Third Party Liability Insurance Coverage

Understanding Third Party Liability Insurance

Third-party liability insurance is an insurance policy that is designed to provide protection for an insured against claims that may be made by a third-party for bodily injury, property damage, and/or personal injury. This type of insurance is often required by companies, organizations, or individuals that engage in activities that could lead to potential claims by someone else. It is also known as public liability insurance or general liability insurance.

What Does Third Party Liability Insurance Cover?

Third-party liability insurance generally covers claims made against an insured for bodily injury, property damage, and/or personal injury that is caused by the insured’s negligence or intentional act. This type of insurance also covers claims for libel and slander, as well as for any defense costs associated with defending the insured against the claims.

Who Needs Third Party Liability Insurance?

Third-party liability insurance is important for anyone who is involved in activities that could potentially lead to claims by someone else. This includes individuals, companies, and organizations that engage in activities such as construction, manufacturing, retail, and hospitality. It is also important for individuals who own property, such as homes, boats, and cars, as well as individuals who engage in any type of recreational activities, such as skiing or snowmobiling.

What Are the Benefits of Third Party Liability Insurance?

The primary benefit of third-party liability insurance is that it provides protection for an insured against potentially large claims that could be made by a third-party. This type of insurance also helps to protect an insured’s assets, as well as their reputation, in the event that a claim is made against them. Additionally, this type of insurance can help to reduce the risk of financial losses that could result from a claim.

What Are the Limits of Third Party Liability Insurance?

Third-party liability insurance typically has limits on the amount of coverage that is provided. These limits will vary depending on the policy and the type of coverage that is provided. Additionally, this type of insurance typically does not cover any intentional acts that are committed by an insured. It is important to note that this type of insurance is not a substitute for professional liability insurance, which provides coverage for claims that arise from professional services that are provided by an insured.

Where Can I Find Third Party Liability Insurance?

Third-party liability insurance can be purchased from most insurance companies. It is important to compare different policies and coverage options to find the one that best fits the needs of the insured. Additionally, it is important to consider any discounts or special offers that may be available when purchasing this type of insurance. It is also important to make sure that the policy covers all of the potential risks that could arise from the activities that the insured engages in.

