How Much Does Long Term Care Insurance Cost Per Month

What are the Costs of Long Term Care Insurance?

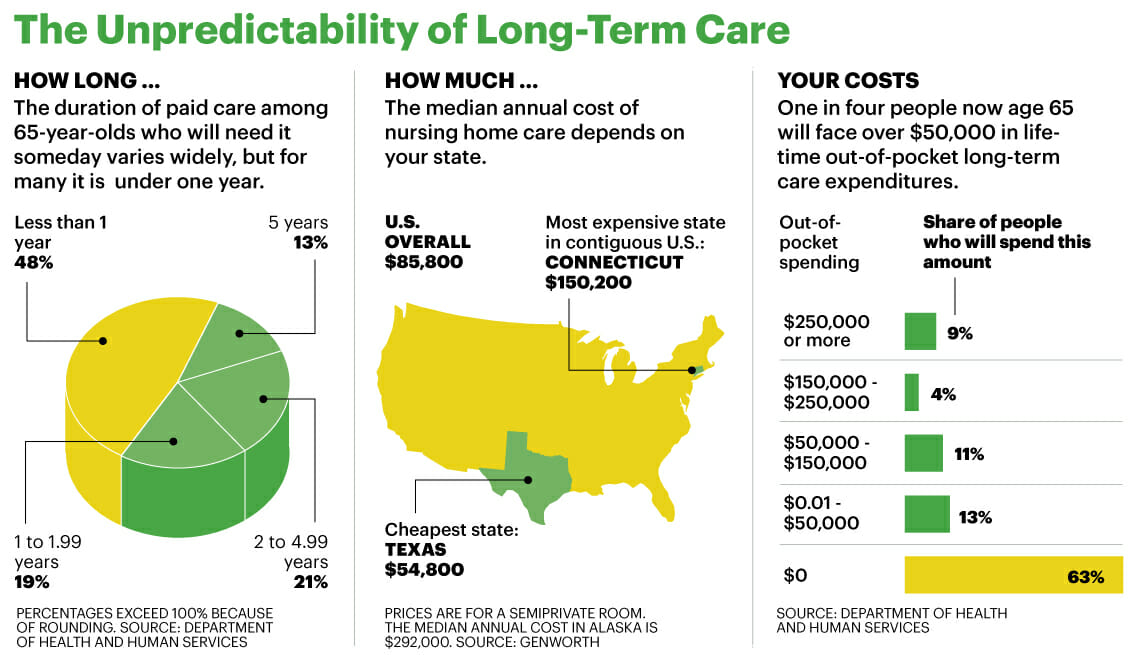

Long term care insurance is a type of insurance policy that is designed to cover the costs of long term care, such as nursing home care, home health care, assisted living, and other medical services. It is important to understand the costs of long term care insurance before you purchase a policy, as it can be quite expensive. Depending on your age, health, and other factors, the cost of long term care insurance can vary significantly.

What Factors Impact the Cost of Long Term Care Insurance?

When it comes to the cost of long term care insurance, there are several factors that come into play. The most important factor is your age, as the younger you are when you purchase a policy, the lower your premiums will be. Your health is also a factor, as those who have pre-existing medical conditions or a family history of certain diseases may have to pay higher premiums. Other factors that can affect the cost of long term care insurance include the type and amount of coverage you choose, the length of the policy, and the insurer you purchase the policy from.

How Much Does Long Term Care Insurance Cost Per Month?

The cost of long term care insurance varies greatly depending on the factors mentioned above. Generally speaking, the average monthly premium for long term care insurance ranges from $100 to $200 per month. However, this can vary depending on the type of policy you purchase and the amount of coverage you choose. Some policies may require a lump sum payment, while others may require monthly payments over a period of time. It is important to shop around and compare policies from different insurers to find the best deal.

Do I Really Need Long Term Care Insurance?

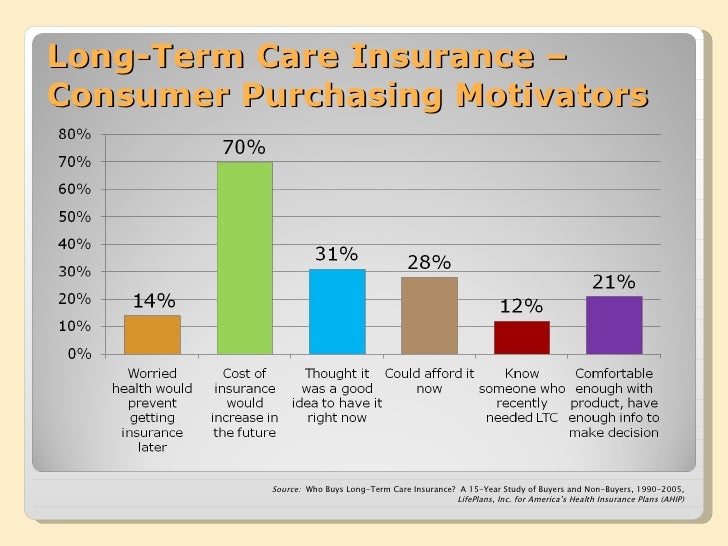

Whether or not you need long term care insurance is a personal decision. It is important to consider the potential costs of long term care and decide if it is something that you are willing to pay for. For some, it may be worth the cost to have peace of mind knowing that they will be covered if they need long term care. However, it is important to remember that long term care insurance can be expensive and may not be the best option for everyone.

What Other Options Are Available for Long Term Care?

For those who do not want to purchase long term care insurance, there are other options available. Medicare and Medicaid are two government programs that may cover some of the costs associated with long term care. Additionally, some employers provide long term care insurance as part of their benefits package. It is important to carefully consider all of your options before making a decision.

Conclusion

Long term care insurance can be an expensive investment, but it is important to consider the costs associated with long term care and decide if it is right for you. The cost of long term care insurance varies greatly depending on a variety of factors, and it is important to compare policies from different insurers to find the best deal. Additionally, there are other options available such as Medicare and Medicaid, as well as employer-provided long term care insurance. It is important to carefully consider all of your options to find the best solution for your needs.

Long-Term Care Insurance Information: Policy Features & Benefits

Nursing Home Insurance Policy Cost - Insurance Reference

Cost of long term care insurance - insurance

Cost Of Long Term Care Insurance Calculator / Best Long Term Care

Cost of Long Term Care | Buffer Benefits