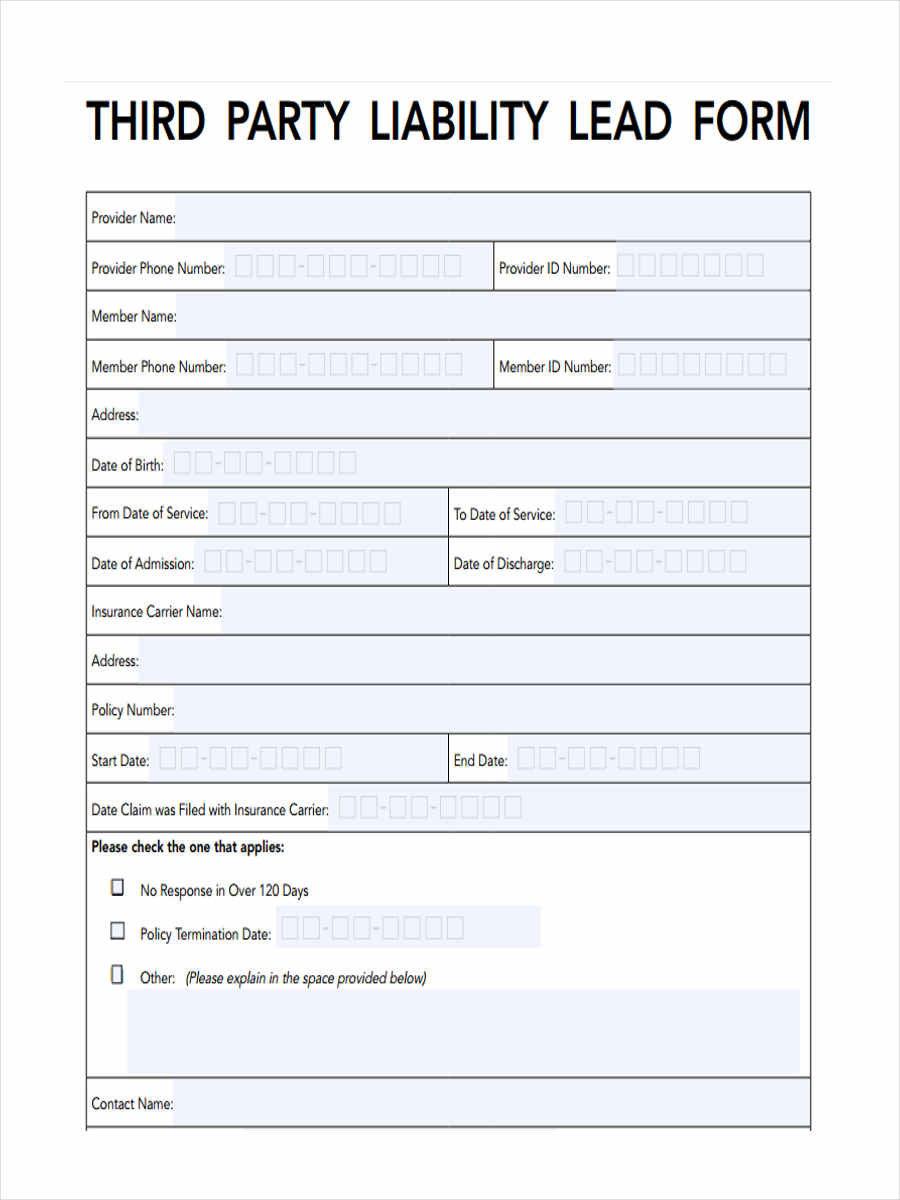

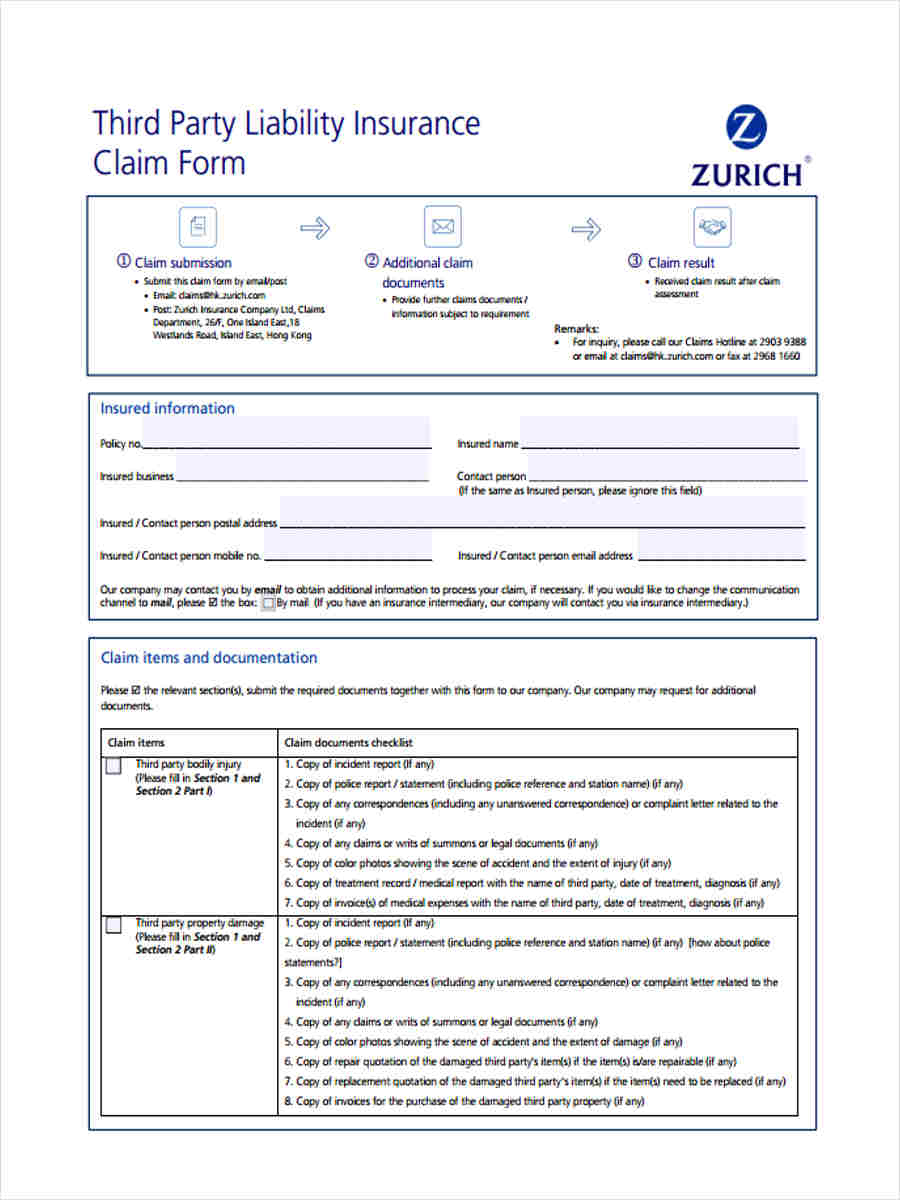

FREE 5+ Third Party Liability Forms in MS Word | PDF

🏡 ¿Qué es el seguro contra terceros?

