Car Insurance Average Cost Per Month

What is the Average Cost of Car Insurance Per Month?

Car insurance is an important expense for many drivers. It's a requirement for most drivers, and it helps to protect them from financial harm if they are ever involved in an accident. But how much does car insurance cost on average? Depending on the type of coverage you choose and the company you select, the cost of car insurance can vary significantly. In this article, we'll explore the average cost of car insurance per month.

Factors that Determine the Cost of Car Insurance

There are many factors that influence the cost of car insurance, including the type of coverage you choose, the state you live in, your age, and your driving record. Generally, the more coverage you choose, the higher the cost of your car insurance. Different states have different insurance requirements, so the cost of car insurance can vary depending on where you live. Additionally, drivers under the age of 25 tend to pay more for car insurance than older drivers. Finally, your driving record can have a direct impact on the cost of your car insurance, as those with a history of traffic violations or accidents will likely pay more than those with a clean record.

Average Cost of Car Insurance per Month

The average cost of car insurance per month will depend on a variety of factors, including the type of coverage you choose and the company you select. According to the Insurance Information Institute, the average cost of car insurance for a 2019 model vehicle was $1,242 per year. That works out to an average of about $103 per month. However, this is just an average and doesn’t take into account individual factors such as age, driving record, and type of coverage. It’s important to remember that the actual cost of car insurance for any individual will vary depending on these factors.

How to Save Money on Car Insurance

If you’re looking to save money on car insurance, there are a few steps you can take. First, compare quotes from different insurance companies to find the best rate. Different companies might offer different rates, so it pays to shop around. Additionally, consider raising your deductible. A higher deductible means lower premiums, but it also means you’ll have to pay more out of pocket if you ever need to make a claim. Finally, if you’re a safe driver, ask your insurance company if they offer any discounts for a clean driving record.

Conclusion

Car insurance is an important expense for most drivers, and it’s important to make sure you’re getting the best rate possible. The average cost of car insurance per month is about $103, but this can vary significantly depending on the type of coverage you choose and the company you select. If you’re looking to save money on car insurance, shop around for the best rate and consider raising your deductible. Additionally, many insurance companies offer discounts for safe drivers, so be sure to ask about those as well.

ALL You Need to Know About the Average Car Insurance Cost

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro

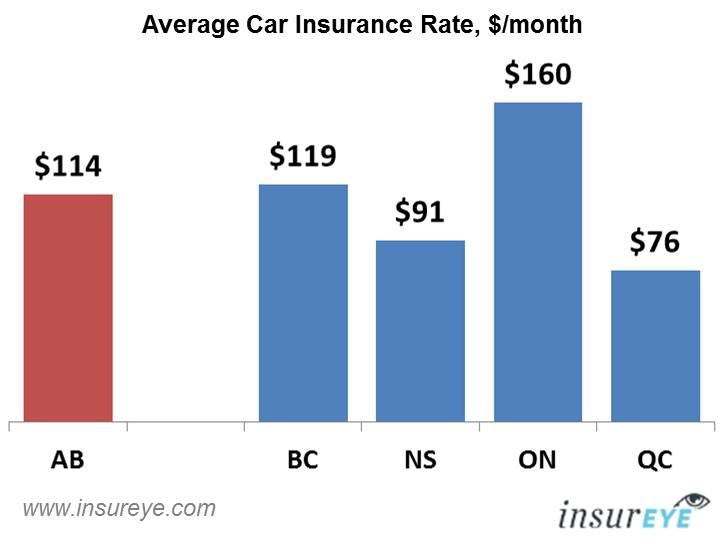

Car Insurance Alberta | Average Rate is $114 per month

Average Cost of Car Insurance UK 2021 | NimbleFins

How Much Is Car Insurance Per Month For A 18 Year Old ~ news word