How Does Car Insurance Work With A Leased Vehicle

How Does Car Insurance Work With A Leased Vehicle?

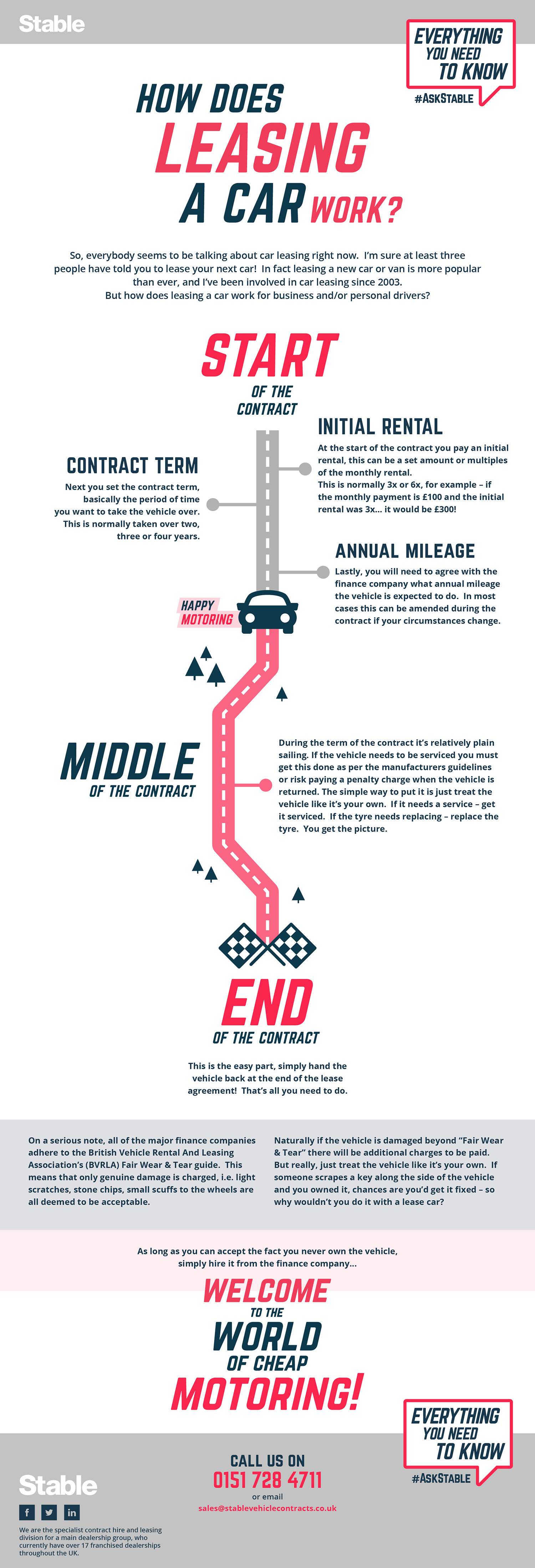

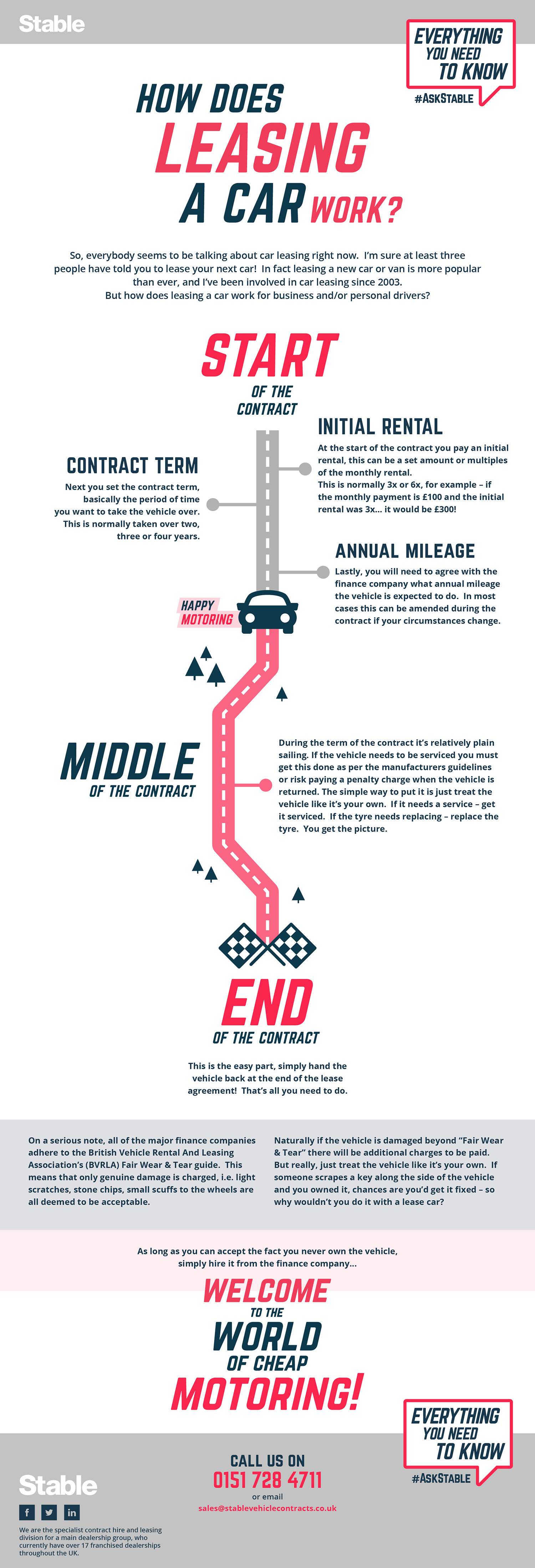

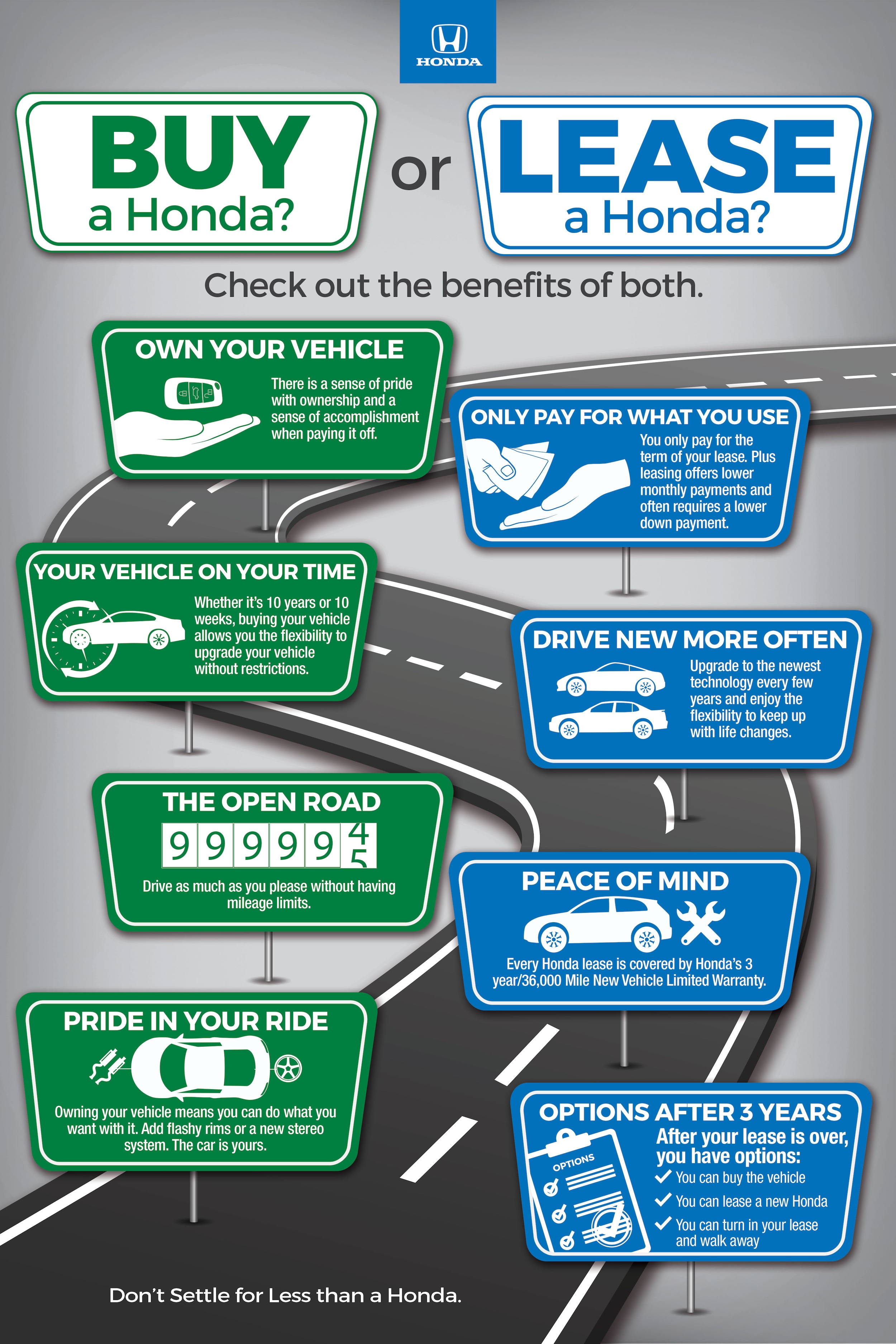

An Overview Of Leasing a Car

Leasing a car is a great way to get a new car without having to take out a car loan. Instead of making monthly payments towards a loan, leasing a car involves signing a lease agreement with a car dealer. This lease will include the payment terms of the car, the length of the lease, and the terms of the return of the car when the lease is up. When you lease a car, you are essentially paying for the use of the car during the duration of the lease. It’s important to understand the terms of the lease and the associated car insurance requirements.

Car Insurance for Leased Vehicles

It is a legal requirement to have car insurance when you lease a car. The lease agreement should specify the type of coverage that is required. Typically, the minimum coverage required is liability insurance. This covers any damage caused to another vehicle or property if you are responsible for an accident. It also covers any medical expenses incurred by the other party. In addition to liability