Federal Long Term Care Insurance Vs Private

Federal Long Term Care Insurance Vs Private: What’s the Difference?

Long-term care insurance can be a great way to cover the costs associated with long-term care, such as nursing home care and home health care. There are two types of long-term care insurance: federal long-term care insurance and private long-term care insurance. But what’s the difference between the two? Here’s a closer look at federal long-term care insurance vs private long-term care insurance.

Federal Long-Term Care Insurance

Federal long-term care insurance is a type of insurance offered to federal employees, retirees, and their eligible family members. It is administered by the Office of Personnel Management (OPM). The insurance covers a wide range of long-term care services, including nursing home care, home health care, and adult day care. The coverage is comprehensive, in that it covers all medically necessary services that are related to the diagnosis of a chronic illness or disability. The coverage is also portable, meaning that it can be used in any state.

Private Long-Term Care Insurance

Private long-term care insurance is offered by private insurance companies. It is typically purchased by individuals who are not eligible for federal long-term care insurance. Private long-term care insurance offers the same type of coverage as federal long-term care insurance, but it is not as comprehensive. Private long-term care insurance generally covers only a limited number of services and is not portable. Additionally, private long-term care insurance is typically more expensive than federal long-term care insurance.

Which Is Right for You?

When it comes to federal long-term care insurance vs private long-term care insurance, it really depends on your individual situation. If you are eligible for federal long-term care insurance, it is worth considering, as it is comprehensive and portable. On the other hand, if you are not eligible for federal long-term care insurance, private long-term care insurance is worth considering. It is important to shop around for the best coverage and the best price.

Conclusion

Federal long-term care insurance and private long-term care insurance are both great options for covering the costs associated with long-term care. The type of insurance you choose will depend on your individual situation. It is important to do your research and compare the coverage and prices of each type of insurance before making a decision. With the right coverage and the right price, long-term care insurance can be a great way to ensure that you and your family are taken care of in the future.

