Minimum Vs Full Coverage Car Insurance

Comparing Minimum and Full Coverage Car Insurance

What is Minimum Coverage Insurance

Minimum coverage insurance is the most basic kind of auto insurance policy you can purchase. In most states, it is the minimum amount of insurance you need to legally operate a motor vehicle. Minimum coverage policies typically provide liability protection for property damage and bodily injury you may cause to another person while driving. Usually, there are two types of liability coverage: bodily injury liability and property damage liability. Bodily injury liability coverage will pay for medical expenses, lost wages, and pain and suffering for another person if you are at fault for an accident that causes injury. Property damage liability coverage will pay for any damage you cause to another person’s property. However, it does not cover any damage to your own vehicle. Minimum coverage insurance also does not cover any type of collision coverage, comprehensive coverage, or uninsured/underinsured motorist coverage.

What is Full Coverage Insurance

Full coverage insurance is a type of policy that includes more comprehensive coverage than a basic minimum coverage policy. In addition to the liability coverage, full coverage insurance also includes collision and comprehensive coverage. Collision coverage will pay for repairs to your vehicle if you are in an accident, regardless of who is at fault. Comprehensive coverage will pay for damages to your vehicle caused by something other than a collision, such as theft, fire, vandalism, or hail. It can also provide protection in the event of an accident with an uninsured/underinsured motorist. In some states, full coverage insurance also includes medical payments coverage and towing and labor coverage.

Which Type of Insurance is Right for You?

Deciding which type of insurance is right for you depends on a variety of factors, including your budget and the value of the vehicles you own. If you own an older car that is not worth very much, then a minimum coverage policy may be sufficient for your needs. However, if you own a newer vehicle, or if you have a loan or lease on your car, then it may be wise to invest in a full coverage policy. This is because if you are in an accident and your vehicle is damaged, a full coverage policy will pay for the repairs, while a minimum coverage policy will not. Additionally, if you are in an accident with an uninsured motorist, then a full coverage policy will provide the necessary protection.

How Much Does Insurance Cost?

The cost of insurance depends on a variety of factors, including your age, driving record, credit history, and the type of car you drive. Generally, minimum coverage policies are much less expensive than full coverage policies. However, the cost of a full coverage policy can be much lower if you qualify for certain discounts, such as a good driver discount or a multi-car discount. Additionally, if you have a good credit score, you may be able to get a discount on your insurance premium.

Choosing the Right Coverage

Choosing the right coverage for your needs can be confusing and overwhelming. It is important to understand the difference between minimum coverage and full coverage policies, and to weigh the cost of each policy against the value of your vehicle. Additionally, it is wise to shop around and compare rates from different insurance companies in order to find the best policy at the most affordable rate. Ultimately, the right coverage for you is the policy that provides the coverage you need at the most affordable price.

Conclusion

When it comes to auto insurance, it is important to understand the difference between minimum coverage and full coverage policies. Minimum coverage policies provide the basic liability protection you need to legally operate a motor vehicle, while full coverage policies provide additional protection against damages to your vehicle. The cost of each policy depends on a variety of factors, such as your age, driving record, and credit score. Ultimately, it is important to weigh the cost of the policy against the value of your vehicle and choose the coverage that provides the protection you need at the most affordable rate.

The Real Difference Between Minimum and Full Coverage Car Insurance

Liability vs. Full-Coverage Car Insurance: Understanding the Difference

List of the Best Car Insurance

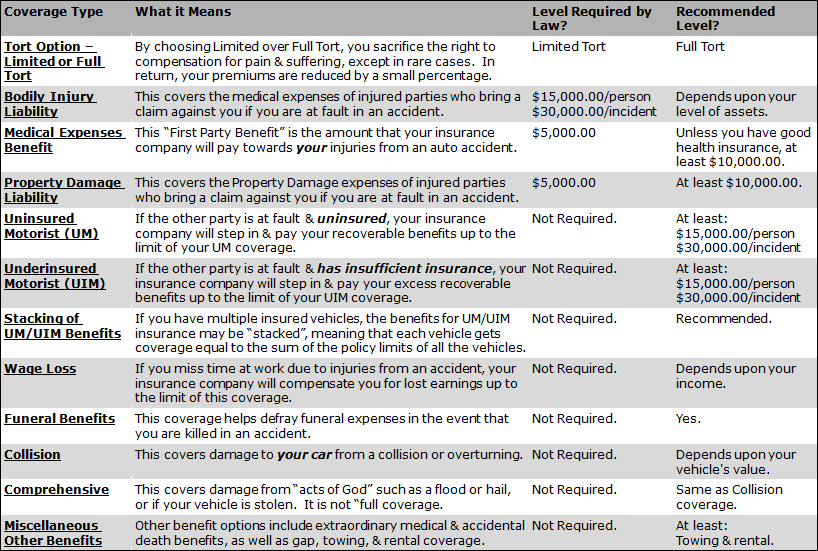

Seflin Law | Auto Insurance Overview