Which State Has The Highest Car Insurance Rates

Which State Has The Highest Car Insurance Rates?

Understanding Car Insurance Rates

Car insurance rates can vary significantly from one state to another. In some states, rates are much higher than in others. Depending on the state in which you reside, you may be paying more for car insurance than drivers in other states. It's important to understand the factors that influence car insurance rates so you can make sure you're getting the best possible rate.

Factors That Affect Car Insurance Rates

When it comes to car insurance rates, a variety of factors can affect the cost. These include the type of car you drive, your driving record, the amount of coverage you purchase, and the state in which you live. Additionally, certain states have higher average insurance rates than others due to the population, number of drivers, and number of accidents in the state.

Which State Has the Highest Car Insurance Rates?

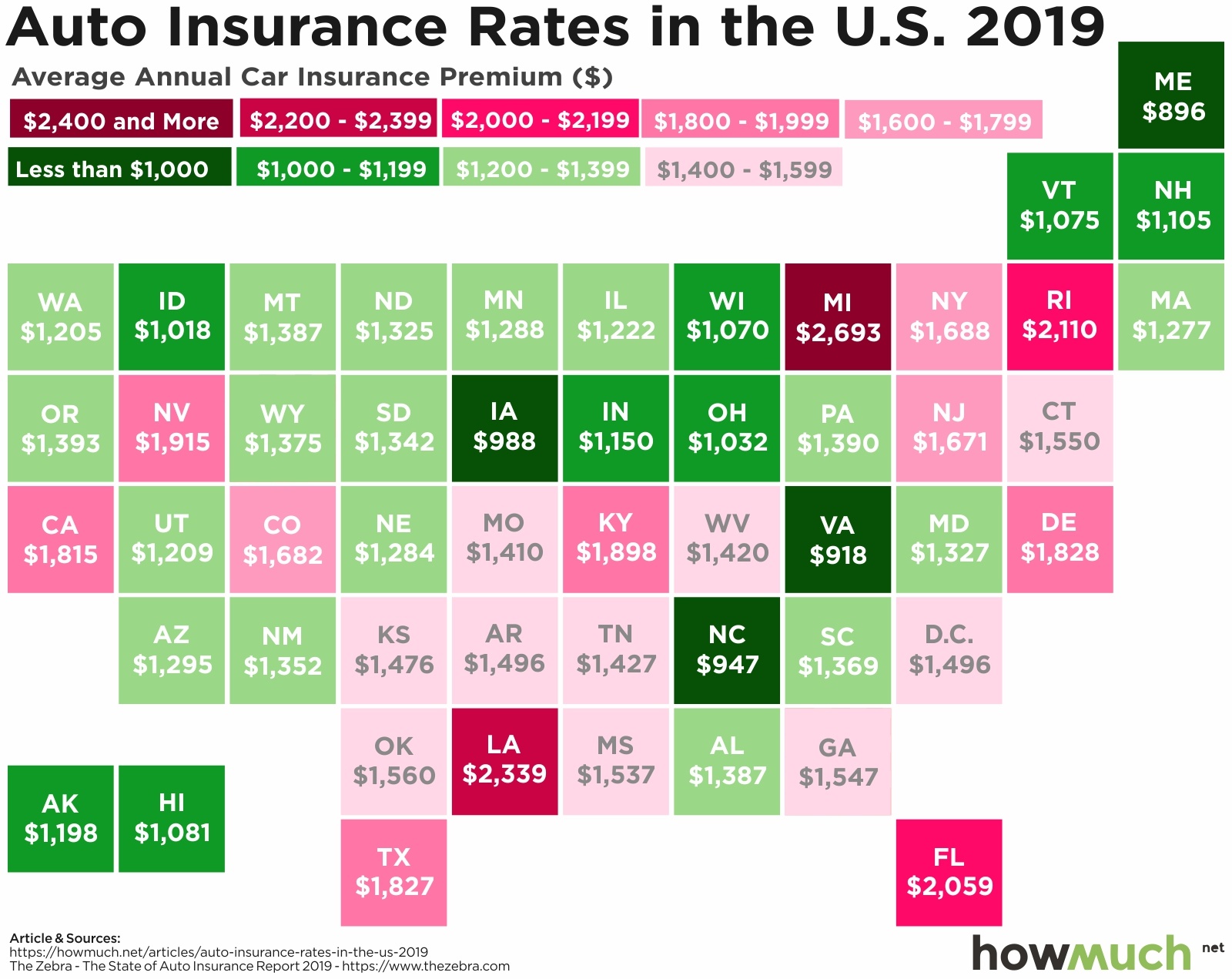

The state with the highest car insurance rates in the US is Michigan. Michigan drivers pay an average of $2,541 per year for car insurance, which is more than double the national average of $1,311. This is due to the fact that Michigan is a No-Fault state, meaning drivers are required to carry more coverage than drivers in other states. Additionally, Michigan has a higher-than-average population density and a large number of uninsured drivers on the road.

Other States with High Car Insurance Rates

In addition to Michigan, there are several other states with higher-than-average car insurance rates. These include Louisiana, Florida, and Rhode Island. Louisiana drivers pay an average of $2,272 per year, while Florida drivers pay an average of $2,084. Rhode Island drivers pay an average of $2,076. All of these states have high populations, high numbers of uninsured drivers, and/or higher-than-average rates for car insurance coverage.

What Can You Do to Lower Your Car Insurance Rates?

If you live in a state with high car insurance rates, there are still some steps you can take to lower your premium. The first step is to shop around and compare rates from different insurers. You may find that one company offers a better rate than another. Additionally, you can look for discounts such as good driver discounts, multi-policy discounts, and safe driver discounts. Finally, you can look into raising your deductible, which can lower your premium.

Conclusion

Car insurance rates vary significantly from one state to another. Michigan has the highest car insurance rates in the US, but other states such as Louisiana, Florida, and Rhode Island also have high rates. If you live in one of these states, there are still steps you can take to lower your car insurance rate. By shopping around, looking for discounts, and raising your deductible, you can save money on your car insurance policy.

Highest Car Insurance Rates By State / Which states have the highest

Find Out Which States Have the Most Expensive Car Insurance Rates in

What do Americans Pay for Car Insurance in 2019? – Investment Watch

How Much Is Car Insurance? Average Car Insurance Cost 2020

Highest Car Insurance Rates By State 2020 : Used Suzuki Vitara 1.6 GL+