Private Long Term Care Insurance

Private Long Term Care Insurance: What You Need to Know

Most people don't think about getting long-term care insurance, but it is becoming more important as we age. It can help protect you and your family from the costs of long-term care, including nursing home care, home health care, and more. There are two types of long-term care insurance: private and public. Private long-term care insurance is offered by private companies and is generally more expensive than public insurance. It is also more customizable and can provide more benefits than public insurance.

What Does Private Long Term Care Insurance Cover?

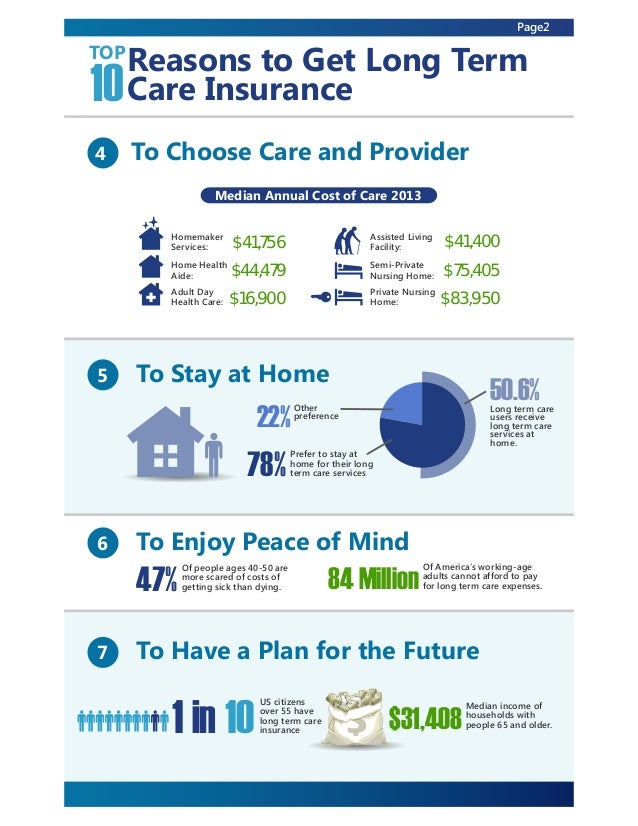

Private long-term care insurance generally covers nursing home care, home health care, assisted living, and other long-term care services. The services covered vary depending on the policy, so it's important to read the policy carefully to make sure you understand what is and isn't covered. It's also important to note that the costs of long-term care can be very high, so it's important to make sure that the policy you purchase provides enough coverage to meet your needs.

Who Should Consider Private Long Term Care Insurance?

Anyone who is concerned about the potential cost of long-term care should consider private long-term care insurance. This includes people who are already retired, those who are close to retirement, and those who are younger but still want to protect themselves and their families from the potential costs of long-term care. It's also important to consider private long-term care insurance if you want more control over the type of care you receive and the benefits you receive.

How Much Does Private Long Term Care Insurance Cost?

The cost of private long-term care insurance varies depending on the type of policy you purchase and the amount of coverage you need. Generally, the more coverage you need, the more expensive the policy will be. It's also important to keep in mind that the cost of the policy will increase over time as you age, so it's important to choose a policy that you can afford now and in the future.

What Factors Affect the Cost of Private Long Term Care Insurance?

There are several factors that can affect the cost of private long-term care insurance. These include your age, health, and the type of policy you purchase. Your age and health can affect your premiums, while the type of policy you purchase can affect the benefits you receive. It's important to compare different policies to make sure you get the best coverage for your needs at the best price.

How Do I Find the Right Private Long Term Care Insurance Policy?

The best way to find the right private long-term care insurance policy is to speak with an insurance agent or an independent insurance broker. An agent or broker can help you compare different policies and discuss the coverage and costs associated with each policy. It's important to understand all of the terms and conditions of the policy before you purchase it, so make sure to ask any questions you may have.

PPT - What We Already Know about Long-Term Care and Should Tell the

What Senior Citizens Need To Know about Private Long Term Care

Private Long Term Care Insurance: What Does It Pay For?

(PDF) Evaluating Consumer Preference for Private Long-term Care Insurance

Top 10 Reasons to Get Long Term Care Insurance