What Is 3rd Party Liability Car Insurance

What is 3rd Party Liability Car Insurance?

3rd party liability car insurance (also known as third party insurance) is a type of car insurance that provides coverage against any legal liability arising due to the death or injury of a third party or damage to the property of a third party caused by your car. The third party could be an individual, an organization or even a government body.

In India, it is mandatory by law to have a 3rd party liability car insurance policy for any vehicle that is used on public roads. This type of car insurance covers any legal liabilities that may arise due to an accident or other mishap involving your car and a third party. It also covers any damage caused to the property of a third party that was caused by your car.

What Does 3rd Party Liability Car Insurance Cover?

The coverage provided by 3rd party car insurance includes the legal liabilities arising out of death, injury or damage to property of a third party caused by your car. The coverage also extends to any legal costs incurred in defending a claim against you.

What Does 3rd Party Liability Car Insurance Not Cover?

3rd party liability car insurance does not provide coverage for the damage to your own car, or any medical expenses incurred by you or your passengers in the event of an accident. It also does not provide coverage for any damage to property owned by you.

How Much Does 3rd Party Liability Car Insurance Cost?

The cost of 3rd party liability car insurance will vary depending on a number of factors, including the make and model of your car, your age and driving experience, the area you live in, and the type of cover you choose. Generally speaking, the cost of third party insurance is lower than the cost of comprehensive cover.

How Do I Get 3rd Party Liability Car Insurance?

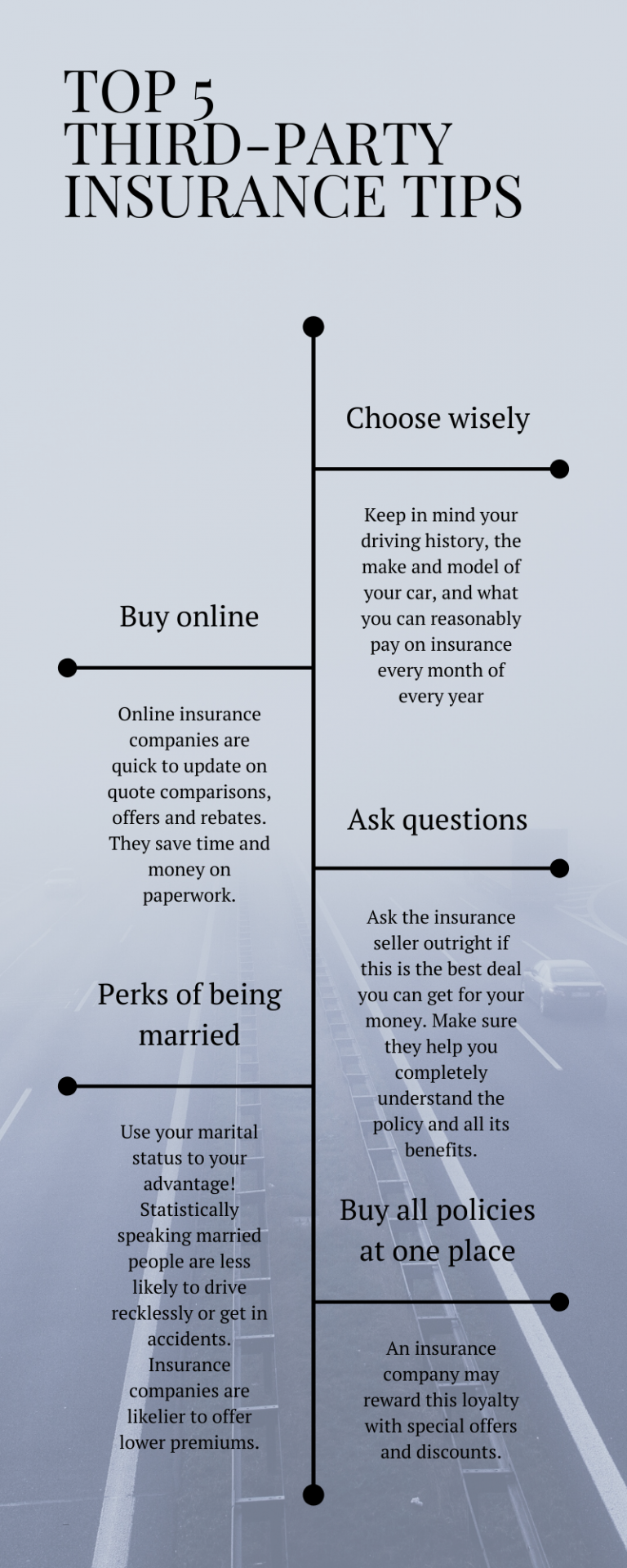

3rd party liability car insurance can be purchased from a variety of sources, including insurance brokers, direct insurers and online comparison sites. It is important to compare the different policies on offer in order to find the one that best meets your needs. When making your decision, it is important to consider the level of coverage provided, the cost of the policy, and the reputation of the insurer.

What Is Third-party Insurance?

Third Party Property Car Insurance | iSelect

What is third party insurance | Online insurance, Compare insurance

What is Third Party Insurance | What is Third Party Insurance for Car

PPT - third-party car insurance online PowerPoint Presentation, free