Named Non Owner Policy Geico

What is a Named Non-Owner Policy from Geico?

For many drivers, having auto insurance is essential for protecting their financial assets and for complying with state laws. That’s why Geico offers non-owner policies for those who don’t have regular access to a vehicle. A named non-owner policy from Geico is a type of car insurance specifically designed to provide coverage for those who do not own a car but still need to be insured while driving a vehicle they don’t own.

With a named non-owner policy from Geico, you can get coverage for yourself as a driver and not just the car you’re driving. The policy provides liability coverage to protect you if you are found to be at fault in an accident. It also provides uninsured/underinsured motorist coverage, which can help protect you if you’re injured in an accident caused by an uninsured or underinsured driver.

Who Needs a Named Non-Owner Policy from Geico?

A named non-owner policy from Geico is ideal for someone who does not own a car but still needs to be insured to drive a vehicle they don’t own. This could include people who rent cars frequently, someone who borrows a car from a friend or family member, or a student who is away from home and needs to be insured to drive a car.

If you’re a driver who does not own a car, a named non-owner policy from Geico is a great option for getting the coverage you need. It’s also a great choice if you’re a high-risk driver who has been denied insurance by other companies.

What Coverage Does a Named Non-Owner Policy from Geico Provide?

A named non-owner policy from Geico provides the same types of coverage as a standard auto insurance policy. The policy covers liability, which pays for damage or injuries to other people or property if you’re at fault in an accident. It also provides uninsured/underinsured motorist coverage, which pays for your medical bills and other costs if you’re injured in an accident caused by an uninsured or underinsured driver.

In addition, a named non-owner policy from Geico provides medical payments coverage and personal injury protection to cover your medical expenses and lost wages if you’re injured in an accident. It also provides coverage for rental cars and towing and labor costs.

What Are the Benefits of a Named Non-Owner Policy from Geico?

There are several benefits to having a named non-owner policy from Geico. One of the biggest benefits is that you can get coverage without having to own a car. This makes it a great option for people who don’t own a car but still need to drive one.

Another benefit of a named non-owner policy from Geico is that it provides the same types of coverage as a standard auto insurance policy. That means you can get the same level of protection as someone who owns a car.

Finally, a named non-owner policy from Geico is a great option for high-risk drivers who have been denied coverage by other companies. It can provide you with the coverage you need at a competitive price.

How Much Does a Named Non-Owner Policy from Geico Cost?

The cost of a named non-owner policy from Geico will vary based on a variety of factors, including your driving record, the type of coverage you select, and the state you live in. Generally, though, a named non-owner policy from Geico is more affordable than a standard auto insurance policy.

It’s important to shop around and compare rates from different companies to make sure you’re getting the best deal on your policy. Geico offers competitive rates and discounts for certain drivers, so it’s worth taking a look at what they have to offer.

Get the Coverage You Need with a Named Non-Owner Policy from Geico

If you don’t own a car but still need to be insured while driving a vehicle you don’t own, a named non-owner policy from Geico is a great option. It provides the same types of coverage as a standard auto insurance policy, and it’s an affordable way to get the coverage you need.

For more information about a named non-owner policy from Geico, visit their website or speak to an insurance agent. They can help you find the right policy for your needs and answer any questions you have.

Geico non-owner car insurance - insurance

Non Owners Insurance Policy Geico - Financial Report

Geico non owner insurance - insurance

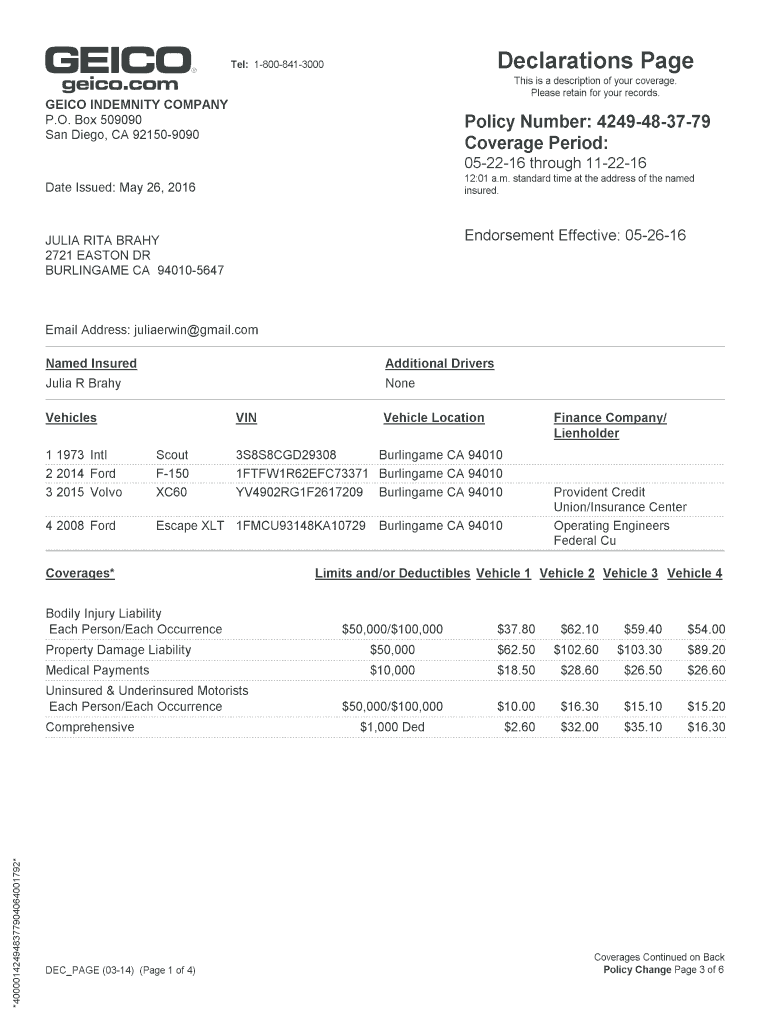

Declaration Page Geico - Fill Online, Printable, Fillable, Blank

GEICO Car Insurance Coverage Calculator | GEICO