Long term Care Insurance Cost By Age

Friday, March 10, 2023

Edit

Long Term Care Insurance Cost By Age

What is Long Term Care Insurance?

Long term care insurance (LTC) is a type of insurance that helps pay for long term care services, such as home health care, assisted living and nursing home care. It can help cover the costs of these services if you need them due to a disability, illness or injury. While LTC insurance isn’t required, it can help you protect your assets and provide you with the care you need.

How Much Does LTC Insurance Cost?

The cost of long term care insurance depends on your age, the type of policy you choose, and the amount of coverage you purchase. Generally speaking, the younger you are when you purchase a policy, the lower the premiums will be. But the cost of premiums can vary widely, so it’s important to shop around and compare policies from different insurers.

LTC Insurance Cost By Age Group

The cost of long term care insurance can vary widely depending on your age. Here’s a general overview of what you can expect to pay for a policy, broken down by age group.

Ages 18-35:

The cost of long term care insurance for those ages 18-35 is typically the lowest. Premiums can range from $500 to $1,500 per year, depending on the type of policy and amount of coverage you purchase.

Ages 36-55:

The cost of long term care insurance for those ages 36-55 is typically higher than it is for younger individuals. Premiums can range from $1,500 to $3,500 per year, depending on the type of policy and amount of coverage you purchase.

Ages 56-65:

The cost of long term care insurance for those ages 56-65 is typically the highest. Premiums can range from $3,500 to $7,000 per year, depending on the type of policy and amount of coverage you purchase.

What Else Do I Need to Consider?

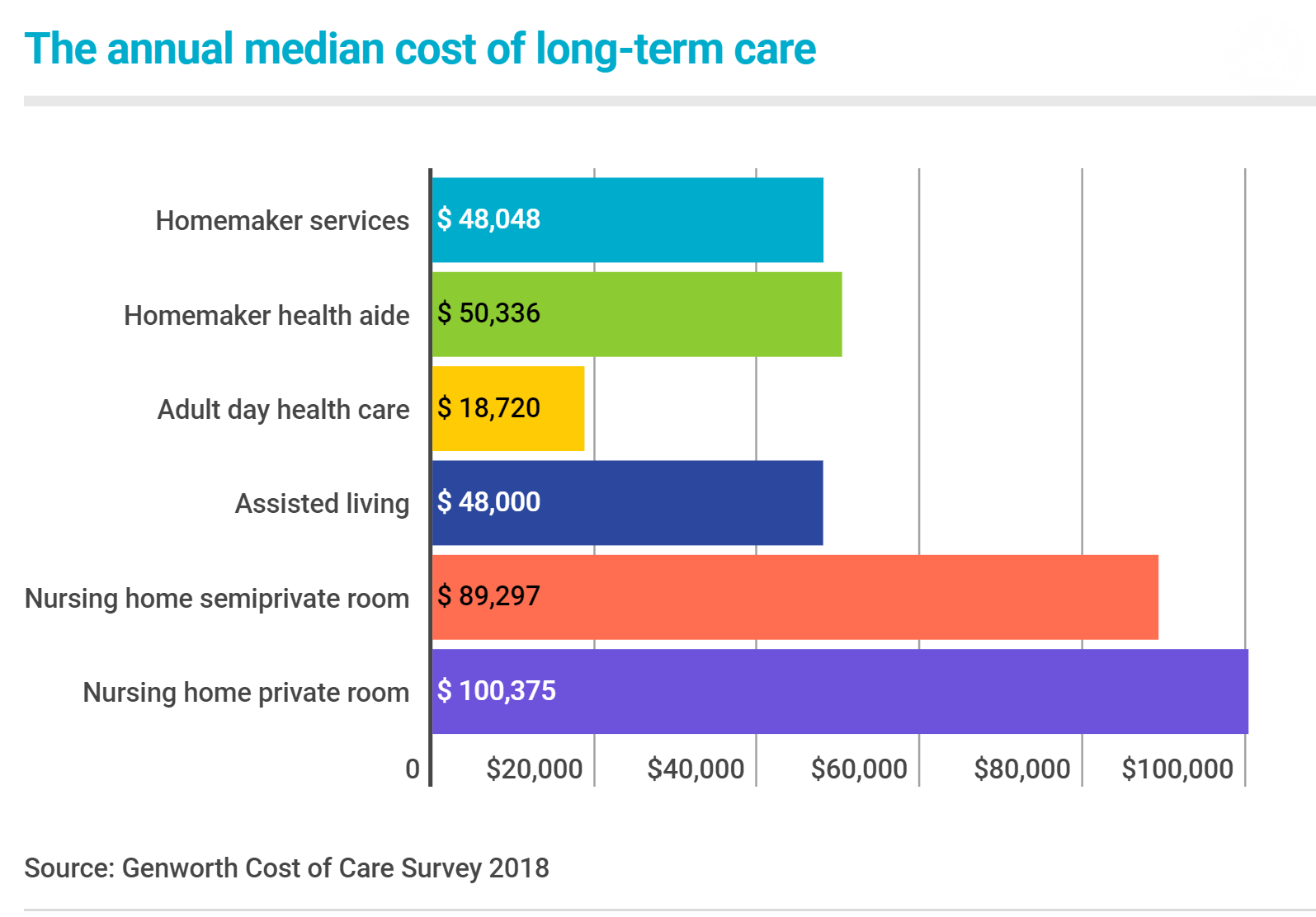

When shopping for long term care insurance, it’s important to consider other factors, such as the cost of living in your area, the cost of long term care services, and the type of coverage you want. In addition, you’ll need to think about the deductibles, co-pays, and other out-of-pocket expenses that may be associated with your policy.

Bottom Line

Long term care insurance can be a great way to protect your assets and provide for your care if you become disabled or ill. But the cost of premiums can vary widely, so it’s important to shop around and compare policies from different insurers. The cost of premiums also depends on your age, so it’s important to consider that when you’re shopping for a policy.

Cost of Care in Arizona – INtouch Senior Services

Long-Term Care Insurance Overview - ESI Money

Why People Don’t Buy Long-Term-Care Insurance - WSJ

Longterm Care: Costs, Caregiving and Choices | Long term care, Long

How to Buy Long-Term-Care Insurance - WSJ