Aa Third Party Insurance Price

Third Party Insurance Price - Important Things to Consider

Third party insurance is a type of insurance policy that is designed to protect you from liability in the event that you cause damage to another persons property, or injury to another person, during the course of your business activities. The cost of third party insurance can vary depending on the type of coverage that you need, the amount of coverage that you need, and the company that you purchase the policy from. It is important to compare the different types of policies that are available to determine which one is best for you and your company.

What is Covered by Third Party Insurance?

Third party insurance typically covers the cost of any damage that you cause to another person’s property or to another person’s body. This type of insurance is designed to protect you from liability in the event that you cause damage to another person’s property or injure another person while conducting business activities. It is important to be aware of the different types of coverage that are available to you so that you can ensure that you are adequately covered in the event that you cause damage to another person’s property or injure another person.

Factors that Influence Third Party Insurance Price

The cost of third party insurance is affected by several factors. The amount of coverage that you need, the type of policy that you purchase, and the company that you purchase the policy from all play a role in determining the cost of your policy. The amount of coverage that you need will depend on the type of business that you are conducting, as well as the amount of risk that is associated with your business activities. It is important to take the time to research the different types of policies that are available to you in order to ensure that you are adequately covered in the event that you cause damage to another person’s property or injure another person.

Factors that Affect Third Party Insurance Price

The cost of third party insurance is also affected by the type of policy that you purchase. Certain types of policies may be more expensive than others, depending on the amount of coverage that is provided. Additionally, the company that you purchase the policy from can also affect the cost of the policy. It is important to compare the different types of policies that are available to you in order to ensure that you are adequately covered in the event that you cause damage to another person’s property or injure another person.

How to Find the Best Third Party Insurance Price

The best way to find the best third party insurance price is to compare the different types of policies that are available to you. It is important to compare the different types of policies in order to determine which one is best suited to your needs. Additionally, the company that you purchase the policy from can also affect the cost of the policy. It is important to compare the different types of policies that are available to you in order to ensure that you are adequately covered in the event that you cause damage to another person’s property or injure another person.

Conclusion

Third party insurance is an important type of insurance policy that is designed to protect you from liability in the event that you cause damage to another persons property, or injury to another person, during the course of your business activities. The cost of third party insurance can vary depending on the type of coverage that you need, the amount of coverage that you need, and the company that you purchase the policy from. It is important to compare the different types of policies that are available to you in order to determine which one is best suited to your needs.

Third Party Insurance Price Uae - akuapprovesing

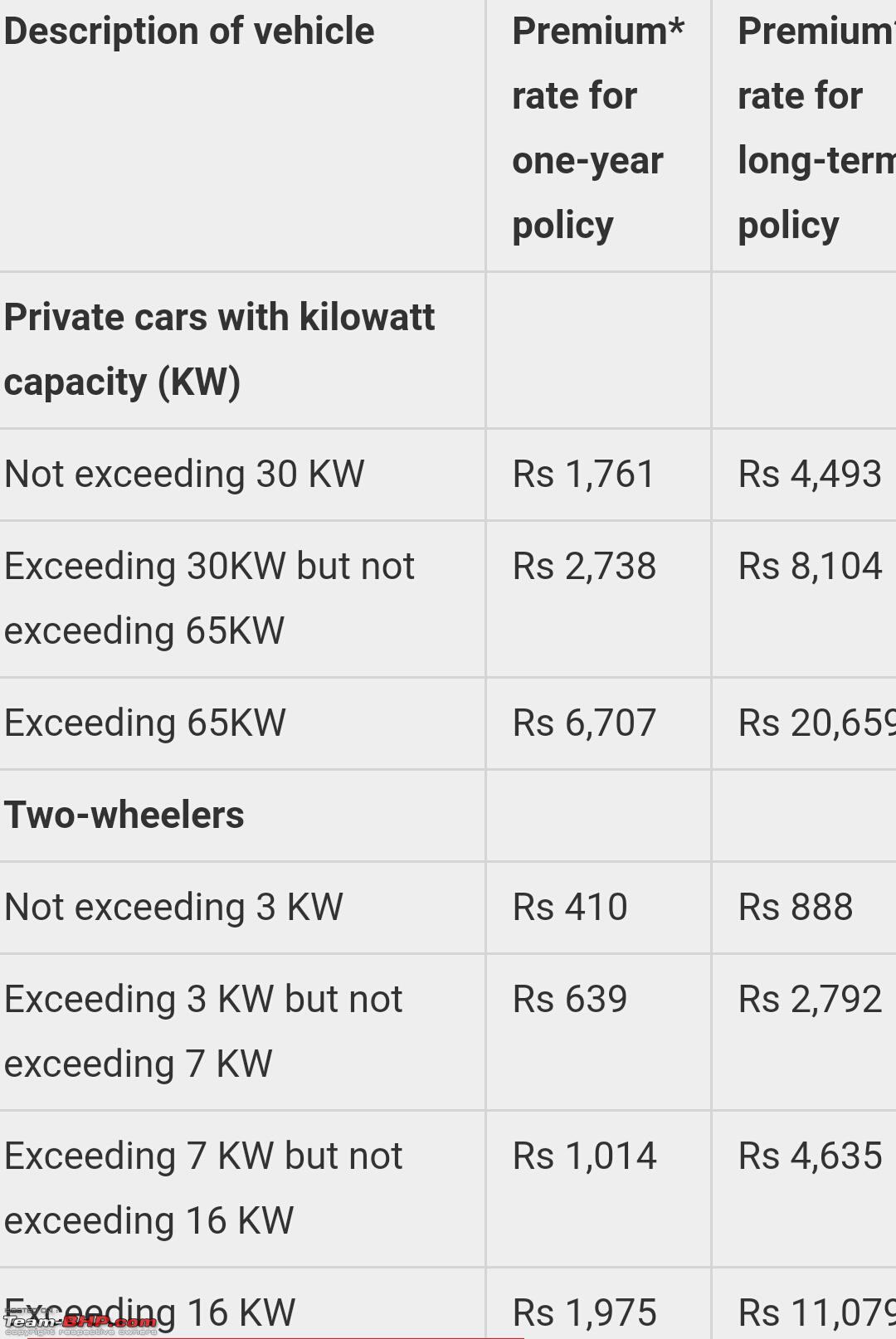

3rd-party insurance prices hiked for the nth time (June 2019) - Team-BHP

Third Party Property Car Insurance | iSelect

HOW TO APPLY THIRD PARTY INSURANCE IN UNIVERSAL COMPANY IN CSC - YouTube

Third Party Vs Comprehensive Car Insurance Policy | Which is Better