Typical Cost Of Long Term Care Insurance

What is Long Term Care Insurance?

Long-term care insurance is an insurance policy that helps pay for the cost of long-term care, such as in-home care, assisted living, and nursing home care. It is designed to help those who may not be able to afford the cost of long-term care on their own. Long term care insurance is important to consider because the cost of long-term care can be very expensive, and it can quickly deplete your savings if you don't have insurance in place to help cover some of these costs. It's important to understand the cost of long-term care insurance before purchasing a policy.

What Does Long Term Care Insurance Cover?

Long-term care insurance can cover a wide range of services, including in-home care, assisted living, and nursing home care. Most policies will cover some of the costs associated with these services, such as the cost of medical equipment, medication, and other related costs. Some policies may also cover non-medical services, such as home maintenance and personal care services. It's important to understand exactly what your policy covers before purchasing a policy.

What is the Typical Cost of Long Term Care Insurance?

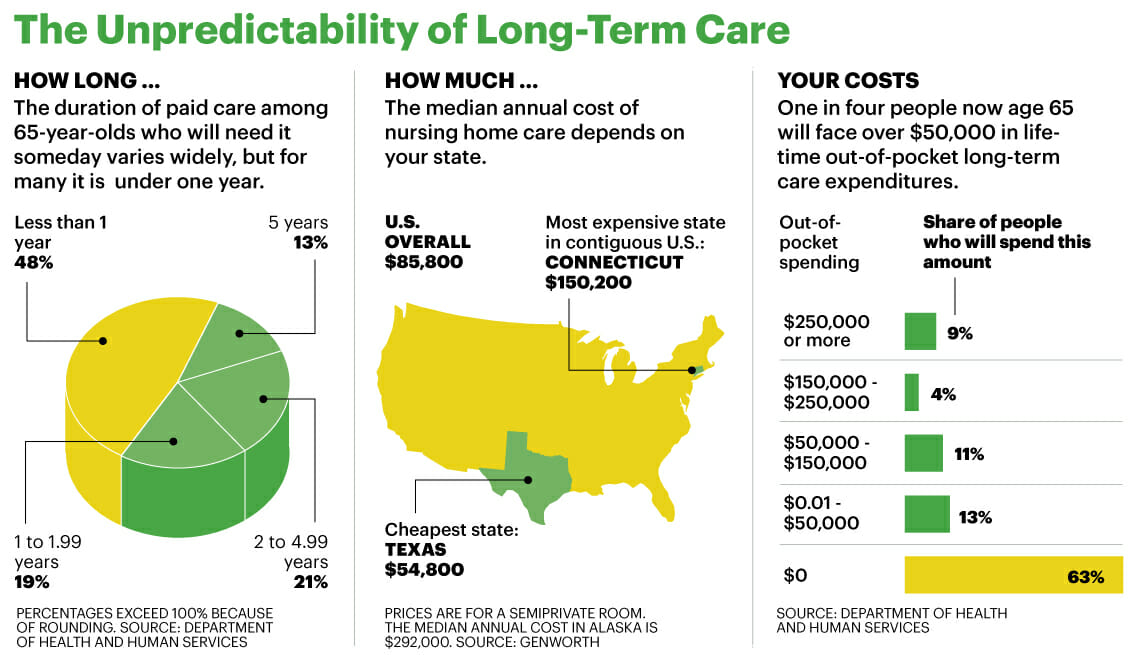

The cost of long-term care insurance can vary widely depending on the type of policy you choose, your age, and the amount of coverage you select. Generally, the younger you are when you purchase the policy, the lower the cost of the policy. The type of coverage you select also affects the cost of the policy. Policies can range from a few hundred dollars to several thousand dollars annually. It's important to compare different policies and determine which one best fits your needs and budget.

What Factors Can Affect the Cost of Long Term Care Insurance?

The cost of long-term care insurance is affected by several factors. Some of these include age, gender, health status, and whether or not you smoke. In addition, the amount of coverage you select can also affect the cost of the policy. It's important to consider all of these factors when shopping for a policy to ensure you are getting the best coverage at the best price.

What Are Some of the Benefits of Long Term Care Insurance?

Long-term care insurance can help protect you from financial ruin should you need long-term care services. It can also help provide peace of mind by knowing that you are covered for the cost of long-term care should you need it. Additionally, it can provide tax advantages, as long-term care insurance premiums are often tax-deductible. Lastly, long-term care insurance can help protect your assets from the costs of long-term care.

Should I Get Long Term Care Insurance?

Long-term care insurance is an important consideration for anyone who may need long-term care services in the future. It can help protect your assets and provide peace of mind that you will have the resources to pay for long-term care should you need it. Before purchasing a policy, it's important to consider the cost of long-term care insurance, the type of coverage you need, and the benefits of the policy. It's also important to compare different policies to ensure you are getting the best coverage at the best price.

What Long-Term Care Will REALLY Cost You (INFOGRAPHIC) | Long term care

Long-Term Care Insurance Information: Policy Features & Benefits

Cost of Long Term Care | Buffer Benefits

Long Term Health Insurance Cost / Long Term Care Insurance - Some costs

Cleveland’s long-term care continuum: Capacity and need - The Center