Third Party Liability Meaning In Insurance

Third Party Liability Meaning In Insurance Explained

What is Third Party Liability Insurance?

Third Party Liability Insurance is a type of coverage that provides financial protection for individuals and businesses against legal liability for harm caused to others. It generally covers any legal fees, court costs, and damages awarded to the other party. Third Party Liability Insurance is sometimes referred to as “general liability” insurance. It is different from first party insurance, which provides coverage for the policyholder’s own losses or injuries.

Who Needs Third Party Liability Insurance?

Third Party Liability Insurance is typically purchased by individuals or businesses that are likely to be sued by third parties, such as contractors, manufacturers, distributors, and service providers. People who are employed in certain professions, such as lawyers, doctors, and real estate agents, may also be required to purchase Third Party Liability Insurance. In some cases, businesses are legally obligated to carry Third Party Liability Insurance, such as in the case of employers who must purchase workers’ compensation and employers’ liability insurance in some states.

What Does Third Party Liability Insurance Cover?

Third Party Liability Insurance generally covers legal fees and damages awarded to third parties for bodily injury, property damage, and personal or advertising injury that is caused by the policyholder’s negligence. In some cases, it may also cover certain medical expenses and lost wages caused by the policyholder’s negligence. Third Party Liability Insurance may also cover punitive and exemplary damages, depending on the policy.

What Does Third Party Liability Insurance Not Cover?

Third Party Liability Insurance typically does not cover the policyholder’s own losses. It also does not cover intentional acts, contractual liabilities, or losses caused by war or nuclear disaster. Some policies may have exclusions for certain types of claims, such as libel and slander, which may not be covered.

How Much Does Third Party Liability Insurance Cost?

The cost of Third Party Liability Insurance depends on a variety of factors, including the type and amount of coverage, the policyholder’s business activities, the number of employees, and the claims history. Generally, the more coverage a policyholder purchases, the higher the cost of the policy. Additionally, the cost of Third Party Liability Insurance may be affected by the policyholder’s risk profile, such as the type of business, geographic location, and industry.

Conclusion

Third Party Liability Insurance is a type of coverage that provides financial protection for individuals and businesses against legal liability for harm caused to others. It typically covers legal fees, court costs, and damages awarded to third parties for bodily injury, property damage, and personal or advertising injury caused by the policyholder’s negligence. The cost of Third Party Liability Insurance depends on a variety of factors, including the type and amount of coverage, the policyholder’s business activities, and the number of employees. Individuals and businesses who may be sued should consider purchasing Third Party Liability Insurance to protect themselves from legal liability.

What Is Third-party Insurance?

How is a group insurance scheme effective? - MyAnmol Insurance

PPT - Chapter 12 Commercial Insurance PowerPoint Presentation - ID:1673639

FREE 5+ Third Party Liability Forms in PDF

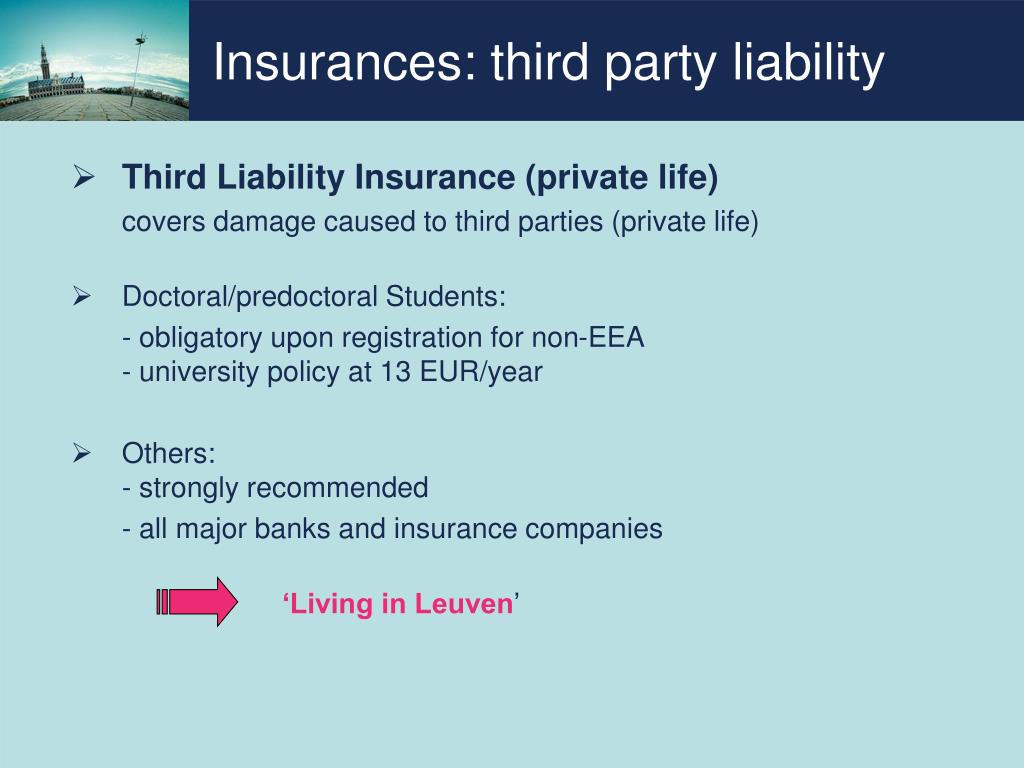

PPT - International researchers @ K.U.Leuven Bob Geivers Annemie