Chubb Long Term Care Insurance Cost

Friday, December 13, 2024

Edit

Chubb Long Term Care Insurance Cost - What You Need to Know

What is Long Term Care Insurance, and Why Do You Need it?

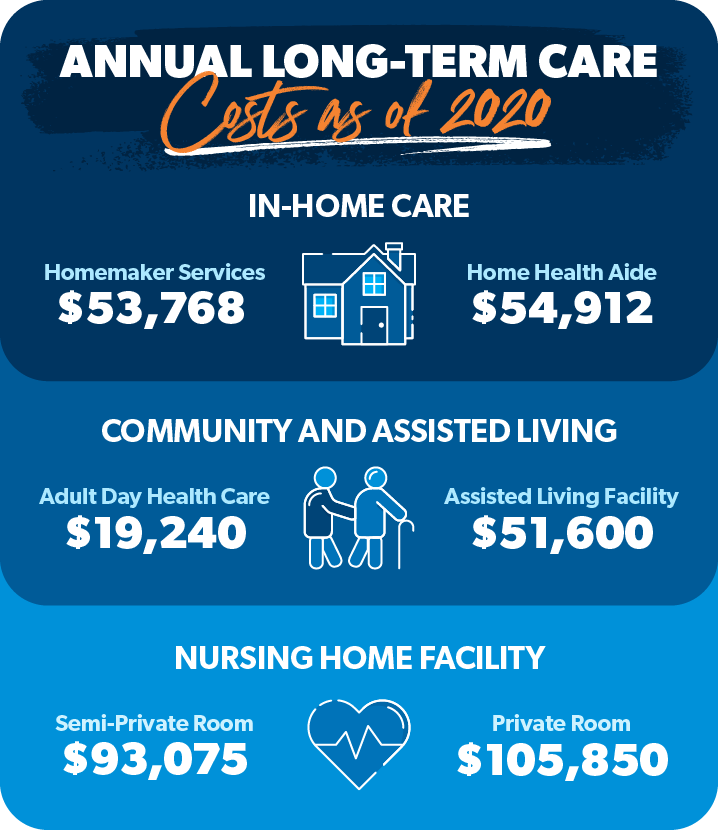

Long term care insurance is a type of insurance policy designed to help you pay for long-term care expenses. Long-term care refers to the type of care you may need when you can’t do everyday activities on your own, such as bathing, dressing, eating, or using the toilet. These services may be provided in your home, in a nursing home, or in an assisted living facility. Long-term care insurance can help cover the costs of these services, allowing you to maintain your quality of life and maintain your independence.

Chubb is one of the leading providers of long-term care insurance, offering plans that are tailored to your individual needs. Chubb's long-term care insurance policies provide coverage for a variety of services, including home care, assisted living, and nursing home care. Chubb offers flexible coverage options, so you can find a plan that fits your budget and meets your needs.

How Much Does Chubb Long Term Care Insurance Cost?

The cost of Chubb long term care insurance will vary depending on a number of factors, including your age, health, and location. Generally speaking, the younger you are and the healthier you are, the lower your premiums will be. Additionally, premiums may be lower in certain states due to differences in regulations.

The cost of a Chubb policy will also depend on the coverage you choose. There are a variety of coverage options available, including a comprehensive plan that will cover a range of services, or a more basic plan that will provide coverage for a limited number of services. Chubb also offers discounts for couples who purchase coverage together, as well as discounts for those who purchase coverage through an employer or a trade association.

What Does Chubb Long Term Care Insurance Cover?

Chubb's long-term care insurance policies can provide coverage for a variety of services, including home care, assisted living, and nursing home care. Home care may include help with activities of daily living, such as bathing, dressing, eating, and using the toilet. Assisted living may include assistance with medical care, meals, and medication management. Nursing home care may include skilled nursing care, physical therapy, and other services.

Chubb's policies also provide coverage for respite care, which can provide short-term relief for a caregiver. Additionally, Chubb's policies may cover the cost of certain durable medical equipment, such as wheelchairs or walkers. Chubb's policies also provide coverage for adult day care and home health aides.

What is the Claims Process for Chubb Long Term Care Insurance?

Chubb's long-term care insurance policies have a simple and straightforward claims process. To make a claim, you'll need to submit a claim form and supporting documentation to Chubb. Once the claim is approved, Chubb will pay the benefits directly to you or to your service provider.

Chubb's policies also include a Cash Benefit Option, which allows you to access a portion of your benefits as a lump sum payment. This money can be used to pay for out-of-pocket expenses related to your long-term care, such as transportation or medication.

Is Chubb Long Term Care Insurance Right for You?

Chubb's long-term care insurance policies can provide financial protection for you and your family in the event of an unexpected illness or injury. These policies can help you pay for the services you need to maintain your quality of life and maintain your independence.

Chubb offers a variety of coverage options, so you can find a plan that fits your budget and meets your needs. Chubb's policies are also backed by a team of experienced long-term care experts who can answer any questions you may have.

If you're looking for a way to ensure you have the resources you need to maintain your quality of life, Chubb long term care insurance may be the right option for you.

Conclusion

Chubb long term care insurance can provide financial protection for you and your family in the event of an unexpected illness or injury. Chubb offers a variety of coverage options, so you can find a plan that fits your budget and meets your needs. Chubb's policies are backed by a team of experienced long-term care experts who can help answer any questions you may have.

If you're looking for a way to ensure you have the resources you need to maintain your quality of life, Chubb long term care insurance may be the right option for you.

Transparent Chubb Insurance Logo Png - Logo Chubb Insurance Png, Png

Should I Buy Long Term Care Insurance In 2020? - BLOGPAPI

How Much Does Long-Term Care Insurance Cost? | RamseySolutions.com

Chubb Auto Insurance / Property & Casualty Insurance Sector Companies

How Much Does Long Term Care Insurance Cost In 2020?