Average Car Insurance Cost Per Month In Pennsylvania

Monday, March 6, 2023

Edit

Average Car Insurance Cost Per Month in Pennsylvania

What Is the Average Cost of Car Insurance in Pennsylvania

Are you a Pennsylvania resident looking for an affordable car insurance policy? If so, you're in luck, because the average cost of car insurance in Pennsylvania is relatively low compared to other states. According to the Insurance Information Institute, the average cost of car insurance in Pennsylvania is $1,420 per year, or about $118 per month. This is lower than the national average of $1,548 per year, or $129 per month.

The cost of car insurance in Pennsylvania varies depending on a variety of factors such as the type of car you drive, your driving record, your age, your gender, and the insurance company you choose. Insurance companies calculate your premium based on these factors and more. For example, if you have a poor driving record, you can expect to pay a higher premium than someone with a clean driving record.

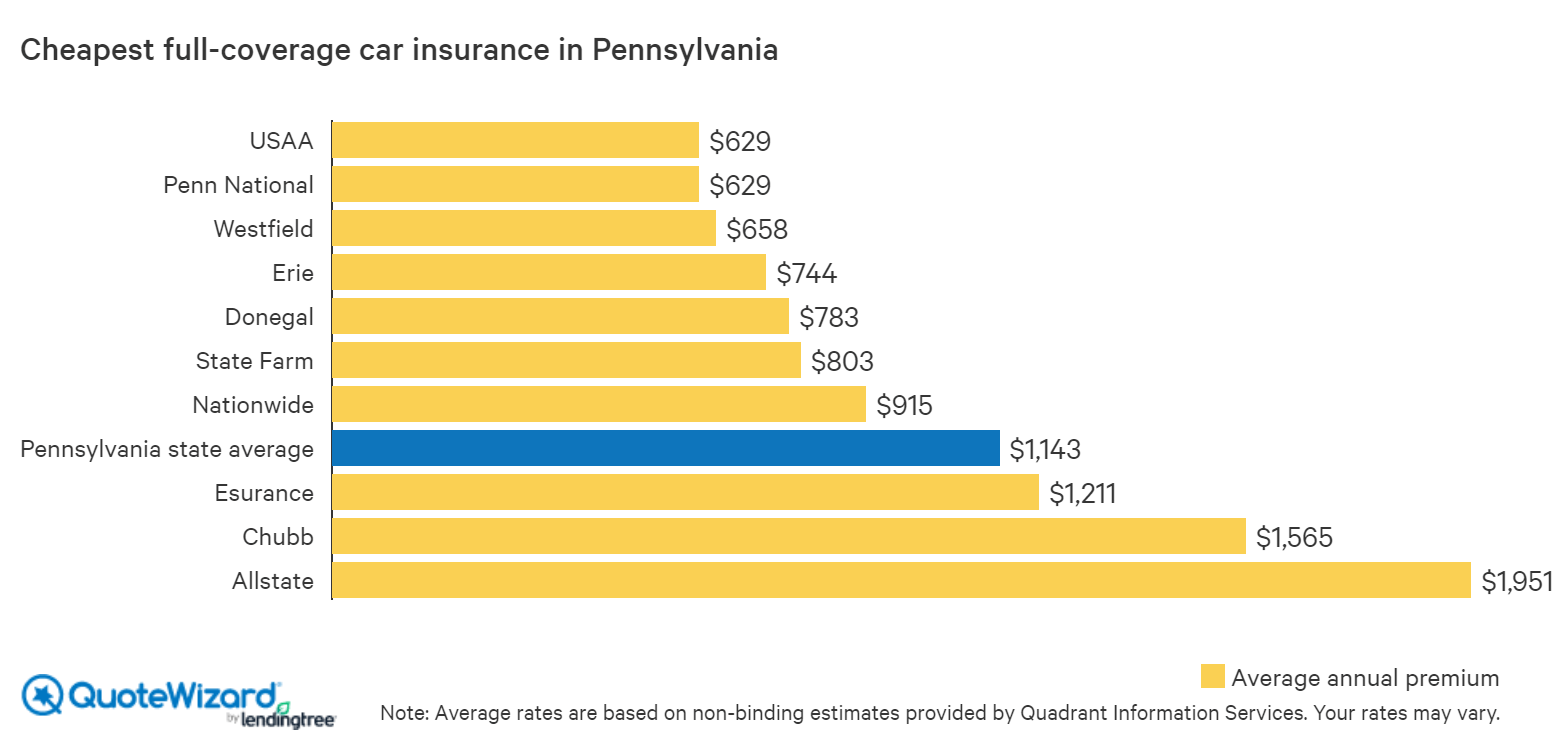

What Are the Cheapest Companies for Car Insurance in Pennsylvania?