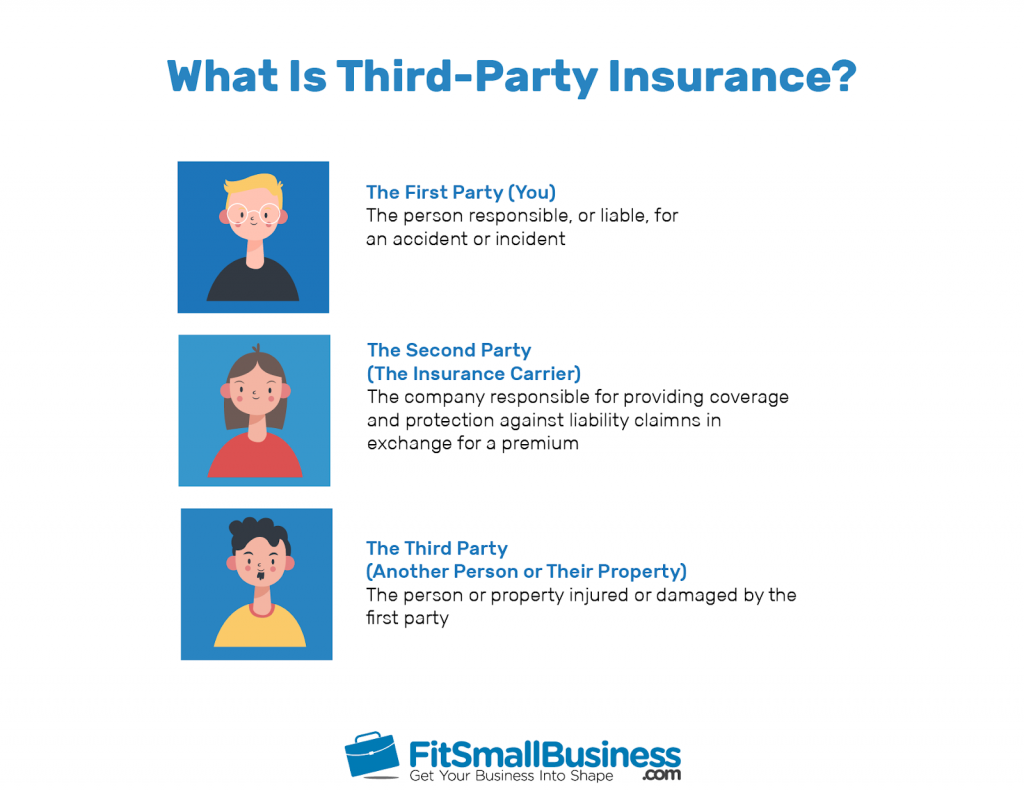

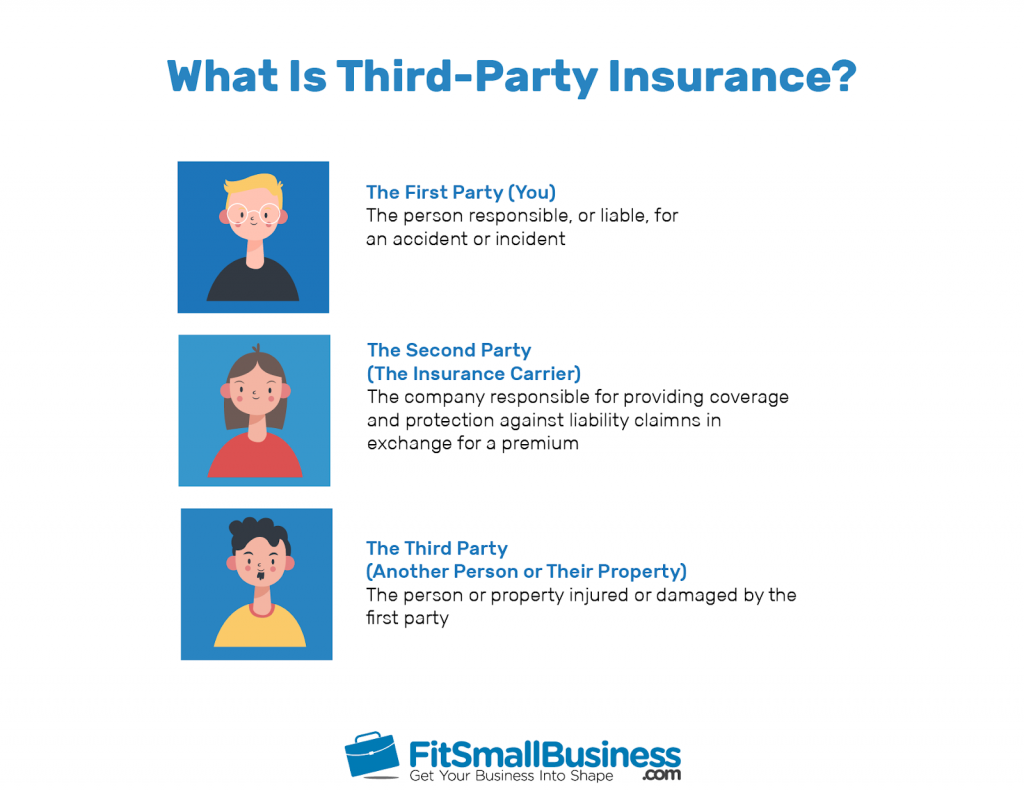

What Is Third-party Insurance?

Adelaide Third Party Liability Coverage | Eastern Equity Insurance

How the MMIS Uses Third Party Liability Information

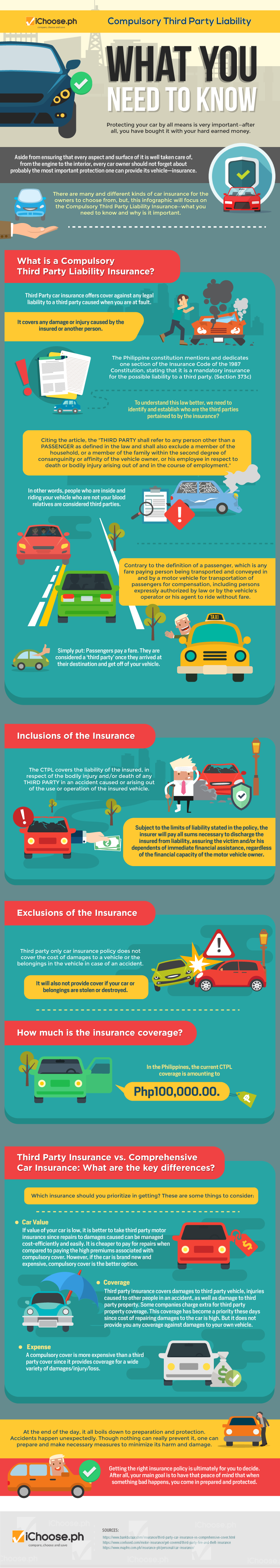

Compulsory Third Party Liability What You Need to Know | iChoose

PPT - Third Party Liability PowerPoint Presentation, free download - ID