Third Party Liability Insurance Policy

Third Party Liability Insurance - What You Need to Know

Third party liability insurance is a form of insurance policy that covers you financially in the event that you are found liable for damage or injury to another person, their property, or their reputation. If you are ever sued for damages, this type of insurance can provide some financial protection for you. Third party liability insurance is also known as public liability insurance and is often included in business insurance policies.

What Does Third Party Liability Insurance Cover?

Third party liability insurance covers a variety of damages and injuries that you may be liable for. These may include damage to property, bodily injury, and personal injury. In addition, this insurance can also protect you in the event that you are sued for libel or slander. The policy will also cover the legal fees associated with defending yourself in court.

Why Do You Need Third Party Liability Insurance?

There are many reasons why you may need third party liability insurance. If you are a business owner, this type of insurance is essential as it can protect you financially in the event that you are sued. It can also provide peace of mind if you are ever in a situation where you may be liable for damages or injury to another person. Additionally, if you are a landlord, you may need this type of insurance to protect yourself from any potential legal issues that may arise from renting out a property.

How Much Does Third Party Liability Insurance Cost?

The cost of third party liability insurance will vary depending on the amount of coverage you require. Generally speaking, the more coverage you require, the higher the premium of your policy will be. Insurance companies will typically offer different levels of coverage so you can choose the one that best suits your needs. Additionally, the cost of your policy may also be affected by the type of business you operate, the size of your business, and any past claims you may have made.

Where Can I Find Third Party Liability Insurance?

Third party liability insurance is widely available from most insurance companies. It is important to shop around and compare quotes from different providers in order to find the best deal for your needs. Additionally, you may be able to find discounts and special offers from certain insurers. It is also a good idea to speak to an insurance expert who can help you understand the different types of coverage available and advise you on the best policy for your business.

What Are the Benefits of Third Party Liability Insurance?

The main benefit of third party liability insurance is that it provides financial protection in the event that you are found liable for damage or injury to another person. It can also help to protect your business, your assets, and your reputation. Furthermore, it can also help to reduce the financial burden of any legal costs that you may incur if you are ever sued. Finally, having third party liability insurance can help to give you peace of mind when operating a business.