When shopping for car insurance in Pennsylvania, it's important to compare rates from different companies to make sure you're getting the best deal. According to the Insurance Information Institute, the four cheapest companies for car insurance in Pennsylvania are USAA, Erie, Penn National, and Geico. USAA has the lowest average annual rate, at $837 per year, or about $70 per month. Erie has the second lowest rate, at $1,048 per year, or about $87 per month. Penn National and Geico have the third and fourth lowest rates, at $1,074 and $1,119 per year, respectively.

It's important to note that the cheapest car insurance company for one driver might not be the cheapest for another. This is why it's so important to compare rates from multiple companies before settling on one.

What Are the Best Car Insurance Discounts in Pennsylvania?

Most car insurance companies in Pennsylvania offer discounts to drivers in order to save them money. Common discounts include those for good drivers, drivers who complete a defensive driving course, drivers who install an anti-theft device in their car, and drivers who bundle their car insurance policy with other types of insurance, such as homeowners insurance or life insurance.

It's important to ask your car insurance company about discounts they offer. You may be surprised to discover how much you can save on your car insurance policy.

What Are the Penalties for Driving Uninsured in Pennsylvania?

Driving without car insurance is illegal in Pennsylvania. If you are caught driving without car insurance, you could be fined up to $300 for a first offense and up to $1,000 for subsequent offenses. You may also have your license suspended for up to three months.

In addition, if you are involved in an accident and found to be at fault, you may be held personally liable for any damages, medical bills, and other costs related to the accident. This means that you would be responsible for paying out of pocket for any damages or costs related to the accident.

How Can I Get the Cheapest Car Insurance in Pennsylvania?

The best way to get the cheapest car insurance in Pennsylvania is to shop around and compare rates from different companies. It's also a good idea to ask your car insurance company about discounts they offer, such as those for good drivers and drivers who bundle their car insurance policy with other types of insurance. Additionally, you can help keep your car insurance costs low by driving safely and avoiding tickets and accidents.

The cost of car insurance in Pennsylvania can vary significantly from one insurer to another, so it's important to shop around and compare rates from multiple companies before settling on one. By taking the time to compare rates and find the best deal, you could save hundreds of dollars per year on your car insurance policy.

Home Insurance York Pa – Home Sweet Home | Insurance – Accident lawyers

Get Cheap Car Insurance in Pennsylvania | QuoteWizard

The average cost of car insurance in the US, from coast to coast

Average Car Insurance Cost 2020 [Updated] | The Zebra

![Average Car Insurance Cost Per Month In Pennsylvania Average Car Insurance Cost 2020 [Updated] | The Zebra](https://doubxab0r1mke.cloudfront.net/media/zfront/production/images/Average_6-MonthPremium_by_Credit_Score.original.png)

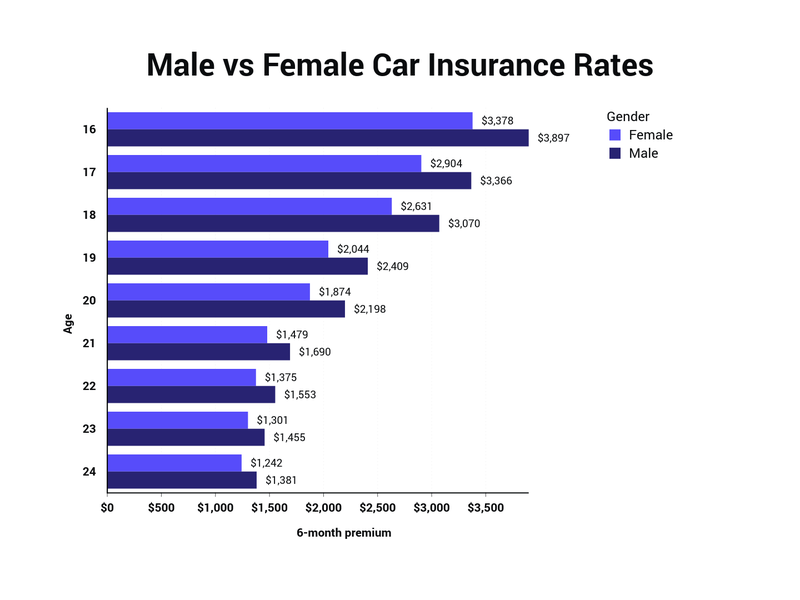

Average Car Insurance Rates by Age and Gender Per Month