How Much Does Long Term Care Insurance Cost

How Much Does Long Term Care Insurance Cost?

Long-term care insurance is a form of insurance designed to cover the costs associated with long-term health care needs. It is designed to provide financial assistance for people who need long-term care due to age, disability, or chronic illness. As people age and become more vulnerable to health risks such as Alzheimer's disease, stroke, or Parkinson's disease, long-term care insurance provides assistance in covering the costs of long-term care services.

What Does Long Term Care Insurance Cover?

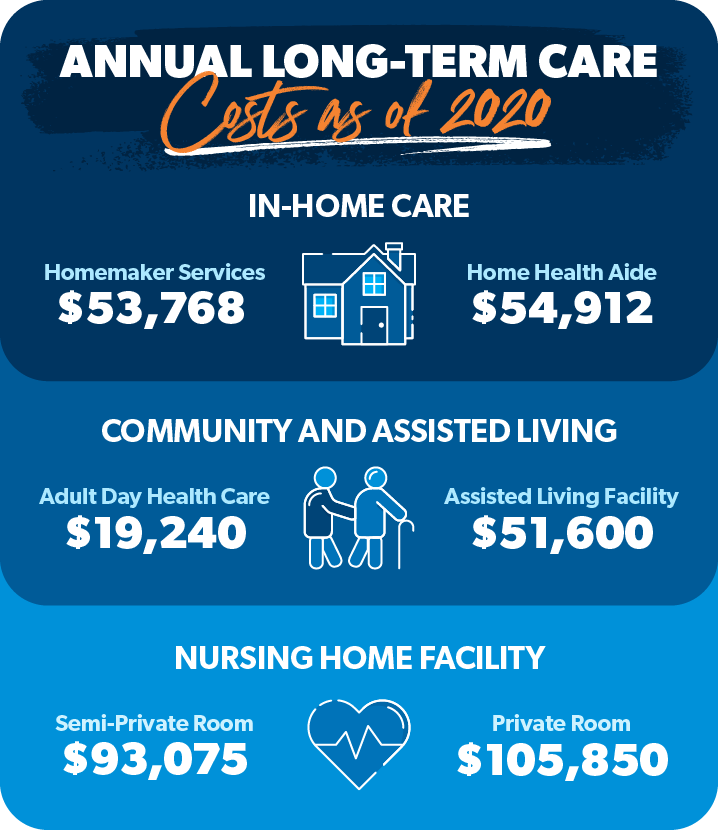

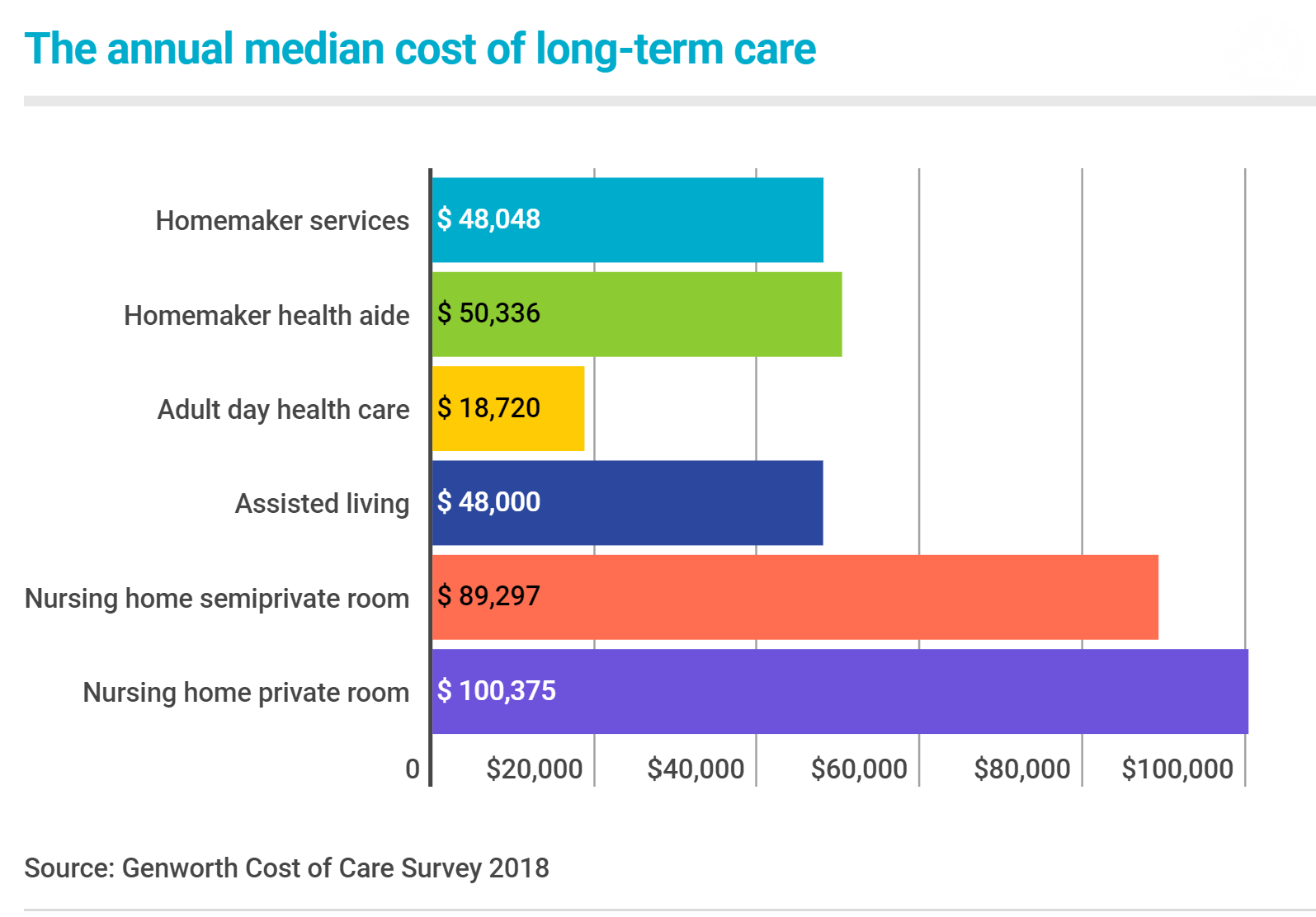

Long-term care insurance can cover a variety of services, including in-home care, assisted living, nursing home care, and home health care. It can also cover services such as personal care, homemaker services, and respite care. Generally, long-term care insurance policies will cover the cost of care for a certain amount of time, such as two years, five years, or even up to a lifetime.

What Factors Affect the Cost of Long Term Care Insurance?

The cost of long-term care insurance is based on a number of factors, including age, gender, health history, and the amount of coverage desired. Generally, the younger you are when you purchase a policy, the lower the cost of the premiums. Additionally, the more coverage you choose, the more expensive the premiums will be. Additionally, those with pre-existing medical conditions may have to pay higher premiums or be denied coverage altogether.

What is the Average Cost of Long Term Care Insurance?