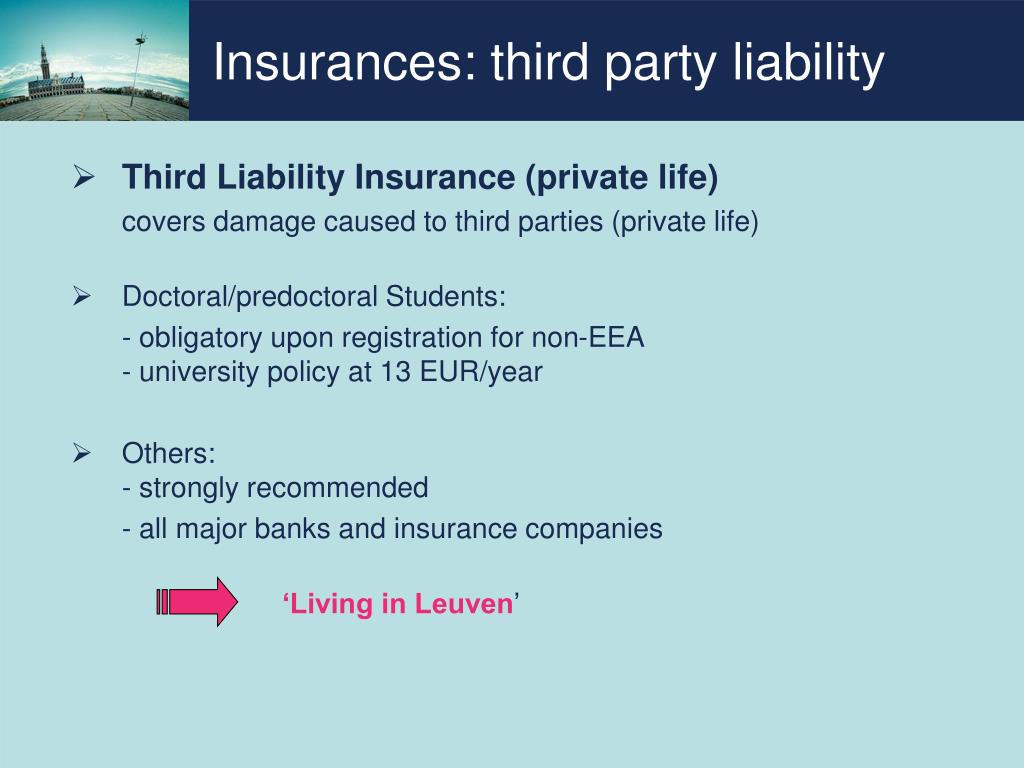

PPT - International researchers @ K.U.Leuven Bob Geivers Annemie

FREE 5+ Third Party Liability Forms in PDF