Cost Of Long Term Care Insurance

What is Long Term Care Insurance and How Much Does It Cost?

Long-term care insurance is a type of insurance that helps cover the cost of a variety of long-term care services. These services can include assistance with activities of daily living (ADLs) such as bathing, dressing, and eating, as well as medical care, nursing home care, and other services. Long-term care insurance can help cover the cost of these services if you need them. But how much does long-term care insurance cost?

Cost of Long-Term Care Insurance

The cost of long-term care insurance varies by provider and the type of coverage you buy. Generally, the cost of a policy will depend on factors such as your age, the amount of coverage you buy, and the type of policy you choose. Premiums also vary by state, so be sure to shop around to find the best rate. Keep in mind that the cost of long-term care insurance can increase over time as you age, so it's important to buy the right amount of coverage when you're younger.

Factors That Affect the Cost

The cost of long-term care insurance can also depend on other factors, such as your health and lifestyle. If you have any pre-existing medical conditions or a high-risk lifestyle, your premiums may be higher. Additionally, the type of long-term care services you need can affect the cost of your policy. Some policies cover only certain types of services, while others may cover a wider range. It's important to research different policies to determine which one is best for you.

Average Cost of Long-Term Care Insurance

The average cost of long-term care insurance is around $2,000 to $3,000 per year. However, the cost can vary depending on the type of coverage you buy and other factors. Generally, the cost of a policy increases with age and with the amount of coverage you buy. It's important to consider your budget and the type of coverage you need when shopping for long-term care insurance.

What is Covered by Long-Term Care Insurance?

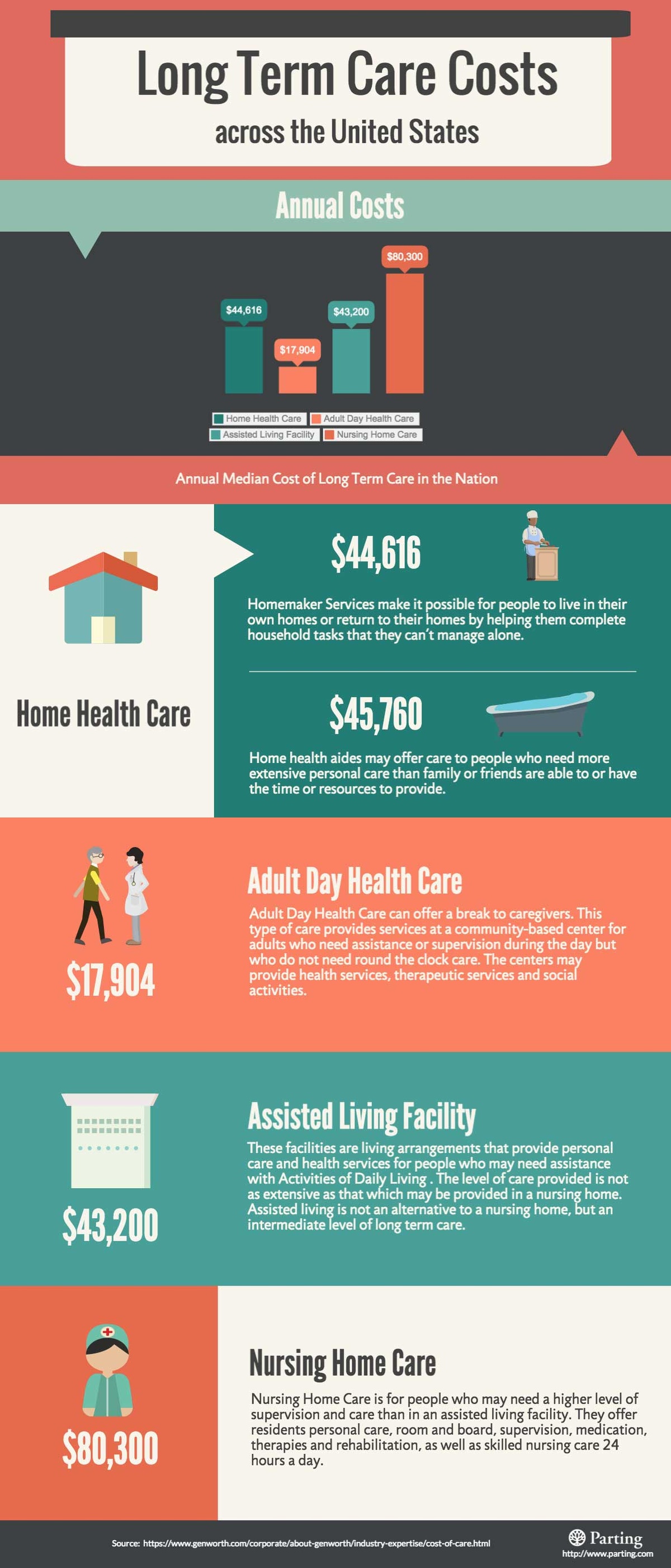

Long-term care insurance typically covers a variety of services, including home health care, assisted living, nursing home care, and other services. Some policies also cover respite care, hospice care, and other services. However, the type of coverage and services covered vary by policy, so it's important to read the fine print to understand exactly what is covered.

Benefits of Long-Term Care Insurance

Long-term care insurance can be a great way to protect your financial future and ensure that you have access to the care you need if you become ill or disabled. It can also help cover the costs of long-term care services that are not covered by Medicare or other types of insurance, such as home care and assisted living. Additionally, long-term care insurance can help reduce the burden on family members who may be caring for you. Finally, it can give you peace of mind knowing that you have a plan in place if you need long-term care.

The Real Cost of Long-Term Care (INFOGRAPHIC) | HuffPost

Long-Term Care Insurance: The Ultimate Guide

6 Useful Tips to Avoid Paying $280,000 Health Care Costs in Retirement

Long Term Care Insurance Cost - Insurance Reference

Why People Don’t Buy Long-Term-Care Insurance - WSJ