The average cost of long-term care insurance varies greatly depending on the policy and the individual's age and health history. Generally, premiums can range from $2,000 to $5,000 per year. It is important to shop around and compare policies to find the best coverage at the most affordable price.

What is the Benefit of Purchasing Long Term Care Insurance?

Long-term care insurance can provide financial security for individuals who need long-term care services due to age, disability, or chronic illness. By purchasing a policy, individuals can rest assured that their long-term care needs will be covered in the event of an illness or disability. Additionally, long-term care insurance can provide peace of mind for both individuals and their families by helping to cover the costs associated with long-term care.

In Summary

Long-term care insurance is an important form of insurance that can provide financial assistance for those who need long-term care services due to age, disability, or chronic illness. The cost of long-term care insurance varies greatly depending on the policy and the individual's age and health history. Generally, premiums can range from $2,000 to $5,000 per year. It is important to shop around and compare policies to find the best coverage at the most affordable price. By purchasing a policy, individuals can rest assured that their long-term care needs will be covered in the event of an illness or disability.

How Much Does Long-Term Care Insurance Cost? | RamseySolutions.com

Long-Term Care Insurance Information: Policy Features & Benefits

Nursing Home Insurance Policy Cost - Insurance Reference

Long-Term Care Insurance Overview - ESI Money

Average Long Term Care Costs in Arizona | ALTCS Planning.net