Does Geico Have Gap Insurance

Does Geico Have Gap Insurance?

What is Gap Insurance?

Gap insurance is a type of auto insurance that covers the difference between what you owe on a vehicle and its current market value. This type of insurance is commonly purchased when you're financing or leasing a car, and it can be really beneficial if your car is stolen or totaled in an accident.

When you purchase gap insurance, it pays the difference between what you owe and what your car is worth at the time of the accident. For example, if your car is worth $10,000 and you owe $15,000, gap insurance will pay the difference of $5,000.

Why is Gap Insurance Important?

Gap insurance is important because it helps you avoid being stuck with the bill in the event of an accident. Without gap insurance, you could end up owing more money than your car is worth, and you'd be left to pay the difference out of pocket.

Gap insurance also helps protect you in the event of a total loss. If your car is totaled in an accident, you'll be reimbursed for the difference between what you owe and the market value of your car at the time of the accident.

Does Geico Have Gap Insurance?

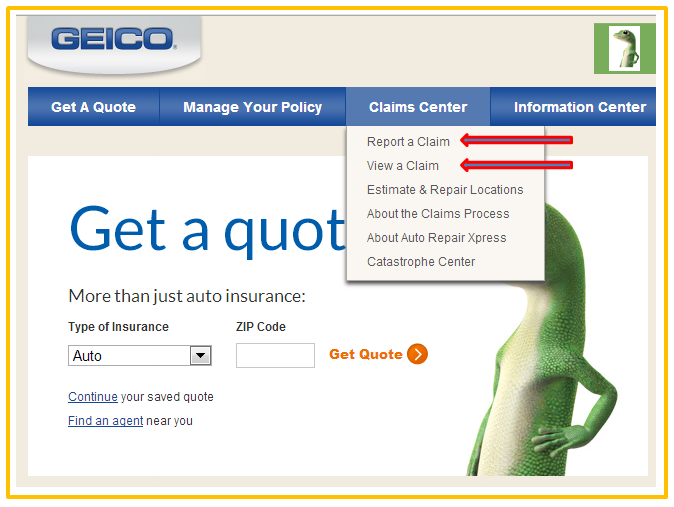

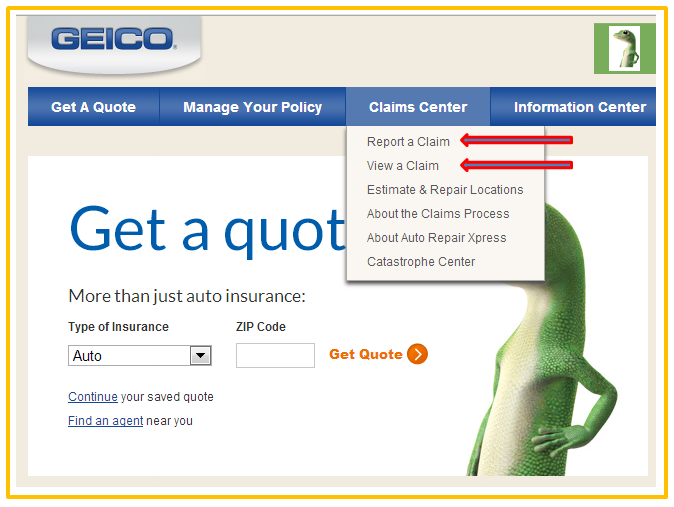

Yes, Geico does offer gap insurance for customers who are financing or leasing a vehicle. Geico's gap insurance covers the difference between what you owe on your car and its current market value in the event of total loss.

If you're looking for gap insurance, Geico is a great option. They offer competitive rates and their customer service is top-notch. Plus, they make it easy to add gap insurance to your existing policy.

How Much Does Geico Gap Insurance Cost?

The cost of gap insurance varies depending on the make and model of your vehicle, as well as your driving history. Geico's gap insurance typically costs between $20 and $30 per month, depending on the factors mentioned above.

Keep in mind that gap insurance is a wise investment, as it can help protect you in the event of an accident. With Geico's gap insurance, you can rest assured that you'll be covered in the event of a total loss.

Gap Insurance Geico See Auto Insurance Options From Geico, Plus

GEICO Home Insurance Review 2019 (Buyer Beware Before You Buy)

Gap Insurance Geico Should You Get In An Accident, You'll Be Able To

General Accident Car Insurance Number | Affordable Car Insurance

How to Cancel Geico Insurance - Honest Policy