Which State Has The Cheapest Car Insurance

Saturday, November 25, 2023

Edit

Which State Has The Cheapest Car Insurance?

The Factors That Affect Car Insurance Prices

When it comes to car insurance, one of the most important questions to ask is which state has the cheapest car insurance? The answer to this question depends on a variety of factors.

The first factor that affects car insurance prices is the type of car you drive. Certain types of cars are considered more risky to insure than others. The more expensive and luxurious a car is, the more expensive it will be to insure. Certain types of cars are also more likely to be stolen or damaged, which can also increase insurance rates.

The second factor that affects car insurance prices is the driver's age and driving record. Insurance companies consider drivers with more experience to be less risky. Additionally, drivers with a history of traffic violations or accidents will usually pay more for car insurance.

The third factor that affects car insurance prices is the state in which the driver lives. Each state has different laws and regulations regarding car insurance. Some states require drivers to purchase certain kinds of insurance, while other states do not.

Which State Has The Cheapest Car Insurance?

When it comes to finding the cheapest car insurance, the answer will vary depending on the factors mentioned above. However, there are certain states that generally have cheaper car insurance rates than others.

Residents of Maine, Ohio, and Virginia often have the cheapest car insurance rates. These states have strict regulations regarding car insurance and they require drivers to purchase higher liability limits than other states.

Residents of New York and California often pay more for car insurance, due to the large population and higher rates of accidents. Additionally, these states tend to have more expensive cars, which can also drive up insurance prices.

Tips to Get Cheaper Car Insurance Rates

There are several steps you can take to help lower your car insurance rates. The first step is to shop around and compare rates from different companies. Many companies offer discounts for good drivers and for drivers who have taken a defensive driving course. Additionally, some companies offer discounts for drivers who have multiple vehicles insured through their company.

Another way to get cheaper car insurance is to raise your deductibles. Higher deductibles usually mean lower premiums. However, it is important to make sure that you can afford the higher deductible if you are in an accident.

Finally, it is important to keep your driving record clean. Traffic violations and accidents can cause your car insurance rates to go up. Therefore, it is important to obey all traffic laws and to drive safely.

Overall, there are several factors that can affect car insurance rates. The type of car you drive, your age and driving record, and the state you live in can all affect your rates. However, you can take steps to lower your rates, such as shopping around and raising your deductibles. By taking the time to compare rates and find the best deal, you can save money on car insurance.

CoverHound’s Steepest and Cheapest States for Auto Insurance in 2015

How Much Is Car Insurance? Average Car Insurance Cost 2020

Best Cheapest Home Auto Insurance Washington State

Who Has the Cheapest Auto Insurance Quotes in Florida? (2019

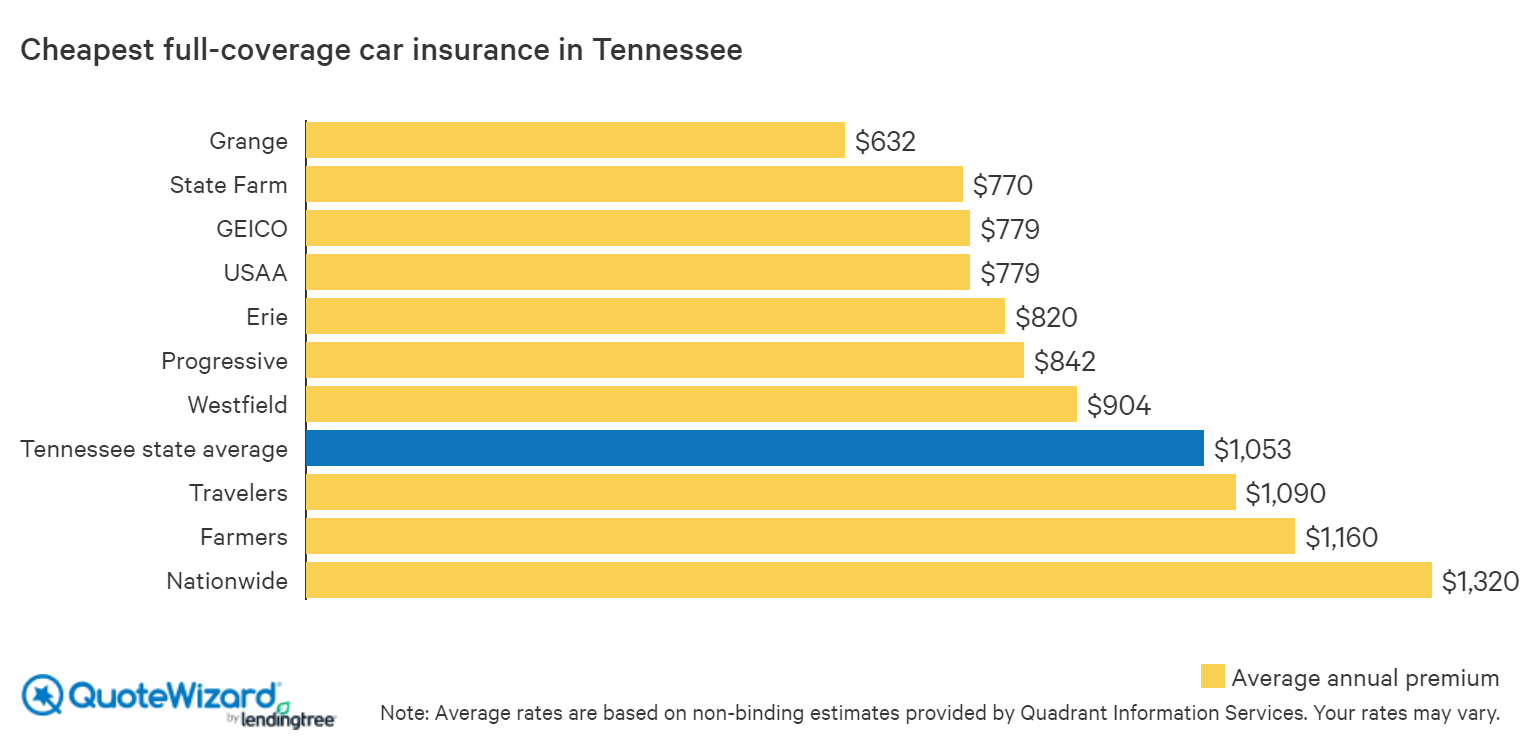

Find Cheap Car Insurance in Tennessee | QuoteWizard