3rd Party Car Insurance Cost

What You Need To Know About Third Party Car Insurance Costs

What is Third Party Car Insurance?

Third party car insurance is an insurance policy that covers you in the event that you cause damage to another person’s car or property. It is one of the most common types of car insurance. It covers you for any legal liability that may arise out of an accident, such as medical expenses, repair costs, and in some cases, lost wages. It does not, however, cover your own car or any damage you cause to it.

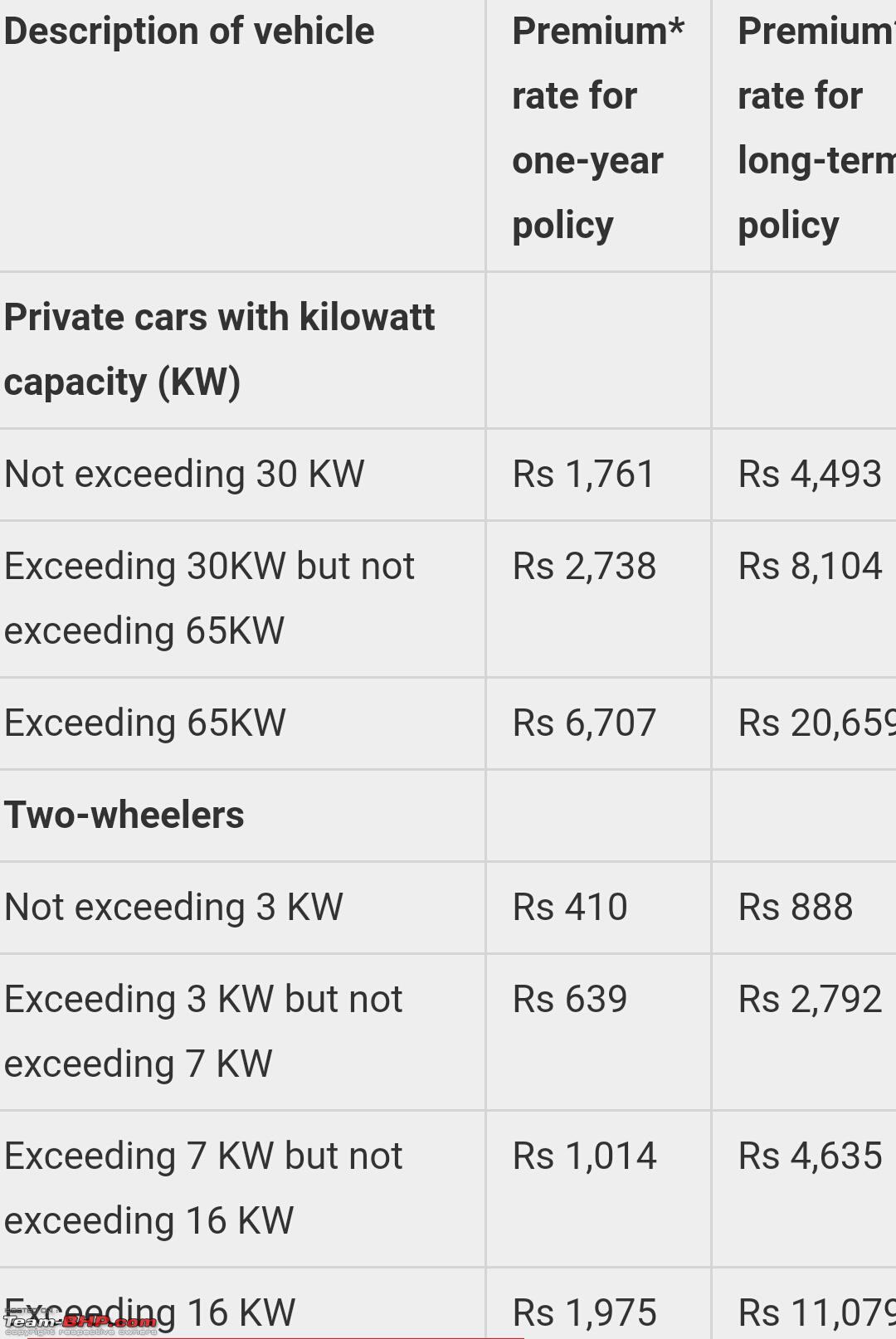

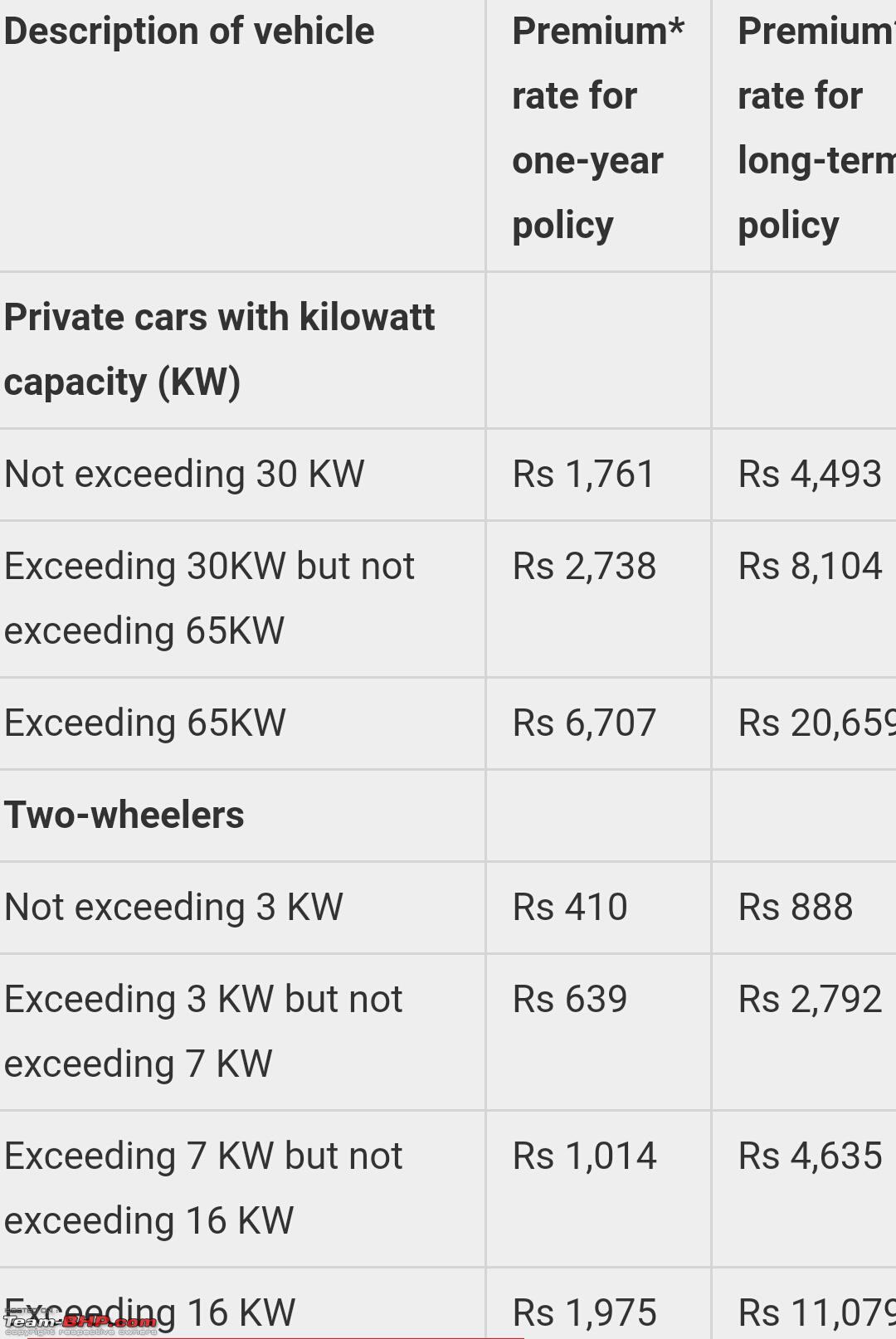

What Does Third Party Car Insurance Cost?

The cost of third party car insurance depends on a variety of factors, including the type of car you’re driving, your age, gender, and driving history. Generally speaking, the cost tends to be lower than comprehensive insurance, which covers damage to your own car in addition to third party liability. The average cost of third party car insurance in the U.S. is around $500 per year, though it can be higher or lower depending on your individual circumstances.

How Can I Reduce My Third Party Car Insurance Costs?

There are several ways to reduce the cost of your third party car insurance. The most effective is to shop around for the best deal. Different insurance companies will offer different rates, so it’s important to compare prices before making a decision. Additionally, you can reduce your premium by increasing your deductibles, opting for a higher excess, or taking out a policy with a no-claims bonus. You may also qualify for discounts if you have a good driving record or are a member of certain organizations.

What About Comprehensive Insurance?

Comprehensive car insurance is an insurance policy that covers both your own car and third party liability. It is typically more expensive than third party car insurance, but it is also more comprehensive, providing coverage for any damage to your car, whether it’s caused by an accident, vandalism, or natural disaster. Comprehensive insurance is typically more suitable for newer cars, as it covers the cost of repairs.

In Summary

Third party car insurance is a type of insurance policy that covers you in the event that you cause damage to another person’s car or property. The cost of third party car insurance depends on a variety of factors, but it is typically lower than comprehensive insurance. You can reduce your premium by shopping around for the best deal, increasing your deductibles, opting for a higher excess, or taking out a policy with a no-claims bonus. Alternatively, you may want to consider comprehensive insurance, which provides coverage for any damage to your car.

3rd-party insurance prices hiked for the nth time (June 2019) - Team-BHP

Car Insurance That Pays For Your Injuries Weegy – Cars Insurance

Third Party Insurance Price Uae - akuapprovesing

Third Party Car Insurance: What You Need To Know

2017 Car Insurance Quotes | Opt For 3rd Party Cover To Reduce Costs