Third Party Legal Liability Insurance

Third Party Legal Liability Insurance: Protecting Your Business

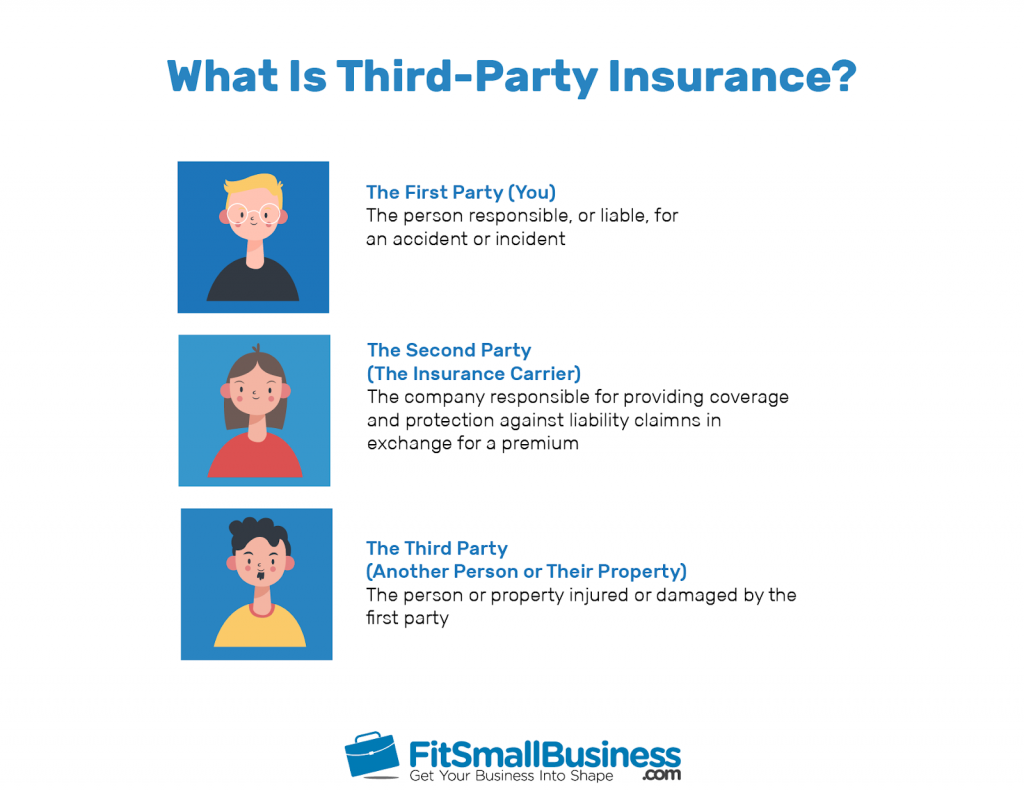

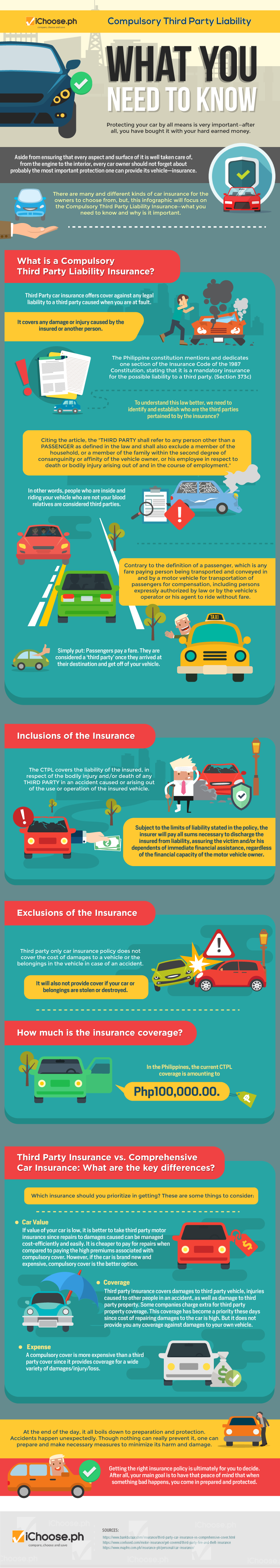

What is Third Party Legal Liability Insurance?

Third Party Legal Liability Insurance is a type of insurance policy that covers a business against the legal costs associated with a lawsuit brought against it by a third party. This type of insurance is essential for all businesses, regardless of size or industry, as it can help protect the business from costly and time-consuming legal proceedings. It is also important to note that this type of insurance is not just limited to businesses, but can also be taken out by individuals, such as landlords or property owners.

