Is Third Party Liability Insurance Mandatory

Is Third Party Liability Insurance Mandatory?

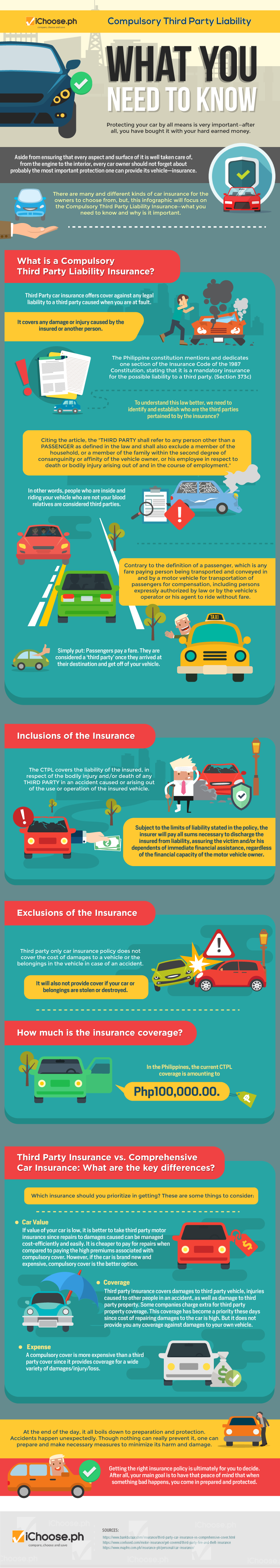

What is Third Party Liability Insurance?

Third Party Liability Insurance is a type of insurance that provides protection to businesses against any claims made by third parties, such as customers, suppliers, or members of the public. It covers any costs associated with defending a claim, as well as any damages that may be awarded. Third Party Liability Insurance is a key component of any business insurance package, as it can help protect against a wide variety of risks, from property damage to personal injury.

Is Third Party Liability Insurance Mandatory?

The answer to this question depends on the type of business you operate and the jurisdiction in which you operate. In some cases, Third Party Liability Insurance may be mandatory and required by law, while in other cases it may be optional. For example, professional liability insurance is often a requirement for certain professionals, such as lawyers and accountants. In addition, if you operate a business that is regulated by a government authority, such as a restaurant or retail store, you may be required to have Third Party Liability Insurance in order to obtain a license.

Why is Third Party Liability Insurance Important?

Third Party Liability Insurance is important because it helps protect your business from any claims made by third parties. In the event that a claim is made against your business, your insurance policy will provide coverage for the costs associated with defending the claim and any damages that may be awarded. Without this type of insurance, your business could be financially crippled by a claim. In addition, Third Party Liability Insurance is important because it can help protect your business’s reputation in the event of a claim.

What Types of Claims Does Third Party Liability Insurance Cover?

Third Party Liability Insurance generally covers claims related to property damage, bodily injury, and personal injury. It may also cover other types of claims, depending on the specific policy. For example, some policies may cover claims related to libel or slander. Additionally, some policies may cover claims related to professional negligence or errors and omissions.

How Much Does Third Party Liability Insurance Cost?

The cost of Third Party Liability Insurance varies depending on the type of policy you purchase and the amount of coverage you need. Generally, the more coverage you need, the higher the cost will be. Additionally, the cost of Third Party Liability Insurance can be impacted by the type of business you operate, the number of claims you have filed in the past, and the risk associated with your business. It is important to work with an experienced insurance provider to ensure that you get the right coverage at the right price.

Conclusion

Third Party Liability Insurance is an important type of insurance for any business. In some cases, it may be mandatory, while in others it may be optional. It is important to understand the risks associated with your business and the types of claims that might be made against you in order to determine the amount and type of Third Party Liability Insurance you need. Working with an experienced insurance provider can help you get the right coverage at the right price.

Basics of Motor Insurance ppt.

Compulsory Third Party Liability What You Need to Know | iChoose

PPT - 3560 & Third Party Liability Data Collection in CYBER PowerPoint

Making third party liability motor insurance mandatory

FREE 5+ Third Party Liability Forms in PDF