insurance, you may also be required to carry comprehensive and collision coverage. This covers any damage to the leased vehicle due to an accident. In some cases, the leasing company may require you to carry full coverage, which covers both liability and comprehensive/collision coverage.

Choosing an Insurance Company

When you’re looking for car insurance for a leased vehicle, it’s important to shop around for the best rate. Different insurance companies will offer different rates and coverage options, so it’s important to compare different companies and policies. You should also consider the type of coverage that is required by your lease agreement. If you don’t have the required coverage, you may be in breach of the lease agreement and could be subject to fines and other penalties.

Payment Terms

When you sign up for car insurance for a leased vehicle, you’ll need to decide on the payment terms. Typically, you’ll be able to make payments on a monthly, quarterly, or annual basis. It’s important to consider your budget and decide which payment option best suits your needs. You should also consider the cost of the insurance and make sure that you’re getting the best rate for the coverage that you need.

Additional Insurance Coverage

In addition to the required coverage, you may also want to consider additional insurance coverage for your leased vehicle. This could include gap insurance, which covers the difference between the value of the car and what you owe if the car is stolen or totaled. You may also want to consider roadside assistance coverage in case you need help with a flat tire, a dead battery, or other roadside emergencies. Finally, you may want to consider rental car coverage, which covers the cost of a rental car if your leased car is in the shop due to an accident.

Conclusion

When you lease a car, it’s important to understand the car insurance requirements. You’ll need to have the required coverage, as specified in the lease agreement. You should also take the time to compare different insurance companies and policies to make sure you’re getting the best rate. Additionally, you may want to consider additional insurance coverage for your leased vehicle to provide additional protection.

Infographic: How does leasing a car work?

Which Is Better Car Lease Or Car Loan - TESATEW

Buying vs. Leasing a New Honda | East Coast Honda

Learn the Different Types of Car Insurance Policies

Lease Or Buy A Car Pros And Cons » Download Best HD Wallpaper