Average Price Of Long Term Care Insurance

Average Price Of Long Term Care Insurance

Introduction to Long Term Care Insurance

Long term care insurance is an important type of insurance policy that helps to protect individuals from the high cost of long term care. Long term care is an extended period of time during which an individual requires assistance with their daily activities. This could include daily activities such as bathing, dressing, eating, and other related activities. It can also include medical services such as nursing care, physical therapy, and other forms of medical care. Long term care insurance helps to cover the costs associated with long term care, including the cost of a nursing home, assisted living facility, or home health care.

The Cost of Long Term Care Insurance

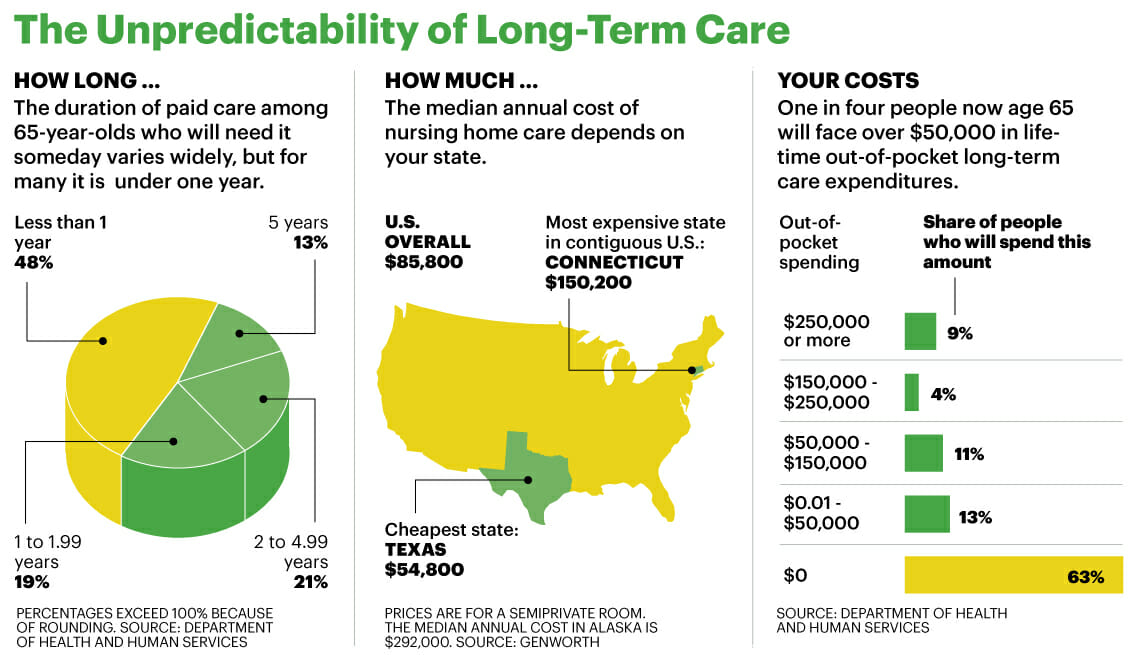

The cost of long term care insurance can vary greatly depending on a variety of factors. These factors include age, health, and the type of coverage desired. Generally, the younger a person is when they purchase a policy, the lower the cost of their policy will be. Also, individuals with good health are usually able to get better rates on their policies. The type of coverage desired will also affect the cost of the policy. For example, an individual who is looking for a policy that covers a nursing home stay may pay more than an individual who is looking for a policy that covers home health care.

Average Price Of Long Term Care Insurance

The average cost of long term care insurance can vary from state to state. The average cost of a policy in the United States is around $2,000 per year, however, there are some states with higher average costs. In California, the average cost of a policy is around $2,500 per year. In New York, the average cost of a policy is around $3,000 per year. In Texas, the average cost of a policy is around $2,500 per year. Additionally, the cost of a policy can also vary depending on the type of coverage desired.

Factors that Affect the Cost of Long Term Care Insurance

There are several factors that can affect the cost of long term care insurance. These include age, health, and the type of coverage desired. Additionally, the cost of a policy can also be affected by the length of time for which coverage is desired. The longer the length of time for which coverage is desired, the higher the cost of the policy will be. Also, some insurance companies may offer discounts on their policies for individuals who purchase multiple policies or for individuals who purchase policies for multiple family members.

Conclusion

Long term care insurance is an important type of policy that can help protect individuals from the high cost of long term care. The cost of long term care insurance can vary greatly depending on factors such as age, health, and the type of coverage desired. The average cost of a policy in the United States is around $2,000 per year, however, there are some states with higher average prices. Additionally, the cost of a policy can also be affected by the length of time for which coverage is desired, as well as discounts offered by insurance companies.

Average Long Term Care Costs in Arizona | ALTCS Planning.net

Average Cost Of Long Term Care Insurance

Cost of Long Term Care | Buffer Benefits

Selling Long Term Care Insurance | TR King Insurance Marketing

Long term care costs and Medicare in retirement planning | Financial