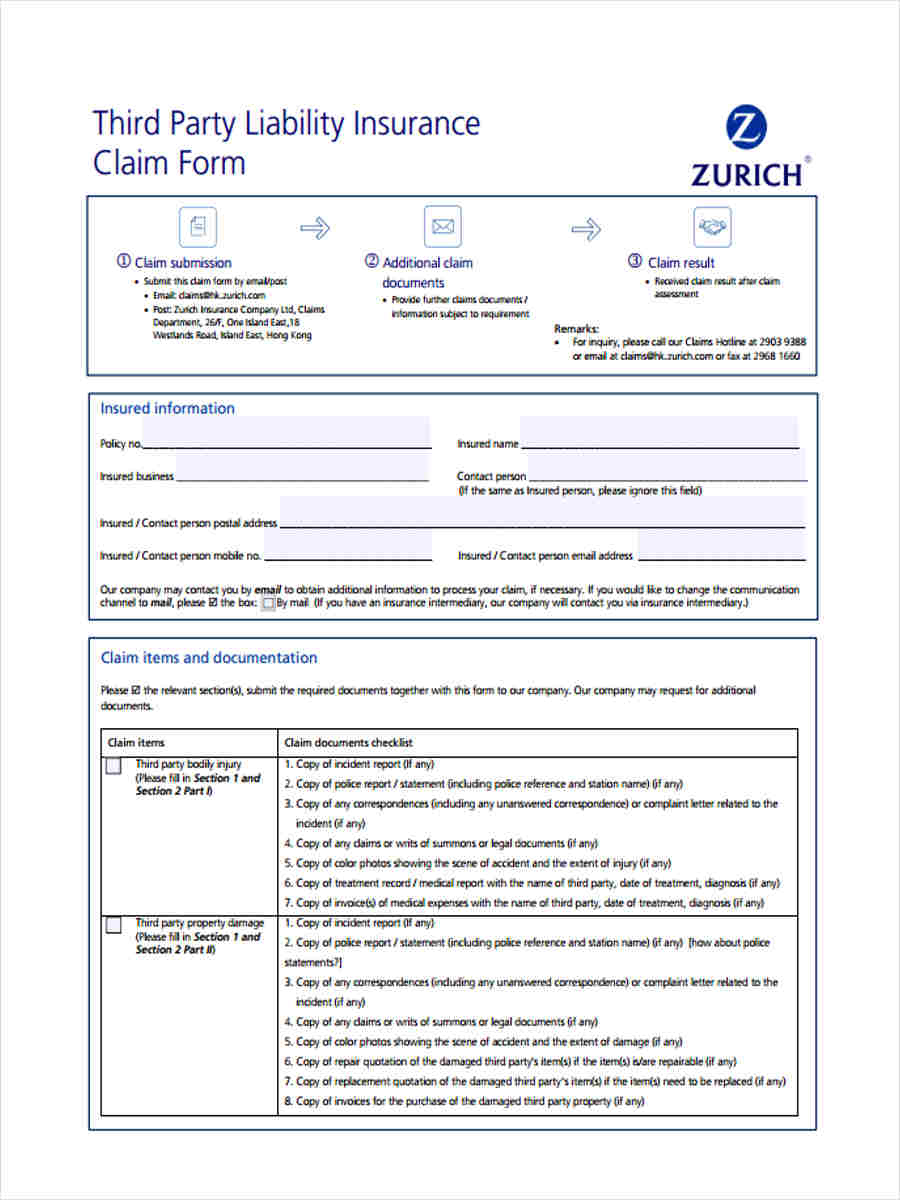

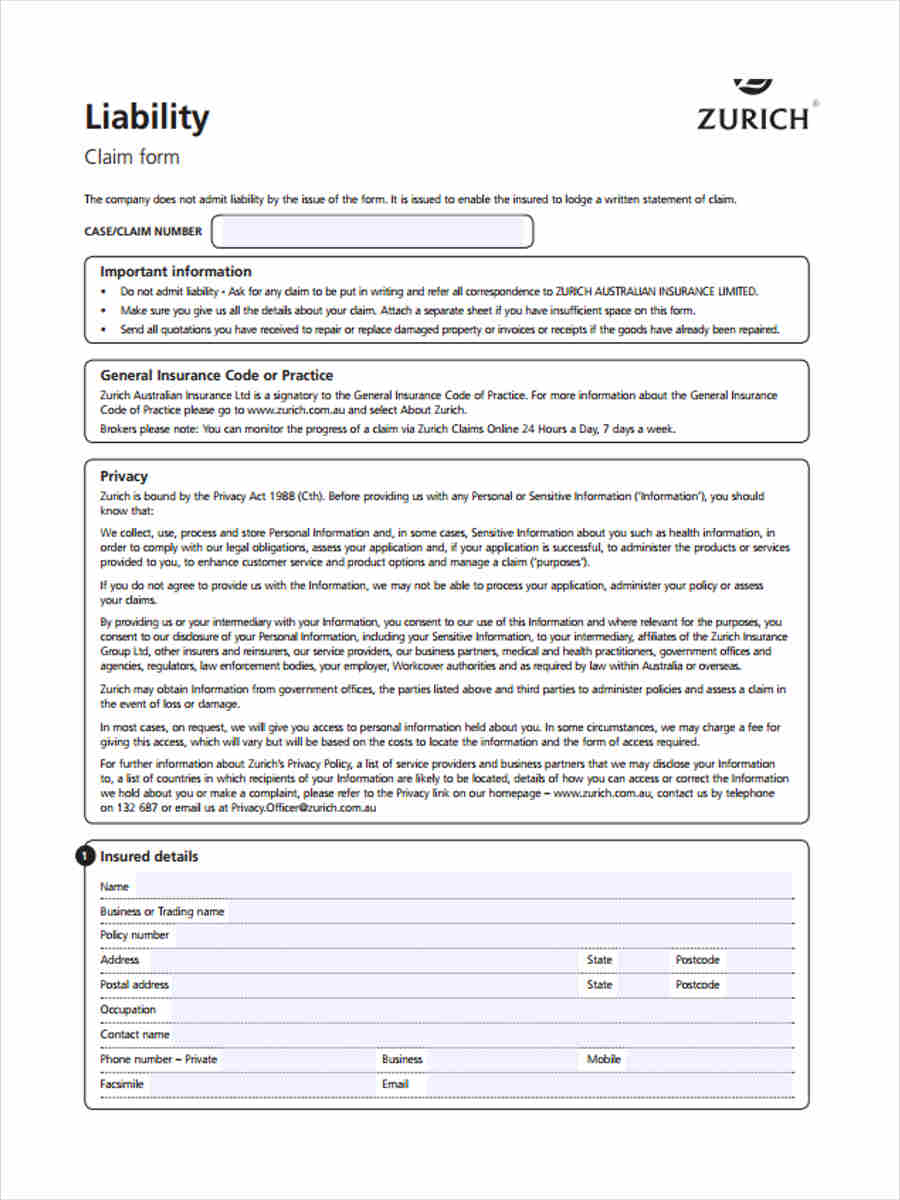

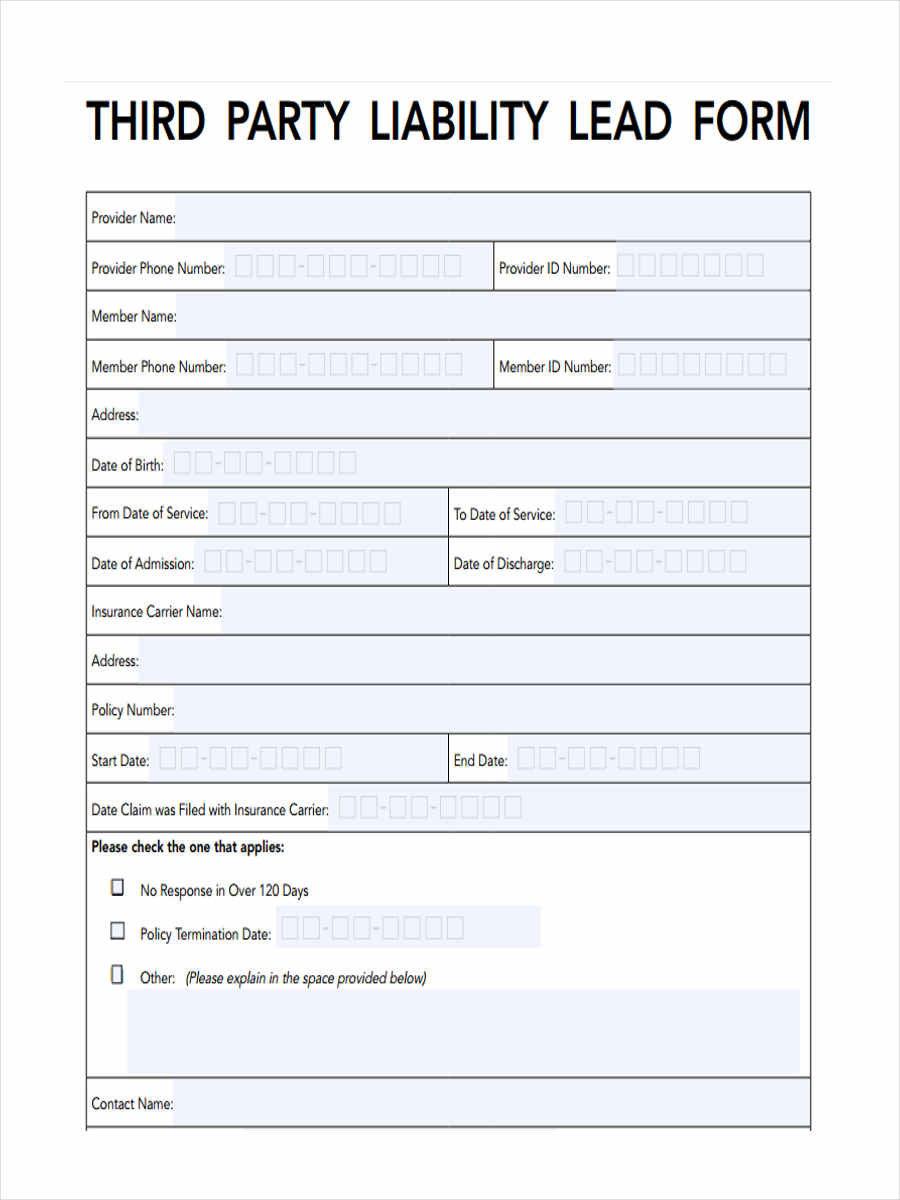

FREE 5+ Third Party Liability Forms in MS Word | PDF

FREE 5+ Third Party Liability Forms in PDF

FREE 5+ Third Party Liability Forms in PDF

PPT - 3560 & Third Party Liability Data Collection in CYBER PowerPoint

Third Party Liability Insurance.docx | Indemnity | Insurance