Why Do You Need Third Party Legal Liability Insurance?

Third Party Legal Liability Insurance is important for any business as it can help protect the business from potential lawsuits. For example, if a customer or third party were to suffer an injury or damages due to the negligence of the business, then this type of insurance would be able to cover the legal costs associated with such a lawsuit. Without this type of policy in place, the business may be liable for a large amount of money, as well as the time taken away from the business to defend the lawsuit.

What Does Third Party Legal Liability Insurance Cover?

Third Party Legal Liability Insurance generally covers the legal costs associated with a lawsuit brought against the business, such as court fees, legal fees, and other associated costs. It may also cover the costs associated with a settlement or award, as well as any damages awarded to the third party. Additionally, this type of insurance may also cover the cost of any medical bills that the third party may incur due to the negligence of the business.

What Does Third Party Legal Liability Insurance Not Cover?

Third Party Legal Liability Insurance does not generally cover any intentional acts of the business, such as fraud or criminal activity. It also does not cover any punitive damages that may be awarded to the third party. Additionally, this type of insurance does not cover any legal costs associated with any disputes between the business and the third party.

How Do I Get Third Party Legal Liability Insurance?

Third Party Legal Liability Insurance can be purchased from most insurance companies. It is important to shop around and compare different policies to ensure that you are getting the best coverage for your business. Additionally, it is important to speak to an experienced insurance broker to make sure that you are getting the policy that best suits your needs.

Conclusion

Third Party Legal Liability Insurance is an essential insurance policy for any business. It can help protect the business from costly and time-consuming legal proceedings and can help cover the costs associated with a lawsuit brought against the business by a third party. It is important to shop around and compare different policies to ensure that you are getting the best coverage for your business. Additionally, it is important to speak to an experienced insurance broker to make sure that you are getting the policy that best suits your needs.

