Third Party Property Insurance Definition

What is Third Party Property Insurance?

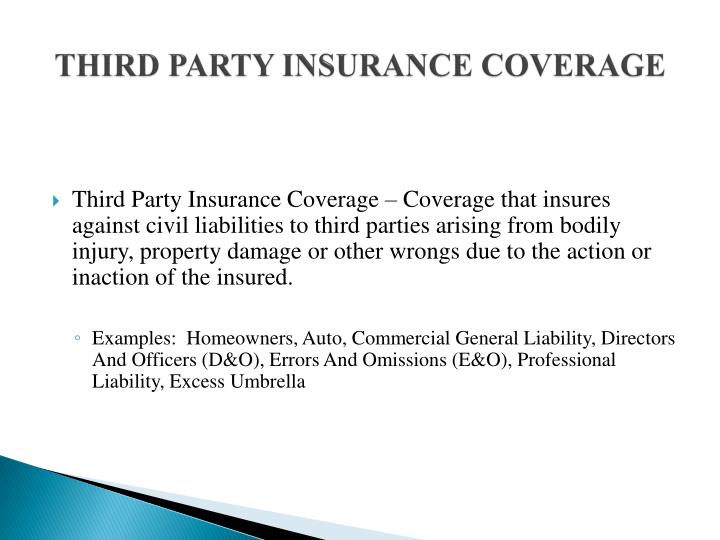

Third Party Property Insurance is a type of insurance that protects you in the event of damage or theft caused to other people’s property. It covers the costs associated with property damage or theft, such as repairs, replacements, and legal costs. In some cases, Third Party Property Insurance may also cover the cost of medical expenses if someone is injured on your property. Third Party Property Insurance is often included in an overall home insurance policy, but it is important to check the details of the policy to ensure it covers the type of damage and theft you are looking to protect against.

What Does Third Party Property Insurance Cover?

Third Party Property Insurance covers damage or theft of other people’s property. This includes damage to property owned by visitors to your home, such as cars, furniture, electronics, and other items. It also covers damage caused to property owned by neighbors or others in your area, such as fences and trees. Additionally, Third Party Property Insurance may also cover medical expenses if someone is injured while visiting your property. It is important to check the details of your policy to determine what type of property damage and theft are covered.

What Is Not Covered By Third Party Property Insurance?

Third Party Property Insurance does not cover damage or theft of your own property. If you own a business, you may need to purchase a separate business insurance policy to cover your property. Additionally, Third Party Property Insurance does not cover acts of vandalism. If you are concerned about vandalism, you may need to purchase a separate vandalism insurance policy. It is important to read the fine print on any insurance policy to ensure it covers the type of damage and theft you are looking to protect against.

Do I Need Third Party Property Insurance?

Whether or not you need Third Party Property Insurance will depend on a variety of factors, such as where you live and the type of property you own. If you own a home or other property, it is important to consider Third Party Property Insurance as it can help protect you in the event of damage or theft to other people’s property. Additionally, if you own a business, you may need to purchase a separate business insurance policy to cover damage or theft of your own property.

How Much Does Third Party Property Insurance Cost?

The cost of Third Party Property Insurance will depend on a variety of factors, such as the type and amount of coverage you purchase. Generally, Third Party Property Insurance is much less expensive than other types of insurance, such as home insurance or business insurance. Additionally, many insurance companies offer discounts for bundling multiple types of insurance together, such as home and auto insurance. It is important to shop around and compare different insurance policies to ensure you are getting the best deal for your needs.

Conclusion

Third Party Property Insurance is a type of insurance that can provide protection in the event of damage or theft of other people’s property. It covers the costs associated with property damage or theft, such as repairs, replacements, and legal costs. Additionally, Third Party Property Insurance may also cover the cost of medical expenses if someone is injured on your property. The cost of Third Party Property Insurance will depend on the type and amount of coverage you purchase, but it is generally much less expensive than other types of insurance. It is important to shop around and compare different insurance policies to ensure you are getting the best deal for your needs.

What Is Third-party Insurance?

PPT - INSURANCE LAW : What Every Practitioner Should Know PowerPoint

Third Party Property Car Insurance | iSelect

What is Compulsory Third Party Insurance - YouTube

Business Concept Meaning Third-Party Insurance with Sign on the Sheet