How To Get The Lowst Rate Possible On Root Insurance

How To Get The Lowest Rate Possible On Root Insurance

Root Insurance Overview

Root Insurance is an insurance technology company that has created an app and uses data-driven technology to provide competitive car insurance rates. Founded in 2015, Root Insurance is based in Columbus, Ohio. Root Insurance provides car insurance to customers in 17 states, including Arizona, Iowa, Illinois, Indiana, Kentucky, Louisiana, Mississippi, Missouri, New Mexico, Ohio, Oklahoma, Oregon, Pennsylvania, Texas, Utah, Virginia, and Wisconsin. Root Insurance seeks to reward safe drivers with lower rates; to that end, Root Insurance requires customers to install the Root Insurance app and have their driving assessed for a minimum of two weeks. Root Insurance rates customers based on their driving behaviors, and those who qualify for the lowest rates are often those who are the safest drivers.

How to Qualify for the Lowest Rates

Root Insurance customers who wish to get the lowest rate possible should start by downloading the Root Insurance app and driving safely. The Root Insurance app will track a customer's driving and provide a score based on the customer's risk level. Customers who score higher will be eligible for the lowest rates. During the two-week assessment period, customers should drive as safely as possible, avoiding speeding, hard braking, and other risky behaviors. Customers should also make sure to drive during the day and at night, as Root Insurance takes both into consideration when assessing a customer's risk level.

Other Factors That Impact Root Insurance Rates

In addition to driving behaviors, Root Insurance takes other factors into consideration when assessing a customer's risk level and providing a rate. These include a customer's age, gender, marital status, educational background, occupation, credit score, and state of residence. Customers should ensure that all of this information is accurate and up-to-date when signing up for Root Insurance. It is also important to note that Root Insurance does not offer discounts for good students, safe drivers, or other types of discounts.

How to Save Money on Root Insurance

In addition to qualifying for the lowest rates, customers can also save money on Root Insurance by taking advantage of the Root Rewards program. The Root Rewards program offers customers cash back based on their driving behaviors. Customers are eligible to receive up to 15% cash back on their premium each month, based on their driving score. Customers can also save money by taking advantage of the refer-a-friend program, which offers customers a $25 cash bonus for each referred friend who signs up for Root Insurance.

How to Contact Root Insurance

If customers have any questions or need assistance with their Root Insurance policy, they can contact Root Insurance customer service by phone, email, or through the Root Insurance website. Customers can also contact Root Insurance via social media channels such as Facebook, Twitter, and Instagram. For more information about Root Insurance, customers can visit the Root Insurance website.

Conclusion

Root Insurance is an insurance technology company that offers competitive car insurance rates based on a customer's driving behaviors and other factors. Customers who wish to get the lowest rate possible should start by downloading the Root Insurance app and driving safely for at least two weeks. Customers can also save money on Root Insurance by taking advantage of the Root Rewards program and the refer-a-friend program. If customers have questions or need assistance, they can contact Root Insurance customer service by phone, email, or through the Root Insurance website.

大数据能改变美国车险的现状吗?Root 车辆保险简介 · 北美牧羊场

Root Car Insurance 6 Months Later Full Review - Is It Worth It ?? - YouTube

Does Root Insurance Cover Rental Cars : Will Insurance Still Pay for My

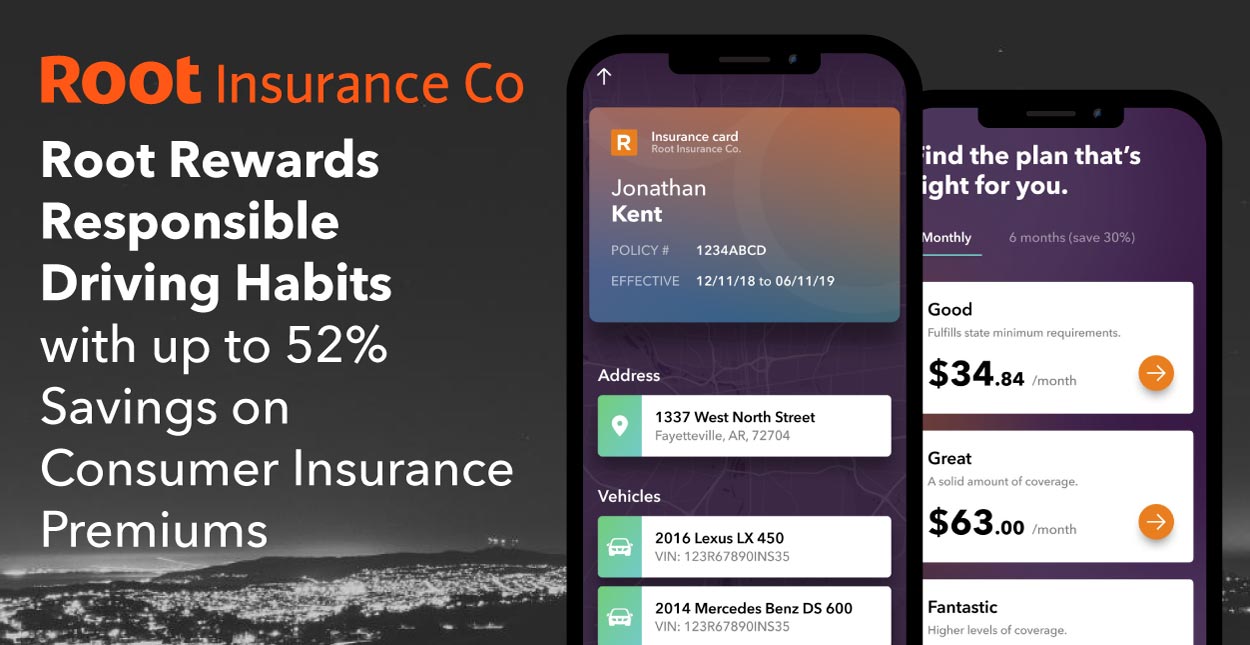

Root Rewards Responsible Driving Habits with up to 52% Savings on

Detailed Root Car Insurance Reviews | Policy Advice