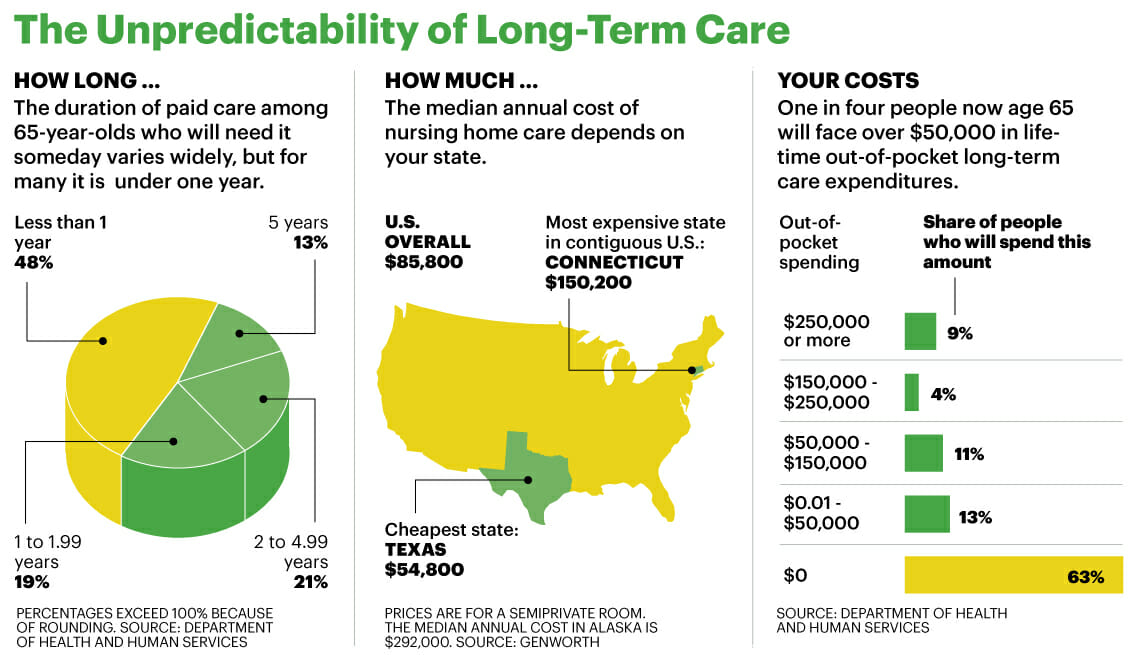

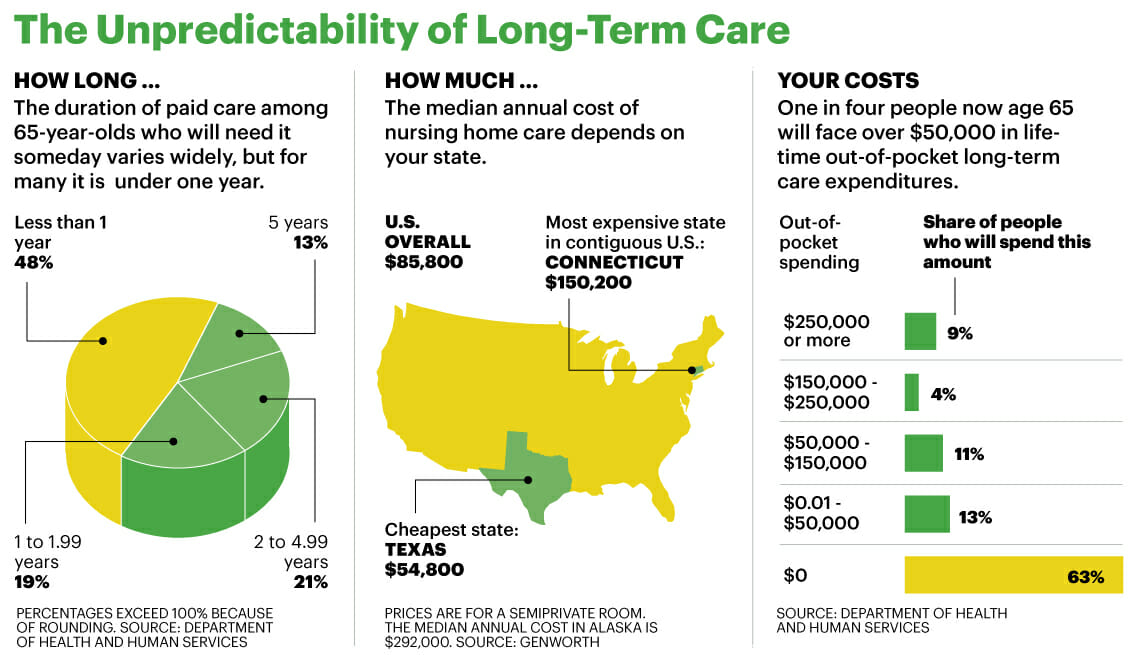

Cost of Long Term Care | Buffer Benefits

Long Term Care Insurance Cost - Insurance Reference

PPT - USDA, MRPBS Human Resources Operations Benefits Section 100 North

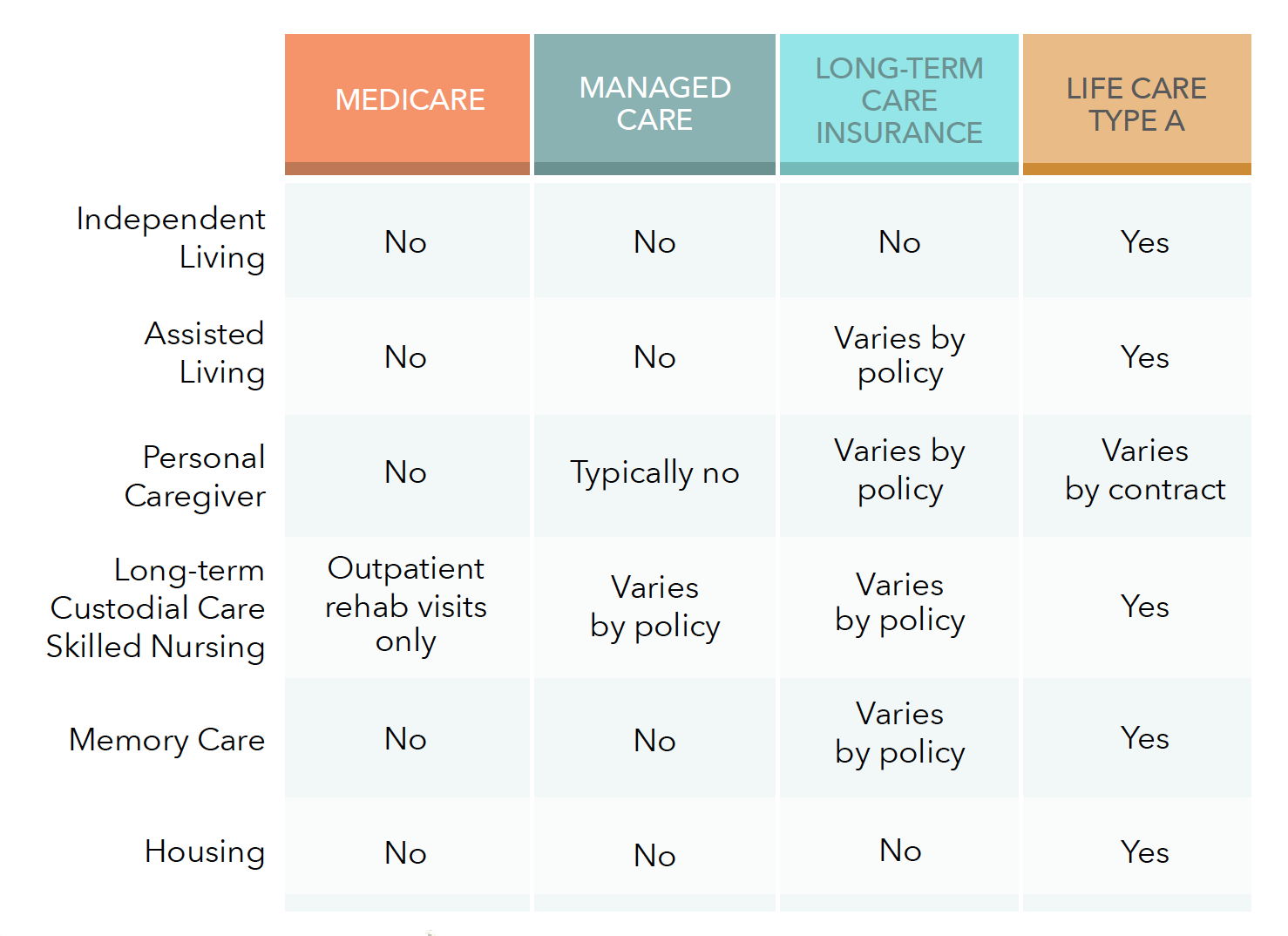

Life Care Coverage versus Health Insurance and Medicare