State Farm Full Coverage Car Insurance Price

State Farm Full Coverage Car Insurance Price

Overview of State Farm

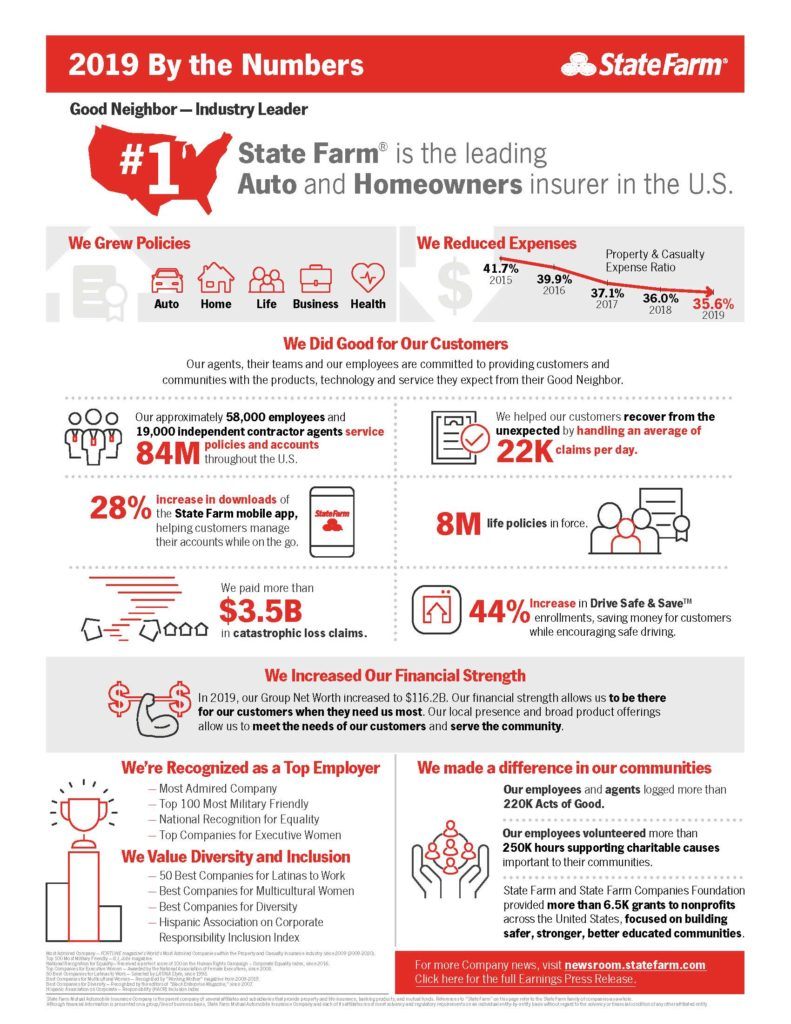

State Farm is one of the oldest and largest insurance companies in the United States. Established in 1922, it offers a variety of insurance products, including auto, home, and life insurance. State Farm is known for its excellent customer service and its competitive prices. It has an A+ rating from the Better Business Bureau and is one of the largest providers of car insurance in the United States.

What Does State Farm Full Coverage Car Insurance Cover?

State Farm’s full coverage car insurance provides protection for your vehicle in the event of an accident or other covered loss. It includes liability coverage, which pays for damages to other people’s property or injuries caused by you or another driver insured by State Farm. It also includes collision coverage, which pays to repair or replace your vehicle if it’s damaged in an accident. Comprehensive coverage pays for damage to your vehicle caused by events such as theft, fire, hail, or vandalism. Lastly, medical payments coverage pays for medical expenses caused by an accident.

What Affects the Cost of State Farm Full Coverage Car Insurance?

The cost of State Farm full coverage car insurance is determined by a variety of factors. These can include your age, driving record, the type of vehicle you drive, and the amount of coverage you need. The amount of coverage you purchase and the deductible you choose will also affect the cost of your policy. State Farm also offers discounts for good drivers, multiple vehicles, and other factors.

How Do You Get a Quote?

If you’re interested in getting a quote for State Farm full coverage car insurance, you can start by visiting the State Farm website. From there, you’ll be able to get a quote in just a few minutes. You can also call State Farm directly to get a quote or talk to an agent.

How Do You File a Claim?

If you need to file a claim with State Farm, you can do so online or by calling their 24-hour claims service. If you file online, you’ll need to provide your policy number and some basic information about the accident. You’ll also need to submit photos and other documents to support your claim. Once all the paperwork is submitted, State Farm will review your claim and issue a payment.

Conclusion

State Farm full coverage car insurance is a great option for those looking for comprehensive coverage at a competitive price. State Farm has excellent customer service and is one of the largest providers of car insurance in the United States. Getting a quote is easy and filing a claim is simple. If you’re looking for quality car insurance coverage, State Farm is a great option.

Should you get car insurance through your credit union?

Is State Farm Auto Insurance Right For You? We Did The Research

How Does State Farm Rideshare Insurance Work?

State Farm Homeowners Claim

USAA Vs State Farm Car Insurance: 6 Differences (Easy Win)