Bodily Injury Property Damage Liability

Bodily Injury Property Damage Liability: What You Need To Know

What is Bodily Injury Property Damage Liability Insurance?

Bodily Injury Property Damage Liability (BIPD) insurance is a type of liability insurance that provides coverage to policyholders in the event that they cause damage to another person’s property or cause bodily injury to another person. BIPD is a must-have for any business that has customers, clients, or employees, as it provides protection in the event that someone is injured as a result of the company’s actions. It is also important for individuals to have BIPD coverage in the event that they are involved in an accident that causes injury or damage to another person’s property.

What Does Bodily Injury Property Damage Liability Insurance Cover?

BIPD insurance covers the costs associated with legal defense and settlements arising from bodily injury or property damage claims. This includes medical expenses, lost wages, and pain and suffering caused by an accident involving the policyholder’s property or person. It also covers the cost of repairing or replacing damaged property. BIPD insurance can also cover the cost of defending the policyholder in court if they are sued for damages.

Why Do You Need Bodily Injury Property Damage Liability Insurance?

Even if you are an extremely careful driver or business owner, accidents can happen. The cost of legal fees and settlements can be astronomical, and without BIPD insurance, you could be left with a large financial burden. With BIPD insurance, you can rest easy knowing that you are protected in the event of an accident.

How Much Bodily Injury Property Damage Liability Insurance Do You Need?

The amount of BIPD insurance you need depends on your individual circumstances. Generally, it is recommended that you purchase a policy with at least $500,000 in coverage. However, if you own a business, you may need to purchase higher limits of coverage depending on the nature of your business and the amount of risk you face.

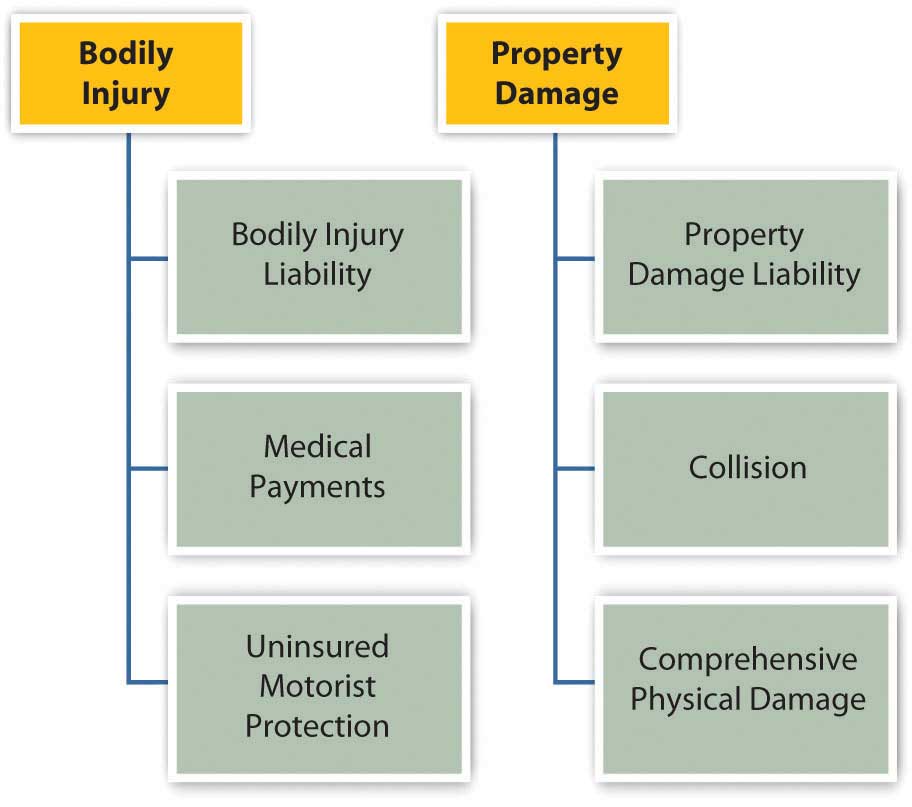

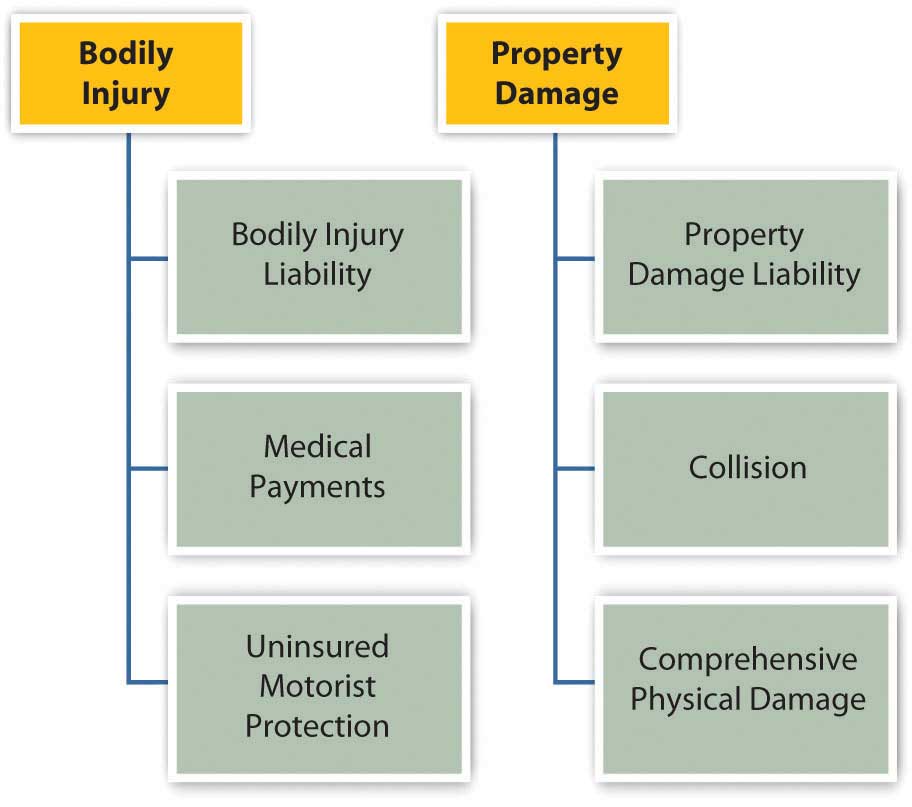

What Are the Different Types of Bodily Injury Property Damage Liability Insurance?

There are two main types of BIPD insurance: general liability and auto liability. General liability covers any accident that occurs on your property or as a result of your actions. Auto liability covers accidents involving vehicles.

How Much Does Bodily Injury Property Damage Liability Insurance Cost?

The cost of BIPD insurance depends on the type of coverage you choose, the amount of coverage you purchase, and the risk factors associated with your business or lifestyle. Generally, BIPD policies are relatively inexpensive and can be found for as little as a few hundred dollars per year. However, the cost can vary significantly depending on the amount of coverage and type of policy.

Personal Risk Management: Insurance

Bodily Injury Liability [What does it Cover?] | Ogletree Financial

![Bodily Injury Property Damage Liability Bodily Injury Liability [What does it Cover?] | Ogletree Financial](https://insurancequotes2day.com/wp-content/uploads/2019/09/liability-limits-by-state.jpg)

Auto insurance final presentation

Bodily Injury Property Damage Liability How Much - Property Walls

Bodily Injury & Property Damage Liability - RAELST