How is a group insurance scheme effective? - MyAnmol Insurance

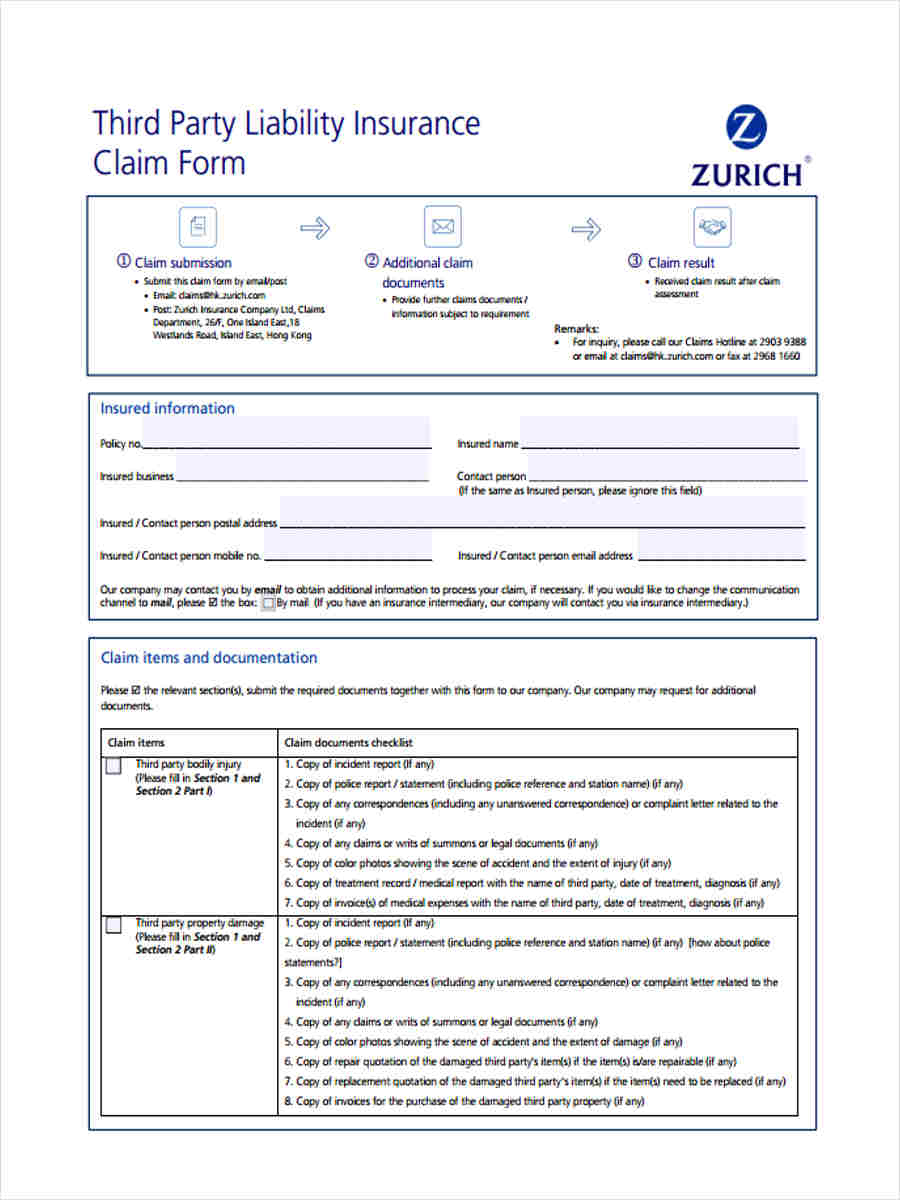

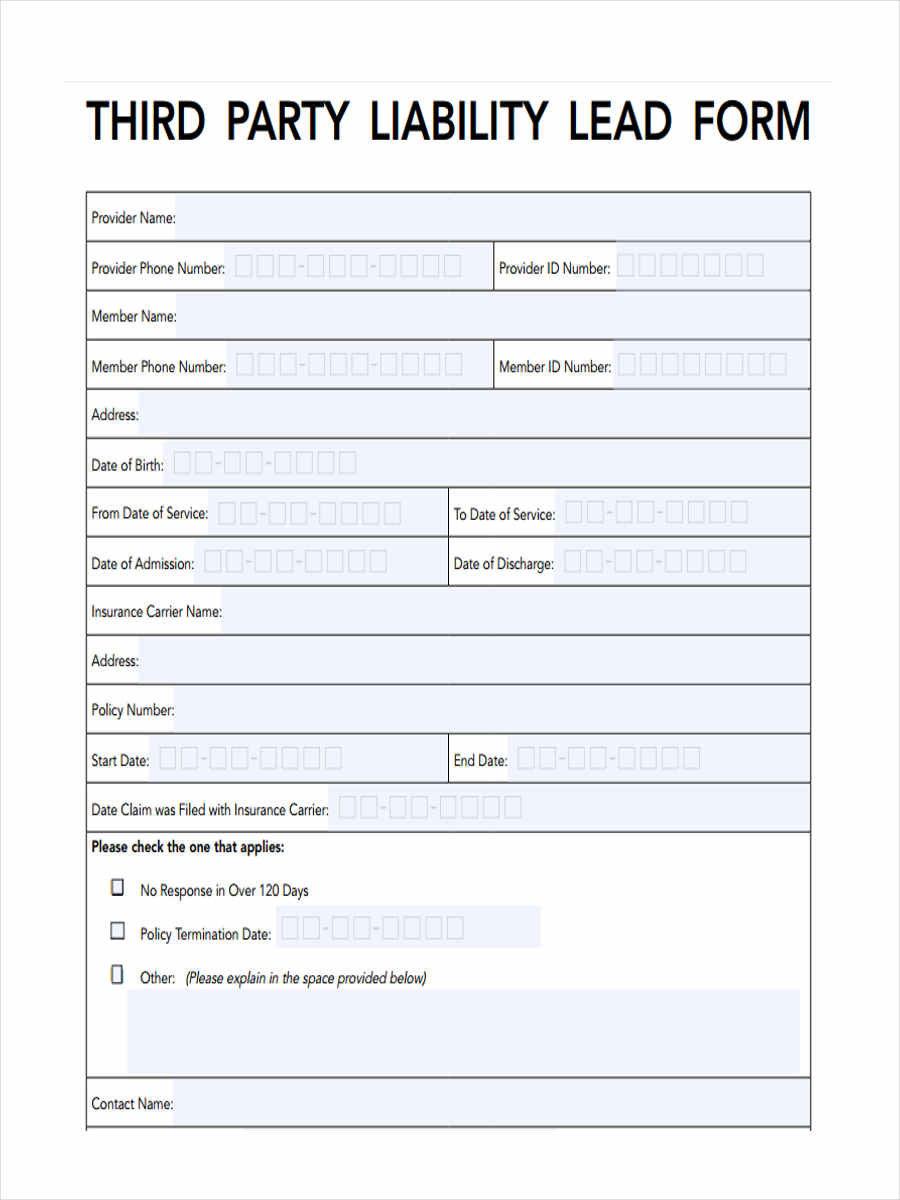

FREE 5+ Third Party Liability Forms in PDF

What Is Third-party Insurance?

Compulsory Third Party Liability What You Need to Know | iChoose

FREE 5+ Third Party Liability Forms in MS Word | PDF